Donald Trump's opaque personal finances and business entanglements around the globe raise the possibility of unprecedented corruption for a United States president. And transportation is one area where the risk of Trump using the powers of the presidency to enrich his family and reward cronies is especially high.

As a candidate, Trump outlined a $1 trillion infrastructure plan, consisting mainly of tax incentives and subsidized loans for private companies to build things like roads and water systems. Paul Krugman and Ron Klain have noted that this would confer huge subsidies to companies that don't need them, for projects that would get built anyway. In other words, government handouts for contractors and financiers.

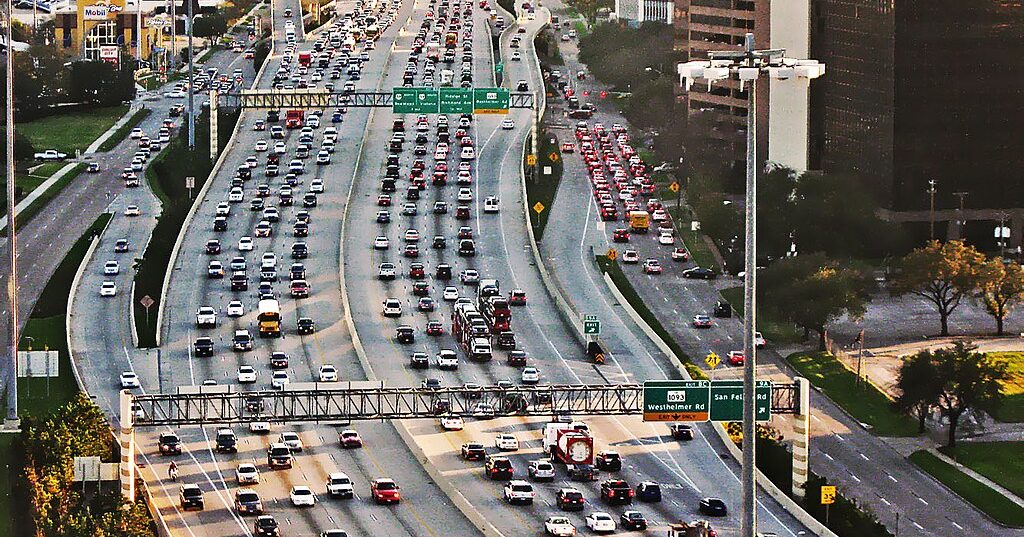

In the transportation realm, Trump's plan would mean building lots of privately-financed toll roads, an arrangement rife with examples of costly blunders, bankruptcies, and conflicts of interest. Letting the Trump White House oversee a huge program of privatized toll road construction would open the door to corruption on a massive scale.

While the vast sums we spend on infrastructure have always been vulnerable to various forms of corruption, the potential for Trump to game the system goes far beyond typical "highway to nowhere" graft. Here's a closer look at why.

1. Trump has not released his tax returns, and his assets are not in a true blind trust

Alone among modern presidents, Trump has not released his tax returns. The public has no way to tell exactly what Trump's financial interests are and how far they extend. And because Trump and his children have not divested from the family's assets and put their wealth under the control of a disinterested third party, or blind trust, they can continue to profit from decisions made by the vast federal government apparatus that Donald Trump will soon steer.

This opens up avenues for corruption, via the federal approval process or pressure exerted on state governments, that otherwise would not exist. Trump's main business is in real estate, for instance, and transportation projects could be selected and fast-tracked to improve access to his properties. Trump and his children could also acquire equity in companies that profit from infrastructure deals under his watch. The Trump family is nothing if not imaginative when it comes to methods of self-enrichment.

The possibility for corruption should undermine public confidence in any infrastructure package the Trump administration puts forward. While the scenarios we'll look at in this post apply to the Trump campaign's infrastructure outline, the threat of presidential self-dealing will remain strong, regardless of the specifics of the infrastructure package, as long as the Trumps do not release their tax returns and put their assets in a blind trust.

