America's pro-car transportation policies are exerting crushing costs on low-income people — and may be slowing down the overall economy, a new report shows.

Auto loan rates are soaring, particularly among the most vulnerable borrowers. And lower-income people are being subjected to a range of shady practices in auto lending, like subprime loans and racial discrimination, the U.S. Public Interest Research Group and Frontier Group say in their report.

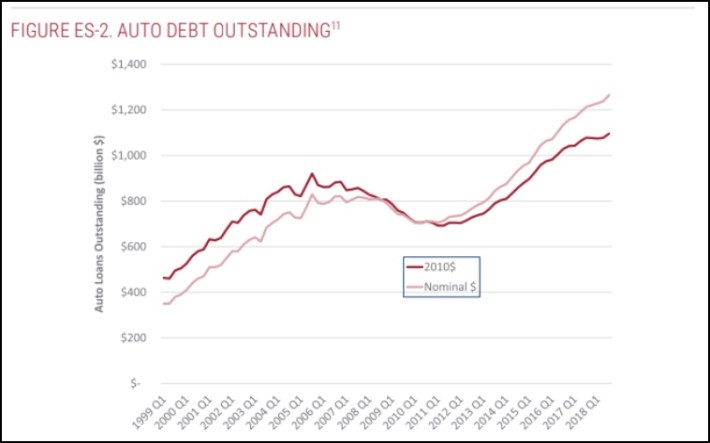

It's starting look almost like a bubble. Car debt has grown an astonishing 75 percent since 2009 to about $1.26 trillion, or roughly 5.5 percent of GDP, PIRG reports. Perhaps more concerning: A record 7 million Americans are now three months behind on their car payments, a sign that the American economy could be faltering, the Washington Post reported on Tuesday.

"In much of America, access to a car is all but required to hold a job or lead a full and vibrant life," the authors write. "Generations of car-centric transportation policies – including lavish spending on roads, sprawl-inducing land use policies, and meager support for other modes of transportation – have left millions of Americans fully dependent on cars for daily living."

Transportation is the second-leading expense for American households, behind housing. And for workers, owning a car is practically a necessity in most of America. About 86 percent of American workers drive alone to work. Even in some of the most transit accessible places, a surprising share of workers rely on driving. In the New York City metro region, with its extensive city-wide subway and regional rail lines, only 15 percent of the area's jobs are accessible in an hour on transit, but 75 percent of the region's jobs could be accessed in the same amount of time by a car driver, PIRG claims.

Americans are coping by borrowing — that's in part thanks to looser lending standards. In 2018, there were 113 million auto loans open, up 39 percent since 2010. And Americans are extending the length of their loans. About 42 percent of auto loans now last 6 years or longer — which cost more over the long haul.

New cars now are almost always financed — about 85 percent, compared to 75 percent a decade ago. And even with used cars, a majority — 53 percent — were financed in 2018.

Discrimination is common. Lenders as diverse as Toyota, Fifth Third bank and the lending company Ally have all been fined by the Consumer Finance Protection Bureau for overcharging black and Hispanic borrowers. Past research has established that black borrowers pay on average $300 to $500 more for an auto loan.

Other lending abuses are profligate. Some borrowers will pursue back payments on loans even after repossessing the car, PIRG reports. Lenders like Santander repossessed a single vehicle from customers as many as three or four times.

Reforms

PIRG and the Frontier group say lending reforms are needed to protect low-income borrowers. They recommend stronger consumer protections and more separation between car sellers and lenders. State government should impose rules that put a ceiling on interest rates charged by car sellers

(Unfortunately, the primary group that was responsible for consumer lending protections — CFPB — was defanged by President Trump.)

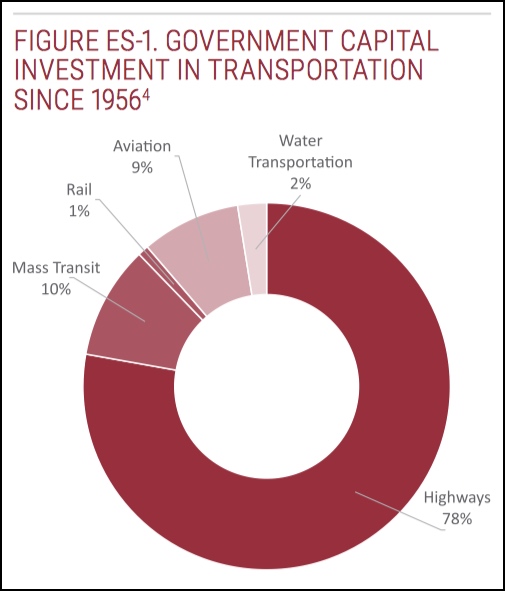

Reforms are also needed in transportation policy so that more people can work and live a full life without owning a car. Transportation investment over the last two generations has flowed overwhelmingly to highways (see graph, right).

