The financial world was riveted this morning by billionaire investor Warren Buffett's move to take full ownership of the Burlington Northern Santa Fe (BNSF) railroad, a $34 billion deal that ranks as the largest ever executed by Buffett's company, Berkshire Hathaway.

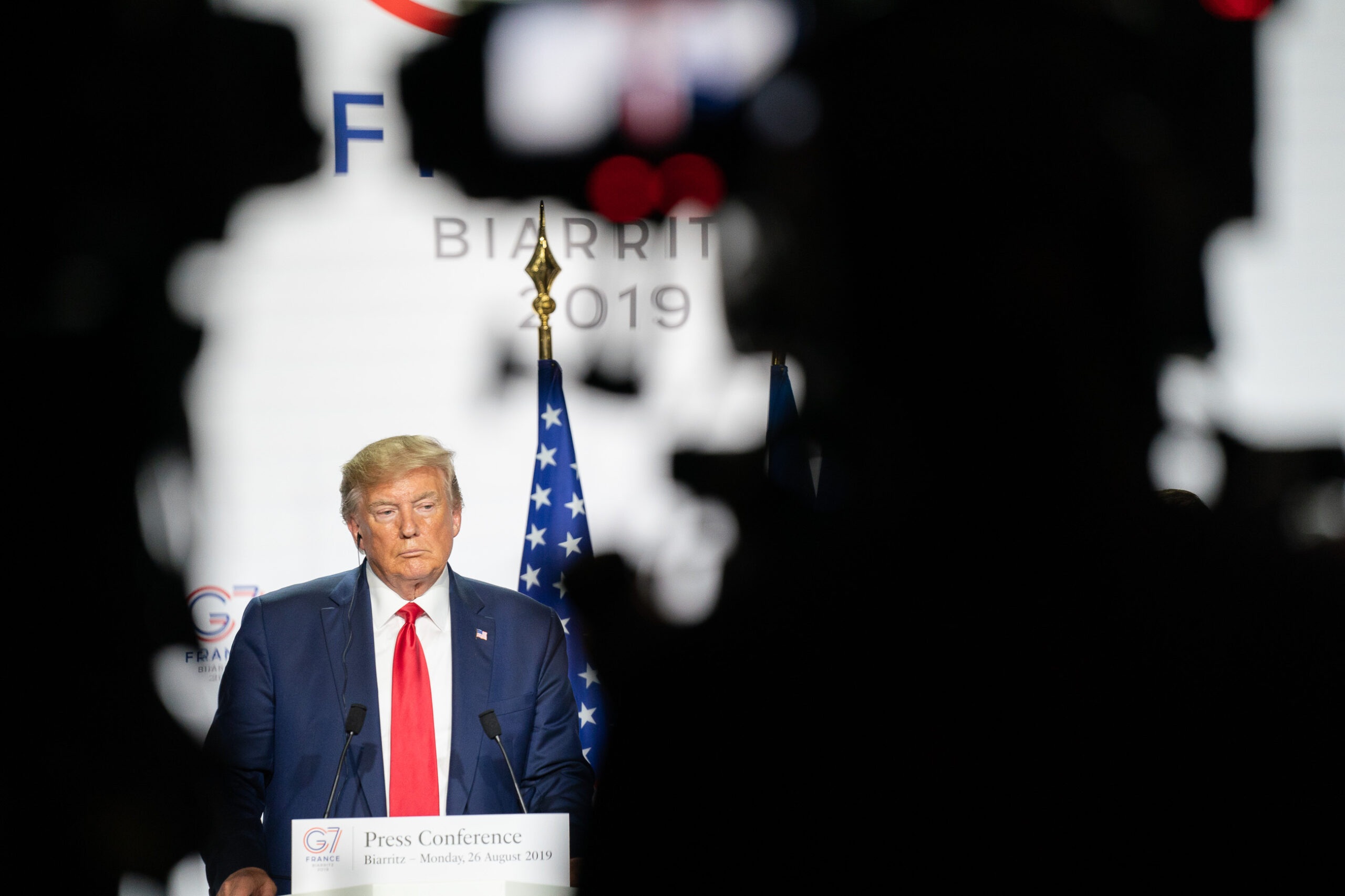

Warren Buffett (Photo: Redfin)

Warren Buffett (Photo: Redfin)But what does Buffett's purchase mean for the nation's energy future? The so-called "Oracle of Omaha" told CNBC today that his decision was "a bet on the country" as well as a bet on the viability of cleaner transportation:

BNSF last year ... moved a ton of goods 470 miles onone gallon of diesel. It releases far fewer pollutants into theatmosphere. It saves enormously on energy consumption and ...it diminishes highway congestion. Rails last year moved 40 percent,more than 40 percent, over the country. They moved more than all thosetrucks, just the four big railroads. It's a very effective way ofmoving goods. I basically believe this country will prosper and you'llhave more people moving more goods 10 and 20 and 30 years from now, andthe rails should benefit.

That environmental rationale for Buffett's deal struck some in Washington as dubious. Frank O'Donnell, president of the green group Clean Air Watch, wrote on his website that the BNSF deal was "the biggest climate story of the day," bigger even than the political maneuverings of the Senate environment committee:

This is a $34 billion dollar bet that coal will remain the

centerpiece of American energy policy in the future. Buffett clearly

believes that coal use will remain strong - and possibly grow. So

he is putting his money on a vision of America with no effective

climate policy at all – or at least one that doesn’t slow coal growth.

BNSF's reliance on coal is indisputable; the black stuff has accounted for nearly half of its tonnage this year, and MarketWatch estimates that 10 percent of U.S. electricity comes from coal hauled by the railroad.

As coal-hauling railroads go, however, BNSF has made an attempt to distinguish itself on the energy efficiency end. The railroad is developing an emissions-free hydrogen-powered locomotive, and in May started to test-run a group of GE locomotives that cuts emissions by 40 percent over previous, dirtier models.

BNSF also has gotten on board the California High Speed Rail Authority's plans for an initial route connecting Merced to Fresno, and its CEO has advocated for a national focus on one initial high-speed project, rather than spreading around the Obama administration's $8 billion investment "like peanut butter."

When putting Buffett's bet into context, however, the corporate identity of BNSF may matter less than the impact of one powerful investor's foray into transportation.

At a time when the job-creation potential of infrastructure spending is increasingly propelling the political debate, Buffett's interest in the transport sector could be a harbinger of greater private-sector involvement to come -- thus bolstering Democratic lawmakers as they make the case for more transit, bridge, and road repair money to hasten the nation's economic recovery.