President Obama’s transportation budget proposal can give you a contact high if you stand too close. The prospect of budget surpluses -- in the near-term, at least -- is intoxicating. And the source of those surpluses -- from Overseas Contingency Operations -- is a hallucination.

The Congressional Budget Office, in its invaluable “just-the-facts” way, released its analysis Friday of the implications of the president’s budget proposal for transportation [PDF]. The long and the short of it is this:

- The fund gets a long-awaited name change to Transportation Trust Fund.

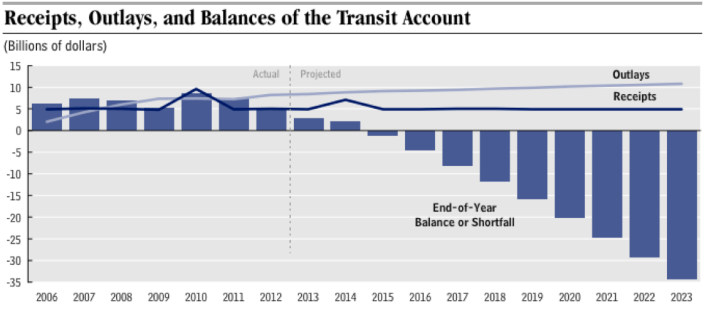

- Instead of falling into insolvency in fiscal year 2015, the highway account would go broke in 2021. The transit account stays solvent under Obama's proposal through at least 2023 -- the last year the CBO contemplates.

- A rail account is added to the trust fund for the first time, bringing Amtrak into the fold of the surface transportation program.

Under the president’s proposal, both highway and transit spending would decline after 2021, when the surplus money runs out.

And where does all that money come from? The CBO calls it an “intergovernmental transfer” to highlight the fact that it’s not traditional Highway Trust Fund revenue. Obama plans to pay for transportation with “savings” from the drawdowns in Iraq and Afghanistan. Just about every expert we talk to agrees these savings are fictitious: The nation was always spending money it didn’t have on the wars. There is no account stuffed with cash just waiting to be spent on track upgrades and potholes now that it’s not being spent on armored tanks. Essentially, the president’s budget spends borrowed general fund money.

So, instead of finding a real and sustainable source of revenue for an ambitious budget proposal, the president seeks to puff up the trust fund with a frontloaded infusion of general fund cash over the first couple of years and then spend down this “reserve” until 2021.

The president’s hat tricks are a somewhat rational response to the unsavory choices that Washington is faced with right now. According to CBO analyst Sarah Puro, lawmakers can address the transportation funding shortfall by either cutting spending, boosting revenues, or both. “Bringing the trust fund into balance in 2015 would require cutting the authority to obligate funds in that year from about $51 billion projected under current law to about $4 billion, raising the taxes on motor fuels by about 10 cents per gallon, or undertaking some combination of those options,” Puro said.

Under the current scenario, the repercussions of the failure to find a sustainable funding solution will be felt even before the fund goes broke in FY 2015. The highway account would end FY 2014 with $4 billion in the bank and the transit account with $2 billion -- “exactly the balance levels where both FHWA and FTA are required to slow down outlays and inform state and cities to slow down their project expenditures -- meaning lay-offs and headwinds for the economy,” according to David Burwell of the Carnegie Endowment.