Columbus, Ohio, is a convenient microcosm of the United States as a whole.

Demographically, Columbus closely resembles America. That's one reason the city ends up being a battleground for presidential candidates every four years, and why fast food chains like to test new menu items there.

Because Columbus is so, well, typical, the city also has a lot to teach us about where the average American city is headed. Esteemed urban affairs researcher Arthur C. Nelson recently took a look at Columbus as part of a report for the Natural Resources Defense Council, and he found that the city is on course for "sweeping demographic changes" that could transform the local housing market.

Columbus is growing at nearly the same rate as America as a whole. By 2040, the region will have added roughly half a million people, bringing its population to about 2.2 million.

But those new households will look a lot different than today's, and that will have huge implications for the local housing market. New households will be older and much more likely to be childless than current households.

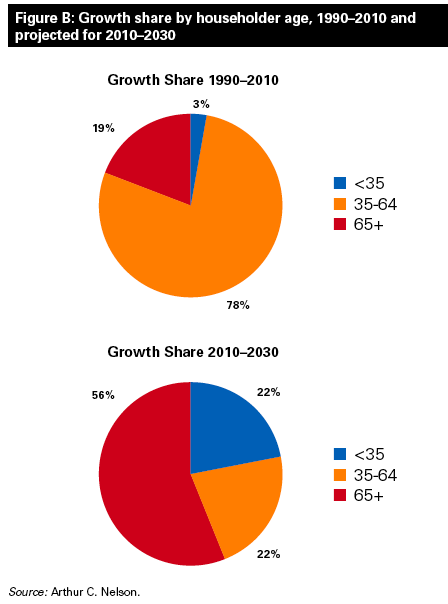

Between 1990 and 2012, for example, about 78 percent of population growth in the Columbus area was among households headed by people between 35 and 64 years old. That stage of life is the period of “peak housing demand,” when homeowners favor detached houses on large lots. But by 2030, that age group will make up just 22 percent of population growth -- while homeowners over 65 will make up 56 percent of new households. Many of these older homeowners will want multi-family housing or single-family homes on small lots, according to Nelson.

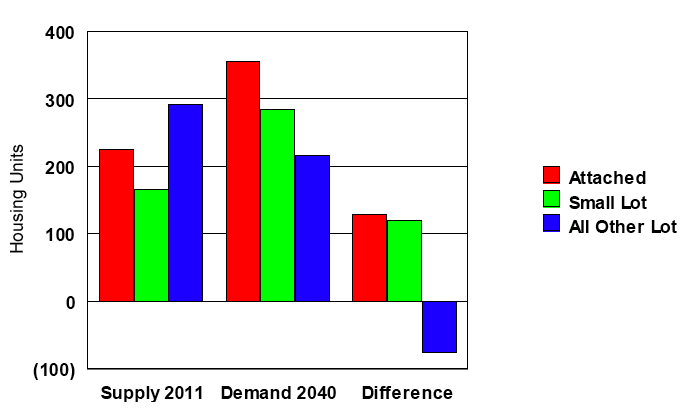

It turns out that Columbus's current housing stock is woefully mismatched to future needs. By 2040, as much as 40 percent of the demand for housing could be for attached, multi-family units, and another 30 percent will be for single-family homes on small lots, Nelson estimates.

"Even if all new residential units built to 2040 were attached and small lots, there would be up to 75,000 more homes on all other lots than the market may demand," Nelson said.

According to Nelson, nonresidential real estate will undergo a similar sea change, with 300 million square feet of growth by 2040 and an additional 750 million square feet that will be "repurposed, redeveloped, and otherwise recycled." Nelson calls that figure "nothing less than staggering." Nevertheless, because of increased demand for mixed-use development and the extent of under-used parcels in the area, he told NRDC Switchboard that technically, "all new jobs and all new multifamily housing could occur on existing parking lots.”

Unfortunately, planning in the Columbus region suffers from what Nelson calls a "baby boom time warp."

"For the past half-century, housing demand in the Columbus MSA was driven by baby boomers’ parents who wanted to raise their children in suburban, single-family, detached homes on larger lots, and then by boomers themselves as they became parents," he writes.

In order to be prepared for the changes expected in the next 30 years, Nelson recommends that Columbus "rethink its transportation investments" and "invest in a modern regional transit system." Columbus is the largest city in the country without any passenger rail whatsoever -- urban transit or inter-city. Nelson also recommends that the Mid-Ohio Regional Planning Commission use some of its planning money to encourage local jurisdictions to conduct land use planning.