How Macquarie Makes Money By Losing Money on Toll Roads

2:16 PM EST on November 19, 2014

This is the second post in a three-part series about privately financed highways. Part one introduced the Indiana Toll Road privatization as an example of shoddily structured infrastructure deals. Part three looks at how faulty traffic projections lead bad projects to get built, and how the public ends up paying for those mistakes.

Macquarie Group, the gigantic Australian financial services firm with some $400 billion in assets under management, has made a lot of money in the infrastructure privatization game.

The publicly traded company owns the Brussels Airport, the Dulles Greenway, telecommunications towers in Mexico, a wind farm in Kenya, and much more. One of those assets was the Indiana Toll Road, which Macquarie purchased in 2006 with Spanish firm Ferrovial -- whose most profitable assets include Heathrow Airport and the 407 toll road ringing Toronto. The Indiana Toll Road was housed in a spinoff company called ITR Concession Co. LLC., which filed for chapter 11 bankruptcy in September after a disastrous eight-year run.

Macquarie and Ferrovial paid the state of Indiana $3.8 billion for the Indiana Toll Road. At the time, it was the largest infrastructure privatization deal in U.S. history. Eight years later, the road was saddled with an astounding $5.8 billion in debt, far beyond the original, unexpectedly-high purchase price.

Traffic fell well short of the projections offered by the engineering firm Wilbur Smith (now CDM Smith), and the company blamed the bankruptcy on the fallout from the recession.

But some observers also pointed to the risky financing underlying the deal. Macquarie and Ferrovial each chipped in just $374 million of their own money to finance the deal. The other $3 billion was borrowed from seven European banks, six of which have since been bailed out by their respective governments.

Granted, the deal happened in 2006, when debt was flowing freely. According to a 2007 profile by Fortune's Bethany McLean, Macquarie borrowed its billions using loans resembling a balloon mortgage. It would purchase a type of derivative, called an "accreting swap," to get a low teaser interest rate, all the while assuming that a refinance was just around the corner. But when credit markets froze entirely, Macquarie couldn't extricate itself from punishing interest payments.

McLean cited the example of the Macquarie-owned Chicago Skyway: "In 2007 the Skyway will pay interest of just $129,000 on $961 million of debt. But the interest payment for 2018 is to be $480 million -- that's not a typo."

That helps explain how Macquarie and Ferrovial ended up owing almost twice as much as they paid for the Indiana Toll Road, after collecting tolls for eight years.

Randy Salzman, associate editor of Thinking Highways North America, has reported extensively about similar tollway deals and their aftermath, saying it's common for privately financed roads to go bankrupt. He says that firms acquiring infrastructure typically provide very little of their own cash, and because of a complicated mix of fees and tax breaks, they may benefit financially even when the deals go sour.

"You’d think that they wouldn’t be investing in these things because so many of them go bankrupt," he said. "You’d think that the money would be running away."

But Salzman says he's seen these kinds of bankruptcies happen over and over again. "The only question is when."

Indiana isn't the first time one of Macquarie's bets on American toll roads has gone bad. Macquarie's first project in the U.S., the South Bay Expressway outside San Diego, filed for bankruptcy in 2010. The $658 million project had been backed by $130 million in equity from Macquarie, $340 million in private loans, and a $140 million TIFIA loan from the federal government. In this case, as with the Indiana Toll Road, Wilbur Smith did the traffic projections.

And just like in Indiana, those projections turned out to be unrealistic. Official reports blamed the softening housing market: The South Bay Expressway was designed to serve San Diego's inland sprawl, and the housing bust dampened projected traffic growth.

In 2011, the South Bay Expressway emerged from bankruptcy and ownership of the road reverted to its private lenders and the federal government. The same year, SANDAG (San Diego's regional planning agency) purchased the road from the lenders for $344 million, almost half off the original price -- using, of course, a fresh federal TIFIA loan to partially pay off the one that went sour.

The public took a hit from all this restructuring, according to a report by the Congressional Budget Office [PDF]:

The new financing and ownership structure required by the bankruptcy court imposed a loss of 42 percent on federal taxpayers, replacing the original TIFIA investment with a package of debt and equity worth only 58 percent of the original investment.

