Editor's note: This article is the first in a two-part series about the proposed bicycle benefits in Biden's Build Back Better act, which the Democrats hope to pass through reconciliation in the coming weeks. Check back for part two tomorrow.

Since the E-BIKE Act was first introduced in the House back in February, there has been a lot of confusion over what the legislation would do, how it relates to a companion bill — the Bicycle Commuter Act — and the general role of tax benefits in encouraging the widespread adoption of bikes as transportation.

It’s imperative that we rethink the transportation mix in the United States. Using bikes as a vector can be part of the solution to address access and equity concerns and can greatly impact climate action and quality-of-life and wellness for many.

Further, it’s clear that revamping the place of bikes in the American landscape, away from a more rarefied sporting and lifestyle pursuit to a substantive pillar of transportation, accessibility, and wellness is possible and needed. How we do this is the current challenge.

Many have praised the E-BIKE Act since it was introduced, and many have criticized it. But more than anything, I have heard a lot of questions about the proposals’ importance and relevance.

Here, I will address some common criticisms I have heard since they were first introduced.

Why tax credits and not direct action?

Before looking at the two proposals in detail, it is important to address a general criticism of using tax credits and income tax exclusions to encourage specific behavior such as riding a bike. This criticism has been leveled against a broad range of tax benefit provisions, including those that are intended to encourage people to save for retirement, build affordable housing, engage in paid work, and drive supposedly emission-free cars. Critics ask: Why not just provide these supports directly?

The short answer to this question is that, whether it makes more sense or not, the political culture and the unique and limited capacities of the federal government have led us slowly and inexorably towards increased reliance on the tax system to deliver government benefits and services. It doesn’t “need” to be this way, but this approach is unlikely to change regardless of what else evolves in Washington.

Resisting incentives would artificially limit the tools available to grow and get more people choosing non-car options. And that is key, because the more people who ride bikes, the more consistently new advocates will call for the reduction of traffic violence and other enhancements to the biking experience. As an intellectual exercise, we should debate the proper role of the tax system in transportation policy. But policymakers should do everything they can to support active transportation, to improve equity and to improve the climate. These policies compliment, and do not compete with, each other.

With that out of the way, let’s turn to the e-bike credit and bike commuter benefit currently before Congress. At the outset, it is important to understand that these proposals are part of a whole. Most commentary has separated them, but they were conceived together and, with luck, they will both make their way into law. If that happens, the combined benefit they offer will be substantial.

Here’s how.

What is the e-bike credit (and why isn't there an acoustic bike credit?)

This provision was first introduced in the House as the E-BIKE Act. As originally drafted, it would have offered a refundable tax credit of 30 percent of the purchase price of a new e-bike. (A credit is a dollar-for-dollar rebate on taxes paid. For example, a $500 credit returns $500 you paid in tax to you). The max credit any one person could claim for the purchase of a single e-bike was $1,500, and there was a price cap of $8,000. In addition, the credit was subject to reduction for taxpayers with income in excess of $75,000 in the case of single filers or $150,000 in the case of joint filers.

There have been two main criticisms of the e-bike credit from the bike community. The most common complaint is that the credit is aimed solely at e-bikes. Many people think that this is misguided because, they argue, non-electric, human-powered “acoustic” bikes are greener. The logical question: Aren’t we punishing people who choose the greener, less expensive option by not giving them a credit too?

