Advocates are uncovering more and more harmful policies in the Republicans' sprawling, shock-and-awe reconciliation package — and bracing themselves for the impacts yet to come on American transportation.

While virtually everything in the legislation known as the One Big Beautiful Bill Act will touch transportation in one way or another, experts warn certain provisions will have a far more direct impact on the way that Americans move, the air they breathe, and the traffic violence they endure as a result — and mostly not in a good way.

"The direct elements [impacting transportation] in this bill are designed to reinforce car dependency — especially of gas powered cars," said Yonah Freemark of the Urban Institute. "That's what's been prioritized by the Trump administration already, and with this bill, they are taking advantage of changes in tax programs and the rescission of major programs to [solidify that]."

Here are a few of the standout changes that have crossed our inbox since last week, so advocates can start organizing in response.

The death of the bike commuting benefit, and heavy blows to other clean commutes

Riders across America enjoyed a modest but impactful "bicycle commuter benefit" until 2017, when the Republicans suspended the credit to clear space for corporate tax cuts. The benefit allowed employers to offer their workers up to $20 a month for bike-related expenses incurred on their daily commute, like bike repairs or bike-share membership, without paying taxes on those benefits.

That might not sound like a lot, but advocates like Eric Salakowsky argue that those kinds of tax tweaks can "place biking on a somewhat more level playing field with cars, for which employees currently receive a massive subsidy in the form of untaxed employer-provided parking." Lawmakers like former U.S. Rep. Earl Blumenauer (D-Oregon) even lobbied to reinstate and expand the benefit to as much as $81 a month.

The reconciliation package, though, officially dealt the bike commute benefit its final death blow.

"It's kind of remarkable that Congress feels willing and able to continue providing car users new subsidies to cover their costs, and treats people using other modes — particularly pedestrians and bikers — as if they are irrelevant and don't need assistance," added Freemark. "We already have a federal infrastructure program that's vastly oriented towards ... the needs of automobiles. And on top of that, we have a tax code that supports drivers over pedestrians and bikers, despite the fact that they're the ones who are costing the least in terms of infrastructure cost."

"If anything we should be rewarding them for their limited use of the infrastructure system — not punishing them," Freemark continued.

The reconciliation bill discouraged other forms of clean commuting, too. While workers who rely on a mix of transit passes and van-pooling used to be able to deduct $175 for expenses related to each of those modes from their taxes — along with another $175 in parking benefits for those days when the bus just doesn't come — the new bill only allows multimodal commuters to deduct a total of $175 across all means of transportation.

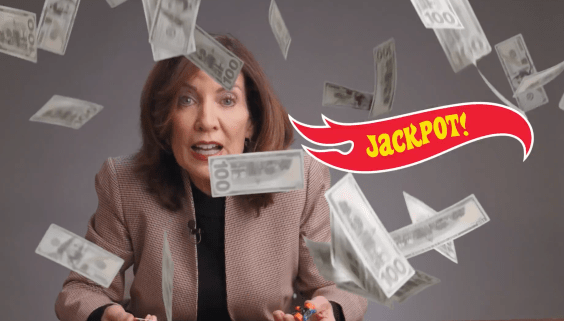

New subsidies for big car loans

While $20 a month for a bike-share membership was simply too much for the federal government to bear back in 2017, Congress did feel comfortable doling out up to $10,000 in deductions on car loan interest per American household— at least if they can afford an expensive-enough ride to max out the benefit.

Alicia Chen of the New York Times notes that at current rates, a motorist would need to buy a brand new $110,000 car to fully cash in on the controversial new policy, which a rep from Cox Automotive said represents just one percent of auto loans written today. The rep also said most of those buyers are purchasing luxury brands, like Aston Martin or Ferrari.

To be fair, the federal government isn't running a free-for-all Bond-movie-sports-car giveaway; vehicles that qualify for the credit must be made or "finally assembled" in the U.S., and the benefit begins phasing out for individuals earning $100,000 or more a year, or $200,000 filing jointly (or enough knowledge of loopholes in U.S. tax code to make their income look smaller than that on paper.)

The Times estimates that the average credit recipient will "pay only about $500 less in taxes in year one, with that amount shrinking each year," an amount that likely isn't big enough to push someone into purchasing a vehicle they otherwise wouldn't.

Nonetheless, Chen writes that the program will cost taxpayers a staggering $31 billion over four years — roughly enough to build the Indianapolis Cultural Trail and its 2022 expansion 333 times over — with few benefits to most low income Americans, who can't afford new cars (or any cars) at all. And it may actually accelerate America's auto lending crisis rather than mollifying it.