In addition, the U.S. needs land-use policies that encourage more walkable, transit-accessible housing development. In addition, greater investment in transit and more street space dedicated to transit, walking and biking could help create a dynamic where people don't have to mortgage their futures to get to work.

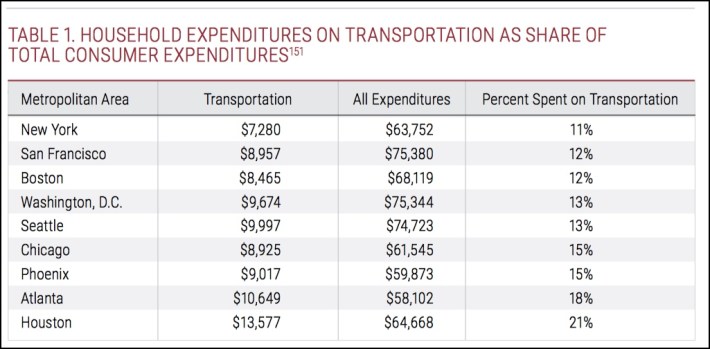

Cities with more compact land use tend to have lower household spending on transportation. For example, Texas was the top state for auto lending, according to PIRG's report. The average borrower there owes $7,000.

But rather than free us from auto dependence, cheap auto loans are worsening the problem. PIRG estimates that increased auto lending may have boosted greenhouse gas emissions from transportation as much as 6 percent between 2010 and 2016. A study released today by TransitCenter also named them as a leading cause in the national drop-off in transit ridership.

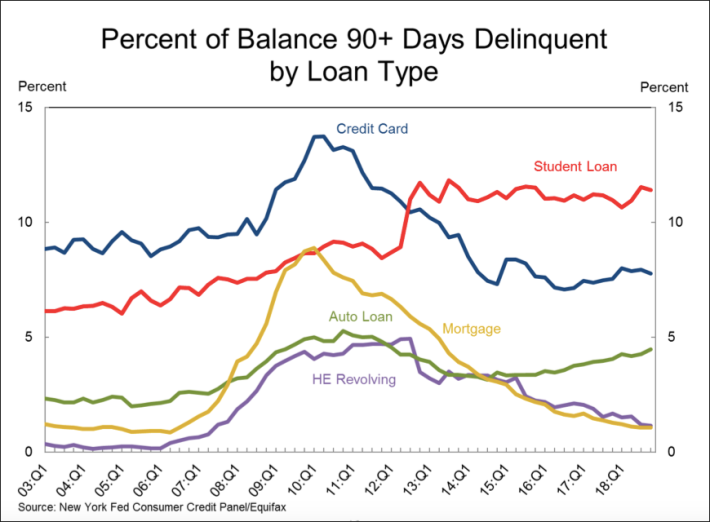

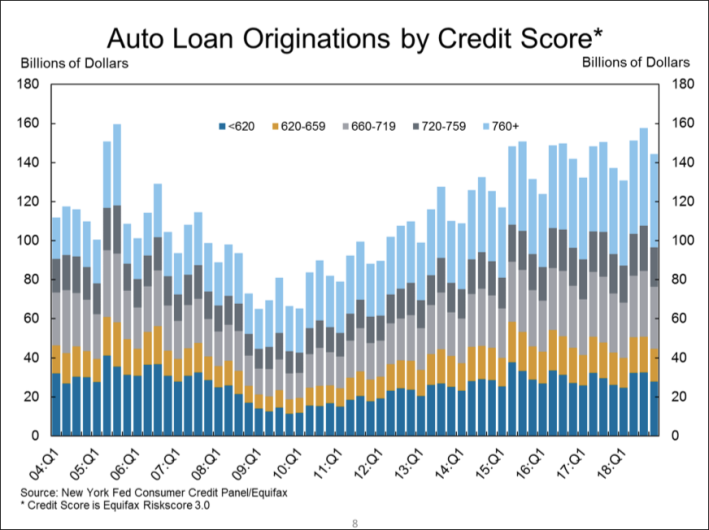

Also alarming: The number of delinquent auto loans is on the rise — and the proportion of auto loans held by people with poor credit is also on the rise, as the Federal Reserve reported earlier this week (see charts below).