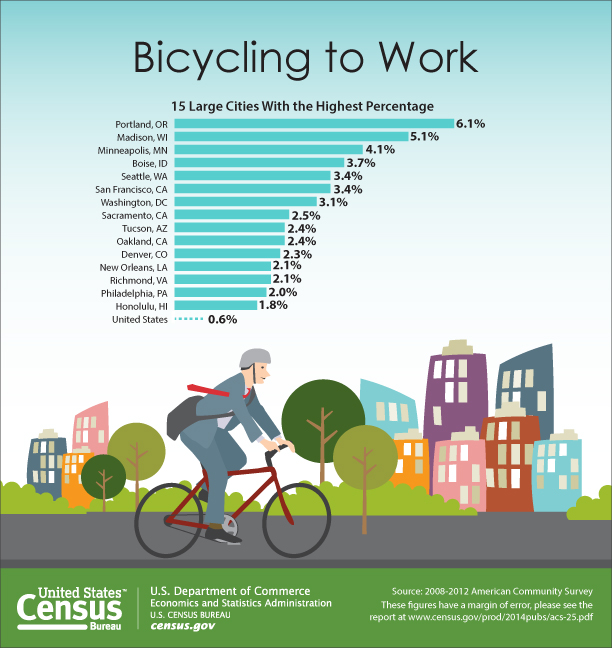

Editor's note: This article is the second in a two-part series about the proposed bicycle benefits in Biden's Build Back Better act, which the Democrats hope to pass through reconciliation in the coming weeks. Click here to read part one on the proposed federal e-bike credit.

Now let’s look at the bike commuter benefit.

A bike commuter benefit was previously available until it was suspended in 2017 to pay for corporate tax cuts. The new bike commuter benefit is substantially more generous, as I will explain.

Unlike the e-bike credit, the bike commuter benefit is directed at every type of bike — including traditional bikes. While the precise scope of the commuting requirement is left vague (a person claiming the benefit must “regularly” commute), the general intention of the provision is to cover a broad range of expenses that a person might incur as they commute to work by bike. That definition undoubtedly leaves a lot of people out, but it is nevertheless quite broad. You don’t need to purchase a new bike to qualify for it. You don’t even need to purchase a bike. Any bike-related expenses, including bikeshare memberships, would be covered.

The bike commuter benefit is structured as an income tax exclusion for employer-provided bike benefits. Under this arrangement, employers can offer employees up to $81 a month in benefits that are not subject to income tax. Some employers may offer this as an additional benefit on top of the employee’s normal compensation package while others would allow the employee to elect to reduce paid wages in an amount that would then be diverted to the non-taxable benefit.

The broad language of the bike commuter benefit is intended to cover a variety of arrangements beyond the simple reimbursement arrangement of the previous version bike commuter benefit that was suspended. At $81 a month, it is also substantially more generous than the $20/month provided before the Trump administration suspended the benefit.

Even more importantly, a coordination provision allows the same person to claim the bike commuter benefit and the transit and parking benefits under existing law. Under the old bike commuter benefit, selecting the $20 a month biking benefit made one ineligible for the much more generous parking and transit benefits. The new bike commuter benefit addresses this problem, allowing more occasional bike commuters to claim the benefit thereby fostering more commutes by bike for those who do more mixed forms of transportation.

I have heard two major criticisms of the bike commuter benefit and I want to address both of them. The first criticism is that the bike commuter benefit is inequitable because only employees may take advantage of it. Independent contractors and those not in the labor force are ineligible, and these groups tend to be disproportionately disadvantaged.

While this complaint is true, it ignores the benefits to these groups of a substantial shift commuting mode towards bikes and away from cars. A major rationale for the bike commuter benefit is to place biking on a somewhat more level playing field with cars for which employees currently receive a massive subsidy in the form of untaxed employer-provided parking.

This policy not only encourages driving, but it also distorts land use. Office buildings must provide ample car parking for their employees, which takes up lots of space that could be used for other things, including housing. It also leads to immense sprawl, which hits people of limited means and transportation budgets hardest. A substantial shift towards bike commuting would have substantial benefits for society — even those who aren’t eligible for the credit itself.

A second major criticism of the bicycle commuter benefit is that the benefit amount scales with income. Higher income people receive a greater benefit because they are taxed at a higher income tax rate. Lower income employees, who may be subject to minimal income tax, receive almost no benefit.

There is a kernel of truth to this criticism. But when we focus on income tax, we miss the equally important role of payroll taxes. The bicycle commuter benefit would not be subject to payroll taxes and thus lower income employees, who owe little or no income tax, will still enjoy substantial tax savings. Because payroll taxes are capped at a certain income threshold, higher income employees would not receive a similar benefit.

Beyond this, the bike commuter benefit will open up lots of new possibilities for all employees eligible for it. For example, employers can give every employee a bikeshare membership without forcing employees to pay income tax on the benefit. The sort of automatic enrollment option has been successfully used by public transit agencies and, for the first time, it would be available for bikeshare.

Another option is for employers to partner with retailers to offer bikes to employees. This would allow employees to obtain bikes upfront and pay overtime with their tax advantaged bike commuter benefit. This sort of approach would offer significant utility to lower income employees as they could pay for a bike over time as they would with other transportation costs.

Improvements Needed to the Bike Commuter Benefit

The biggest flaw in the bike commuter benefit is its relatively low limit of $81 a month. While this may sound like a lot, the transit and parking benefits are $270 a month each. Given the car dominance of our built environment, offering bikes 30 percent of the tax subsidy offered for cars isn’t going to move the needle nearly enough.

It is undoubtedly politically challenging to reduce the parking subsidy, but it isn’t politically challenging to level this particular playing field. It also isn’t costly. Unlike the e-bike credit, the bike commuter benefit is projected to cost very little. Increasing the monthly benefit will add very little cost.

Another issue to address is the requirement that an employee who “regularly” commutes by bike claims the benefit. The meaning of “regularly” is unclear and could encompass everything from the everyday commuter to the once-a-month commuter. This issue could be resolved in subsequent administrative guidance, but that will slow implementation down and discourage employees interested in trying bike commuting from signing up for the benefit.

A better approach would be to allow those who intend to commute by bike at least once a month to claim the benefit. Certification could be annual. This would leave less doubt for employers and employees to resolve.

Two Proposals, One Goal

The goal of the e-bike credit and the bicycle commuter benefit is to get more people riding more of the time. The relatively high acquisition cost of e-bikes merits a targeted credit. For all other expenses, a flexible, annual tax benefit that covers a rider’s typical expenses is the most sensible option. Taken together, these proposals will reach millions of riders. They will not change the situation overnight, especially as we continue to lavish far richer tax credits on cars. But, they offer a foundation at the federal level on which we can continue to build. Such legislation privileges the entire population both directly (in savings for those who choose to purchase new e-bikes and/or start commuting by bike) and indirectly (in reduced traffic congestion, lower pollution, reduction of unnecessary and costly roadwork projects, in more land not consigned to parking lots, etc). The time to act is now.

Eric Sakalowsky has been a passionate cyclist and cycling industry professional for more than 25 years who currently lives in Southern California after growing up in New England, New York, and the Philadelphia area. He believes in the power of cycling as a sport but also as a pretty simple, easy-to-deploy, and invigorating change agent that can address challenges spanning transportation/mobility, climate, and equity/access.