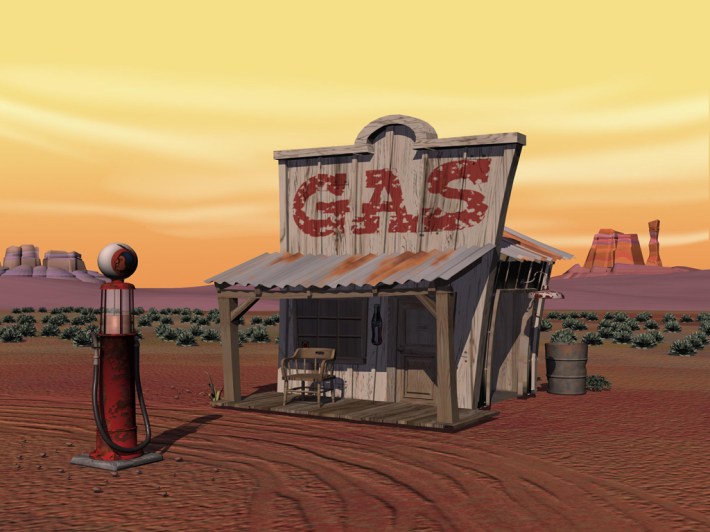

Despite the anti-tax rhetoric of this round of elections, there's been a little flurry of support for raising the gas tax lately. Two senators just proposed bumping it by 25 cents to replenish the highway trust fund. And the co-chairs of the National Commission on Fiscal Responsibility and Reform included a gas tax hike in its proposal for reducing the deficit by $3.8 trillion. Their proposal [PDF] is simple.

Gradually increase gas tax to fund transportation spending

- Raise gas tax gradually by 15 cents beginning in 2013

- Dedicate funds toward fully funding the transportation trust funds and therefore eliminating the need for further general fund bailouts

Well, that’s clear enough. Highways cost money. You gotta pay to pave, and Americans aren't paying.

Bloomberg quotes leaders on both sides of the aisle who lambasted the report. “Democratic House Speaker Nancy Pelosi called the targeting of Social Security and Medicare ‘simply unacceptable,’ and Republican Representative Jeb Hensarling of Texas expressed opposition to proposals to raise taxes.” Everyone from AARP to the AFL-CIO lined up to slam the plan.

The co-chairs of the Commission even joke about the unpopularity of their proposals. “We have harpooned every whale in the ocean and some of the minnows,” said Republican former Wyoming senator Alan Simpson. Erskine Bowles, former chief of staff to President Bill Clinton, joked that they’d have to enter a “witness protection program.”

They also proposed eliminating the tax deduction for mortgage interest payments - or at least restricting the tax breaks so that second homes, expensive homes, and home equity loans weren’t eligible.

The mortgage tax break is a sprawl-inducer, encouraging people to buy "more house" for their money. Besides, home ownership rates are higher in the suburbs, since urbanites are more likely to rent. By removing the tax break, as the deficit commission recommends, they would require people to pay the full cost of the house they buy - and stop subsidizing the choice to live in the suburbs instead of cities.

Which brings us back to the gas tax. Politicians cower when drivers complain about paying more at the pump, so instead they just let the highway trust fund run dry and then raid the general fund to replenish it – meaning we're all paying for their refusal to cover the cost of highways.