FHWA took a more optimistic view, saying that taxpayers are "positioned to realize 100 percent of the original loan balance" -- but over such a long time period that the public would have been better off if the loan had never been made.

Some financial industry analysts have raised these types of concerns about Macquarie in particular, since surprises can easily hide within its opaque corporate structure. The lengthy Macquarie expose by McLean, who also broke the Enron scandal for Fortune, included interviews with several financial analysts who raised troubling points about the company. One of those analysts said that trying to understand the firm's structure is "like wrestling in the dark with a ghost."

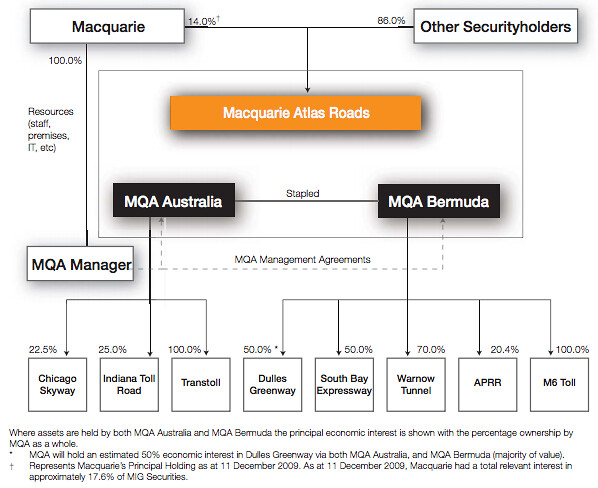

Macquarie flips its infrastructure purchases into separate corporations that are sold to investors as "income trusts," an increasingly popular way to acquire shares of assets -- like real estate, oil pipelines, or transportation infrastructure -- that pay out steady streams of revenue. Investors like income trusts because their high dividends exceed the low returns on bonds, and companies like them because tax laws exempt these trusts' profits from corporate income taxes.

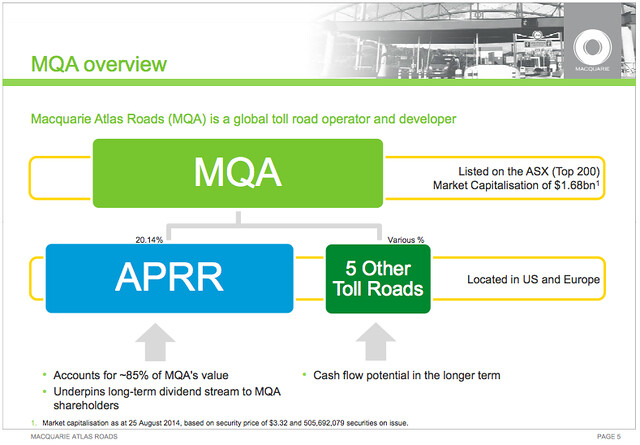

For example, Macquarie transferred half of its share of the Indiana Toll Road to a private fund for large investors, Macquarie Infrastructure Partners. The other half, along with interests in six other toll roads, was folded into a new public company called Macquarie Atlas Roads. The other roads include the Dulles Greenway, Chicago Skyway, the ill-fated South Bay Expressway, and the Autoroutes Paris-Rhin-Rhône (APRR) in eastern France. The investors in these assets, Macquarie explains, are mostly institutions like pension funds and large banks, although small investors own 9 percent of Atlas.

Since APRR is consistently profitable, Macquarie can continue to pay dividends even when the other roads rack up losses. Those losses are hidden away within each individual road's books. This rose-tinted accounting is possible by setting up multiple entities, each owning a minority share of each road.

Since investors buy Atlas for the dividend yield -- which, as a recent presentation to investors makes clear, stems almost entirely from APRR -- they don't seem to mind when its assets fail spectacularly. So, like a Hydra, Macquarie can chop off various subsidiaries if need be. The South Bay Expressway's year-long spell in bankruptcy court resulted in a $65 million paper loss for Atlas, yet over that year the company's stock price rose by 118 percent. Atlas' $80 million interest in the Indiana Toll Road will likely similarly pass from its books with little notice.

