Nearly half of American drivers cite the sky-high expenses associated with car ownership as the reason they can't save money — and as car dependency and auto costs continue to rise, that financial strain and its attendant societal inequalities will likely get worse.

According to new survey of U.S. drivers, the average American is spending 20 percent of her monthly income on auto loans, fuel, insurance, maintenance, which is around twice or at the absolute upper limit of what financial experts recommend they spend on transportation costs, depending on who you ask. (Federal statistics estimate that the average U.S. household spent 15 percent of its income on transportation in 2022, but that includes those who are lucky enough to live in communities where they can rely on other, cheaper modes.)

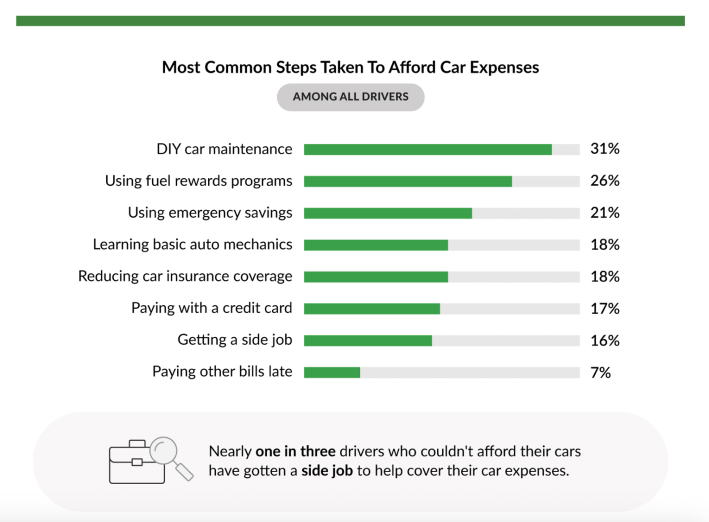

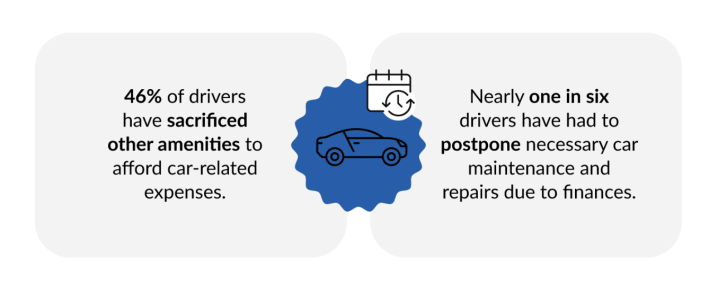

Ten percent of surveyed drivers, meanwhile, estimated they spent 30 percent of their take-home pay on car payments alone, while more than 12 percent "found themselves living paycheck to paycheck due to the financial strain of their cars," the report authors wrote. Close to 17 percent of the survey respondents say they'd gotten a second job specifically to afford their vehicle.

The structural factors behind those stats are numerous, but social factors play a big role, too, the report authors said.

"Car ownership is deeply ingrained in the culture and is often viewed as a symbol of independence, success, and social status," data journalist Ricardo Rodriguez, who worked with MarketWatch Guides on the report, told Streetsblog. "As a result, there is societal pressure to own a car, regardless of one's financial means. This expectation can influence individuals to prioritize car ownership over other financial responsibilities, even if it means stretching their budget."

For Americans in car-dependent communities, of course, those social pressures are simply layered on top of the sheer necessity of owning an automobile in order to participate in daily life. The Marketwatch study did not analyze how respondents' local transportation systems influenced their likelihood to take on onerous automobile costs, but a larger March 2020 survey from Data for Progress found that 80 percent of all Americans feel they have "no choice but to drive as much as they do."

Critically, that survey was conducted prior to the pandemic, when plummeting transit ridership forced fare-dependent agencies to slash service, making the prospect of surviving without a personal automobile even less attractive than it'd been before. The average price of a car, meanwhile, has ballooned in response to a surge in inflation and a raft of supply chain issues, with the average amount U.S. consumers borrowed to buy cars skyrocketing 50 percent between the first quarter of 2020 and the last quarter of 2022.

And because predatory auto lending is so poorly regulated, many borrowers have found themselves trapped in huge loans they can't afford and car-dependent landscapes that make driving non-negotiable. A Frontier Group analysis of pandemic buying patterns found that "there were more auto loan and lease complaints in the five month period from March through July [2020] than at any other point in the history of the complaint database — and the biggest spike in auto loan complaints has been for consumers saying they were denied requests to lower payments." And that's to say nothing of the staggering rise in insurance premiums as road deaths and serious injuries rise alongside auto maintenance costs, medical inflation and more.

"The availability of easy access to auto loans and financing options makes it tempting for individuals to purchase cars beyond their means," added Rodriguez. "Lenders may offer attractive loan terms, low interest rates, and extended repayment periods, leading consumers to overestimate their ability to afford expensive vehicles. Consequently, individuals may commit to large car payments that exceed their budgetary limits."

To cope with these rising costs, the Marketwatch researchers found that 31 percent of drivers are turning to DIY auto maintenance, which Rodriguez fears could be "potentially compromising vehicle reliability and safety," both for the driver herself and those with whom she shares the road. Another 18 percent have reduced their car insurance coverage — also with troubling implications for victims of traffic violence, who often get little to nothing if they're struck by under-insured or un-insured motorists.

Perhaps the most remarkable stat in the study, though, is that only eight percent of motorists "regret their car purchase," and that only 18 percent said car-costs "negatively affected their well being." Because in America, the only thing worse than being functionally required to own a vehicle that drains your bank account, forces you to take on a second job, and prevents you from building any kind of financially stable future is trying to survive without one.