Indianapolis transit advocates were thrilled last February when a long-range transit plan for the city was unveiled, including a network of light rail lines, writes Curt Ailes at Network blog Urban Indy.

Having a good plan is one thing, but having the will to carry it out is another. As soon as policymakers got down to the question of how to finance the plan, known as Indyconnect, the light rail vision started slipping further and further into the future. In the new version of Indyconnect, light rail has fallen off the 25-year time horizon altogether.

Now, the region seems to be downsizing its ambitions, without even testing voters' appetite for the necessary tax increases. Ailes asks:

How was this allowed to happen? How could months of input and a loud voice (at least from urbanists' perspectives) about adding MORE light rail for Indianapolis turn into no light rail at all? The answer lies within the numbers that the “business community"(or private sector) used to determine what the fiscal realities for this plan could be. Initially, a sales tax had been discussed. The prior plan would have taken somewhere between $10-$15 a month per household for those counties who opted into the plan based on voter referendum. State legislators have been cool on this plan altogether, unfortunately, but have also bristled at the idea of a sales tax to cover expenses for the plan. Planners have given more attention to income tax as a primary alternative.

Ron Gifford, the new leader of the Central Indiana Transit Task Force, stated that [the original] 25-year plan could require a 0.7% annual income tax (or $350 in taxes on $50,000 salary). The current Indyconnect long range plan, if given the chance to be adopted, could be funded using a 0.3% income tax increase; and thus the reason why light rail was cut from the initial plan.

We as citizens need to urge our lawmakers at the state level to get on board with allowing a tax referendum to occur for this plan. I ask you, our readers, is an income tax who’s monthly amount is equal to what a half a tank of gasoline costs worth the potential transportation impact? For my part, I am all in.

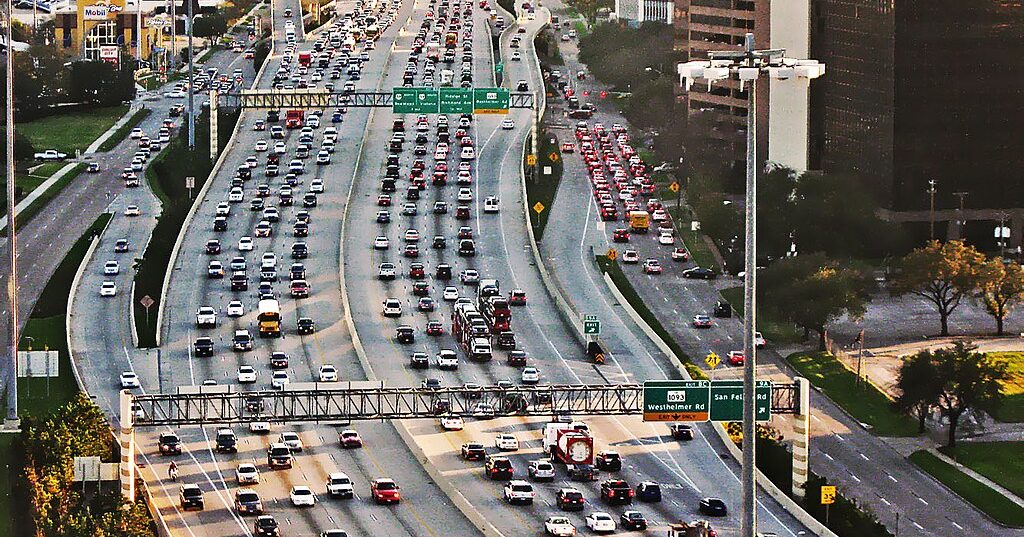

Elsewhere on the Network today: As Columbus, Ohio tries to imagine what the city will look like in 40 years, Xing Columbus asks: Will development blanket the countryside in every direction, aided by additional freeways, or will light rail and infill development put it on a path to sustainability? Meanwhile, Chicargobike lobbies for family friendly routes for Chicago's first protected bike lanes. And Cap'n Transit muses on the obstructionist role of vested interests in transportation reform efforts.