2. Traffic projections -- the basis for selecting toll roads to build -- can easily be gamed

Trump's plan for tax credits and subsidized loans would favor one type of surface transportation infrastructure: privately-financed toll roads. How do decision makers determine which of these projects should get built? By relying on traffic projections and the engineering firms that produce them.

Traffic projections are supposed to predict how many drivers will use a given road and thus how much revenue they will generate. They are the basis for determining whether a toll road project will pencil out.

But the people who produce traffic projections are not disinterested parties. They are engineering firms that also stand to gain from lucrative contracts if the projects are approved. In many cases, there is a clear conflict of interest for many of these firms.

Not surprisingly, there is ample evidence of systemic over-optimism in traffic forecasting for privately-financed toll roads. Leading traffic forecasting expert Robert Bain has catalogued 21 ways forecasters game the numbers. He says traffic projections often resemble statements of advocacy more than unbiased prediction.

A 2012 study of 26 toll road projects with traffic projections conducted by the firm Wilbur Smith (now CDM Smith), for instance, found that the firm overestimated traffic by an average of 109 percent [PDF]. A 2016 investigation by the Denver Post found that Wilbur Smith was among several firms that developed traffic projections for projects it went on to receive construction contracts for.

The system is ripe for abuse, but federal regulators have yet to take basic steps to safeguard against these conflicts of interest.

3. The firms that build and finance private toll roads play with other people's money

Companies that own toll roads tend to put up very little of their own money, with outside investors or taxpayers bearing the brunt if a project goes belly up. Bankruptcy protections also enable private road operators to collect tolls for years and walk away just as maintenance bills come due, reports Randy Salzman at Thinking Highways. The potential is high for deals in which financiers can capture potential profits while exposing other people to the risks of failure.

When the Indiana Toll Road went bankrupt in September 2014, for example, most of the losses were absorbed by several European banks that owned a majority of the venture, not by Australian investment firm Macquarie, which had purchased the road with the Spanish firm Cintra eight years earlier for $3.8 billion.

The complicated corporate structure at Macquarie, which bought the road through a subsidiary, in addition to the fact that it was packaging and reselling the assets to other investors, made it difficult to tell if the company had actually made or lost money on the deal. Its stock price was not meaningfully affected by the bankruptcy:

For the Indiana Toll Road, Macquarie and Cintra put up only about 10 percent of the purchase price. The two private firms that built the now-bankrupt Texas 130, which received $430 million in federally-guaranteed loans, only contributed about 14 percent of the project cost.

Trump's infrastructure outline is structured to minimize the risk for private toll road financiers even more, with tax credits covering 82 percent of the equity they invest. In a scenario where a firm borrows 80 percent of what it takes to build a toll road, writes Krugman, the tax credit would enable the same firm to put up only 3.6 percent of the project costs in its own money.

4. Privately-financed infrastructure deals are complicated, and most public officials don't understand them

Privately-financed infrastructure deals are much less straightforward than bonding against public revenue. Many public officials in the U.S. have little to no experience overseeing these types of deals, which makes makes it difficult for them to protect the public interest.

In Virginia, for instance, the fine print of private infrastructure deals often ran to 700 pages, Salzman reports at Rethinking Highways. Part-time state lawmakers would get a "high-level briefing." Jack Trammell, a former candidate for Congress in Virginia, told Salzman he couldn't understand private infrastructure deals after studying them for a year.

Elected officials without a background in finance are simply outclassed by industry representatives with deep expertise. To make matters worse, private consultants hired by governments to help them understand the deals tend not to be disinterested parties. They often do business with the same firms lobbying the government to make the deals happen.

Even if public representatives were equipped to understand these financial arrangements, some aspects of the deals may not be available to the public because they are considered proprietary. For example, even after Texas 130 went bankrupt, the owners, Cintra and Zachry, refused to release the detailed traffic forecasts that purportedly justified building the highway.

In Canada, a country with a much more extensive track record of privately-financed infrastructure projects, a team of experts with private experience examines deals on behalf of the public and works with elected officials to assure fairness. The U.S. model is far less advanced, with far fewer protections for the public and far more opportunity for corruption.