Jim Chanos, president of the hedge fund Kynikos Associates and another famous early doubter of Enron, has been Macquarie's most outspoken critic. In 2007, Chanos told McLean that Macquarie had "perverse incentive to serially overpay for assets," and compared the company to a Ponzi scheme.

McLean explained: "That's because the assets are owned not by the bank itself but by the shareholders in its funds. The shareholders pay Macquarie management fees that are based on the size of the fund, meaning that Macquarie has an incentive to add to its collection." That's why Macquarie had every reason to bid a full billion dollars more than the second-place bidder for the Indiana Toll Road: Every additional dollar earned fatter fees for its bankers.

As an investment bank, Macquarie also earns money from transaction fees, which its infrastructure funds pay every time its banking arm rearranges investments into new corporate structures, or refinances a loan, or closes a deal. Chanos pointed out that 84 percent of the deals Macquarie advises involve its own entities. Shareholders ultimately eat the cost of these self-dealing fees.

Macquarie also pays itself handsome annual fees to manage its numerous satellite entities, in an "externally managed" arrangement criticized by corporate governance advocates. McLean called the funds "fee factories" for the company, noting they generate hundreds of millions of dollars each year for the firm. Even though Atlas is just a holding company with little of its own overhead, it paid Macquarie $36.7 million in fees in 2013 -- millions more than it paid out to its shareholders.

The Sydney Morning Herald's Alan Kohler shares Chanos' skepticism. In a 2004 editorial, he wrote, "The Macquarie model is justly famous around the world. It is quite possibly the most efficient method of legally relieving investors of their money ever conceived."

In 2013, Macquarie and another firm were sued for fraud in New York State by Syncora Guarantee Inc., a creditor in the Detroit Windsor Tunnel, owned at the time by Macquarie's American Roads. Toll Roads News reported that the Chapter 11 suit alleged "the financing and spinoff by Macquarie involved fraud and misrepresentation... Macquarie had a secret and improper relationship with Australian traffic and revenue forecaster Maunsell Australia Pty Ltd (since absorbed into AECOM) to produce unrealistically high traffic and revenue forecasts."

Syncora alleged that Maunsell's forecasts were "specifically engineered to ensure that the Macquarie Group could justify the overpriced bids it placed in acquiring infrastructure assets such as American Roads."

The judge in the motion ruled that Syncora had enough evidence to proceed in a fraud case against the Australian firm, saying the undisclosed bonuses to Maunsell were what concerned him. Ultimately the two parties settled out of court, and Macquarie was never convicted of fraud.

But the dust-up over traffic forecasts points to another big piece of the puzzle. In the case of the Indiana Toll Road, how did consultant Wilbur Smith (now CDM Smith) get the projections so wrong? In the next story we'll look at the data on traffic projections for privately financed toll roads, why they have a tendency to be very high, and how that can be a very bad thing for investors -- and the public.

Posts in this series:

Angie Schmitt is the author of Right of Way: Race, Class and the Silent Epidemic of Pedestrian Deaths in America, and the former editor of Streetsblog USA.

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Friday’s Headlines Are Down on Highways

Two outlets recently featured articles on the harmful effects of ongoing freeway projects.

Commentary: There is Zero Ambiguity to the West Portal Tragedy

What happened in West Portal was entirely predictable and preventable. The city must now close Ulloa to through traffic and make sure it can never happen again.

Talking Headways Podcast: Details of Development Reform in Minnesota, Part I

Jim Kumon of Electric Housing discusses his work as a developer and urban policy educator in the Twin Cities.

Thursday’s Headlines Don’t Like Riding on the Passenger Side

Can you take me to the store, and then the bank? I've got five dollars you can put in the tank.

Study: When Speed Limits Rise on Interstates, So Do Crash Hot Spots on Nearby Roads

Rising interstate speeds don't just make roads deadlier for people who drive on them — and local decision makers need to be prepared.