Not a day goes by without a raft of stories about "new mobility" providers -- ride-hailing companies like Uber or car-share services like Car2Go that have tapped into recent technological advances to provide new ways to get around.

In a new report, "Private Mobility, Public Interest" [PDF], TransitCenter deflates some of the hype surrounding these services while laying out several opportunities for productive collaboration between public transit agencies and private mobility providers.

Despite what you may have read, none of these services will replace transit -- at least not buses and trains that move large numbers of people. But that doesn't mean they can't help transit agencies improve service, diversify their offerings, and operate more effectively.

Based on interviews with more than a hundred people working on mobility in the public and private sectors, TransitCenter's report examines the opportunities for transit agencies to team up with mobility companies. If transit agencies keep the core values of providing "equitable, efficient, affordable, and sustainable transportation" in mind, TransitCenter writes, they can forge new partnerships that yield broad public benefits.

Here are some of the most fertile areas for collaboration.

Convenient, Cost-Effective Paratransit

Paratransit for riders with disabilities is usually among the most expensive types of service for transit agencies to provide. This can strain budgets and drain resources from other transit services. If agencies can provide paratransit at lower costs per trip, they can free up resources to run more bus or train service.

Both Boston and Washington have started to experiment with contracting paratransit to taxi and ride-hailing companies that can not only operate the service more cost-effectively, but also offer riders more convenience.

In Washington, WMATA offers paratransit riders the option of choosing a taxi with just one-hour advance notice. (The agency's own paratransit services require 24 hours notice.) Now the agency is pursuing a program that would allow paratransit users in select areas to book rides with companies like Uber and Lyft.

Boston's MBTA is exploring a similar program in partnership with Uber and United Taxi. An earlier pilot along the same lines was reportedly popular with customers and offered the possibility, at least, for significant savings. TransitCenter says more research is needed to explore the potential of these types of arrangements.

Reaching Spread Out or Hard-to-Serve Areas

For walkable places with lots of people and destinations clustered together, there is no substitute for buses and trains. But some places and some trips just don't match up well with fixed route transit service. These are intriguing territory for partnership between transit agencies and private mobility providers.

One of these places is the town of Altamonte Springs, outside Orlando, which offers an across-the-board 20 percent subsidy on all Uber trips within city limits. Residents receive a 25 percent discount for rides that begin or end at an Orlando Sun Rail commuter rail station. Right now, TransitCenter says, it's not entirely clear how well the program is working, and it could be that towns like Altamonte Springs are simply too car-oriented to even benefit much from ride-hailing services. The city's goal, however, is an admirable one: allowing residents to use on-demand service like Uber locally and to access the regional commuter rail system for longer trips.

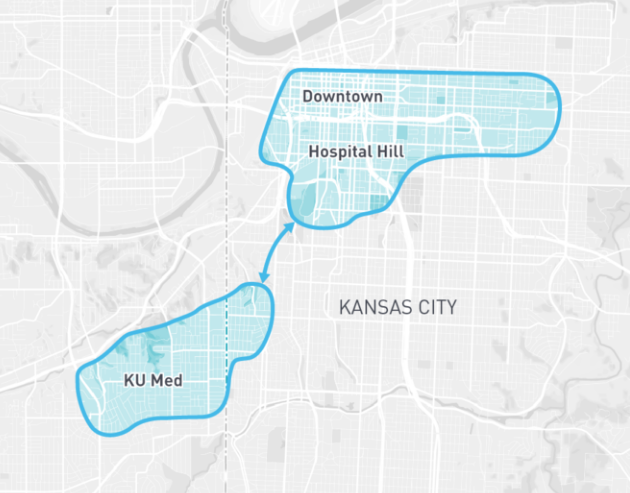

Another type of partnership is taking shape in Kansas City, where KCATA teamed up with the van-pooling company Bridj to provide service between two central city neighborhoods. To get from one neighborhood to the other on KCATA's fixed-route service requires multiple transfers. The Bridj partnership enables more direct service.

KCATA rented Ford vans for the experiment and uses its own drivers, in order to avoid labor disputes. Bridj provides the tech platform for flexible on-demand service. To use it, people usually walk a short distance to a pick-up location and share a vehicle with other people headed in the same direction. The price is the same as a regular bus trip: $1.50. KCATA isn't anticipating enormous ridership, TransitCenter reports (about 200 passengers a day), but the service should save them time.

Data Sharing

Another big opportunity for transit agencies is embedded in the trip data of companies like Uber and Lyft. Information about the origins and destinations of those trips can shed light on travel demand and help adjust service patterns. But companies view this data as proprietary and local governments usually have to pry it out of them the hard way.

California, Chicago, Houston, New York City, New Orleans, Portland, San Antonio, and Seattle have all obtained data from ride-hailing companies using local laws. However, Uber typically goes to court to avoid compliance, and it succeeds about half the time, according to TransitCenter.

Boston tried a different route, forging a voluntary data sharing agreement with Uber. That partnership, however, did not yield much insight, TransitCenter reports, and indicated that "the company -- and its competitors -- will be reluctant to disclose useful data voluntarily."

But the value of data sharing between the public and private sectors runs both ways. Transit agencies can improve the experience of their own riders by opening up data for use by software companies like Transit App and Moovel. Another recent report by TransitCenter found, for example, that transit riders highly value real-time arrival information, which third-party developers can help deliver if the transit agency opens up its data.