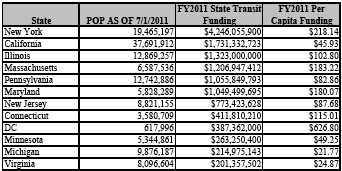

States increased their transit spending more than 5 percent between 2007 and 2011, reaching $13.9 billion annually, according to a recent report from the Association of American State Highway and Transportation Officials. But that increase was concentrated in just a handful of states.

Almost all of the elevated transit spending -- 92 percent -- is attributable to five states: Illinois, Connecticut, Maryland, Alaska and the District of Columbia. Illinois more than doubled its previous transit outlays, increasing its annual transit expenditures by $734 million.

A total of 18 states increased their support for transit between 2007 and 2011, while 17 decreased support and 15 registered no change. Four states -- Alabama, Arizona, Hawaii and Utah -- do not fund transit at all.

If you look at how total state transit spending is distributed, again, the vast majority comes from just a handful of states. New York, California, Massachusetts, New Jersey, Maryland, Pennsylvania and Illinois account for a total $11.4 billion in funding. In addition, these seven states collected about half of the available $10 billion in federal funding for transit in 2011, which is allocated by formula.

States draw their transit funding from a variety of sources, AASHTO reports. Half have rules against using gas tax revenues and motorist fees to support transit. Still, the second most common source of revenues was gas taxes; 14 states fund transit this way. The most common method of transit funding is through general fund expenditures, which 15 states use. Other states use license and registration fees or even lottery revenues.

In most states, the level of transit funding is completely overwhelmed by the amount of road spending.