"[This policy is] encouraging folks to take out bigger loans for purchase of new cars, which is in essence encouraging more debt for vulnerable people — or providing a subsidy to higher-income people who can afford the debt," added Freemark. "We already have a problem in this country with extremely high debt load; now, we're encouraging everyone to take out more. That's not sound policy."

Billions in lost funding for climate projects

Local communities lost big money for transportation projects under the reconciliation package, too, though some got more press than others.

Mobility justice advocates across the country probably already know that the bill clawed back $2.4 billion for the Neighborhood Access and Equity Grants program, a visionary effort that would have reconnected dozens communities across the country torn apart by highways and other transportation infrastructure. (Silver lining: the rescission also killed at least one stealth highway-widening project that threw a highway cap on top of a road that was actively being expanded.)

But Transportation for America says that the damage didn't stop there, and the following efforts were also axed in the name of cutting what the bill called "wasteful Green New Deal spending":

- Up to $1.9 billion for projects funded by the Low-Carbon Transportation Materials Program, which helped communities "build infrastructure using less emissions-intensive concrete and asphalt mix," provided that infrastructure did not expand road capacity

- Up to $42 million for projects funded by the Diesel Emissions Reductions Act National Grants, which "went at least partially to transit electrification, for either the upgrade of diesel trains (to potentially faster and rider-friendly electric rail) or efficient battery electric and hydrogen buses"

- "Well over" $20 billion from the Green House Gas Reduction Fund, which financed a range of carbon-cutting projects but "made clean transportation a priority" — and was potentially illegally frozen in the first months of the Trump administration, "leaving more funds available for rescission in the budget reconciliation bill"

- Up to $100 million in Environmental Review Implementation Funds, "despite the fact that expediting permitting and the environmental review process is a stated priority for the House’s Transportation and Infrastructure Committee Chair" and "the loss of these funds will only have a negative effect on the speed at which these reviews can be completed"

No more automaker penalties for dirty cars (and no more cash for clean trucks)

Thanks to the reconciliation bill, automakers will no longer pay a dime for violating vehicle emissions standards intended to hedge off the worst of climate change —though the policy is unlikely to bring auto prices down like Republican claim.

This one's a little technical, so here's an excellent explanation of the ins and outs from Scott Evans at Motortrend:

"Because this is a reconciliation bill, Congress could not make changes to vehicle emissions and fuel economy laws. Rather than replace or abolish the Corporate Average Fuel Economy program (CAFE), this bill keeps all the existing rules in place but reduces the penalties for breaking them to $0.00. This means automakers are free to ignore federal fuel economy regulations as the EPA cannot meaningfully enforce them.

This could potentially affect consumers in multiple ways. If automakers stop following CAFE rules, fuel economy could go down and emissions could go up. Any savings on R&D could then be passed on to the consumer.

This is unlikely, however. Automakers plan as much as a decade in advance, so vehicles for sale today were engineered years ago and the money already spent. Future iterations of Congress and future presidents could also reinstate the penalties in a few years, which would wipe out any savings and put automakers behind on R&D.

Fuel economy regulations elsewhere in the world aren’t changing, so there’s little incentive for automakers to cut R&D spending regardless, meaning no reduction in pricing is likely."

A less-ambiguous loss was the Clean Heavy Duty Vehicles program, which helped businesses and local governments offset the costs of switching to electric commercial vehicles. That program lost $454 million — and communities that live near heavy industry lost a crucial opportunity to clear their skies and lungs of deadly diesel smog.

The death of the EV credit — and new urgency for locals to step up and support non-automotive climate solutions

You've probably heard by now that would-be electric vehicle buyers are losing their access to federal tax credits in just a couple of months, with both the $7,500 new vehicle and $4,000 used vehicle incentives expiring on September 30.

But it's worth noting that tax credits for the installation of chargers is expiring too (effective June 30, 2026), as are those for solar and battery back-ups to offset the costs of home charging — plus a mess of other energy policies that would have helped green the grid and make sure battery-powered cars ran on clean power.

While Bloomberg's Kyle Stock called those shifts "a major speed bump for battery-powered transportation in the US, but not a brick wall," when it comes to transportation decarbonization, our planet can't handle taking our foot off the accelerator even a bit — and Freemark says cities and states need to step up, even without Washington's help.

"Cities and states that want to [decarbonize the transportation sector] still retain the opportunity to invest in streets that are focused on pedestrians and bikers, and that prioritize transit," he added. "Obviously, the Trump administration is not helping on that front; you have Secretary Duffy going out of his way to blame bikers for congestion and making up claims about the subway. But still, more cities and states need to be saying: how can we ensure that our transportation system is going in that direction of mode shift?"