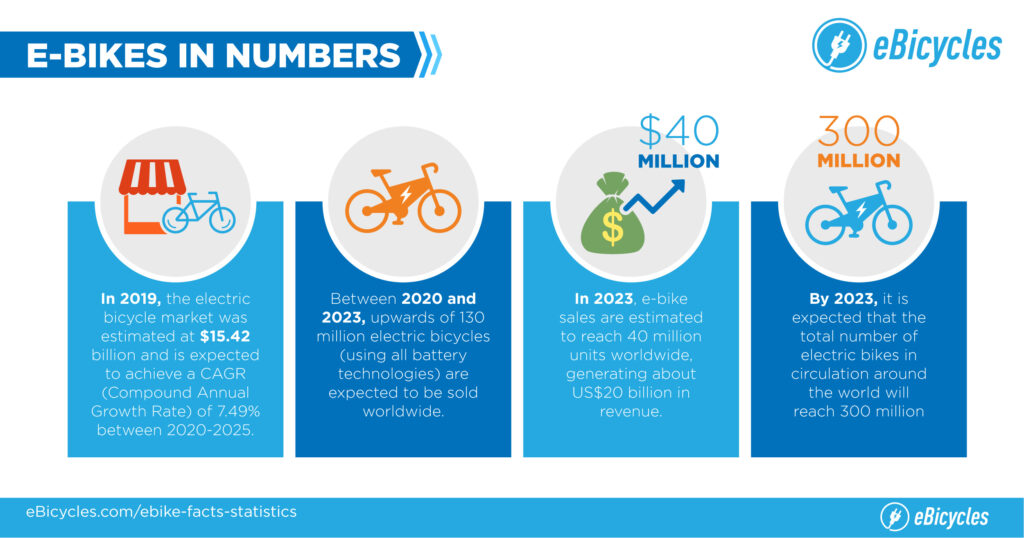

I am sympathetic to this argument, but there is a reasonable explanation for the decision to single out e-bikes for the credit. E-bikes are a new tool in the effort to shift more car trips over to bikes. They open up hilly terrain, give new and less-fit cyclists the ability to travel long distances, and generally make traveling by bike faster and easier. Especially in a built-environment that is hostile to bikes, e-bikes cover a broader range of trips for more people than regular pedal bikes.

The problem, however, is that e-bikes are much, much more expensive than regular bikes. The credit is intended to offer people an opportunity to acquire an e-bike for the first time by reducing the cost.

When considering the non-electric, pedal-powered bikes, acquisition cost has not been a major limiting factor in their adoption. A very large percentage of adults already have access to a typical bike which, in many cases, is not being ridden and may not even be rideable without some servicing, as it’s likely sitting in a garage collecting dust.

For those who don’t currently own a bike, it’s relatively affordable to buy a brand-new one. A solid entry-level bike costs around $500. Cheaper big-box store bikes, some of which are of decent quality, cost half of that amount. A robust used bike market also exists for those who cannot afford a regular bike and do not already have one.

When looking at the potential of the two types of bikes — electric and traditional — and the availability of low cost options, a credit directed at e-bikes makes the most sense.

The second major criticism I came across is that a tax credit directed at lower income people like the e-bike credit will be ineffective, because cash-strapped buyers won’t be able to afford to pay the full upfront cost of an e-bike. If the goal is to encourage this sort of buyer to make the leap, critics argue, the e-bike credit will fail based on household economics alone.

This criticism has a lot of merit. A back-end credit to assist in the acquisition of something expensive does not serve lower-income people well and provisions that rely on back-end credits tend to be claimed more by people who don’t need them than those who do. Because financing options for e-bikes are fairly limited, a 30 percent back-end credit might not accomplish as much as was intended. Financing options may become more available over time, but good policy wouldn’t and can’t rely on that.

Here, the limiting factor is the difficulty in creating a point-of-sale credit. Because eligibility for the credit is contingent on income, it is difficult to know during the year whether a person will be eligible for a credit, and, if so, how much of a credit. It isn’t impossible to make this work. Health insurance premium tax credits and the child tax credit use an advance credit approach, but those are large programs with substantial political support. It is much harder to generate the necessary political will to establish an advance credit for e-bikes.

Improvements needed to the e-bike credit

Now, the E-BIKE Act has taken its first steps towards becoming law, and, as many have feared, it has been watered down. The current draft that has made its way through the House Ways and Means Committee has lowered the credit percentage to 15 percent and the price cap to $5,000, effectively reducing the max credit to $750.

Why was the provision diluted in this way? The unmistakable reason was to reduce its cost. Without getting into the details of the inexact science of scoring revenue proposals, the projected cost of the e-bike credit was considered high. As such, cost had to be stripped out, and this hasty solution was selected. A rework could make this better.

A 15 percent credit does not make e-bikes sufficiently affordable to accomplish the aim of the original draft. And, although the credit would extend through 2031 in theory, the reality is that an unsuccessful credit provision that lacks defenders is ripe for elimination by a subsequent Congress.

The credit could be substantially improved if it was increased back up to 30 percent coupled with a cut to the duration. Given the way costs are estimated, the latter years of the 10-year scoring period are the most expensive. Consequently, a provision that expires after 5 years is less than half the cost of one that lasts 10 years. Cutting the e-bike credit down to 5 years would likely eliminate more cost than doubling the credit would add. Because this would be more effective at stimulating e-bike sales, it would not only accomplish its original goal but would also create a base of political support. This support could be used in a fight to extend the term beyond five years when the credit is set to expire.

In my opinion, the cap should also be increased back up to $8,000. While I do not agree with those who think the original cap was too low, a $5,000 cap does greatly limit the sort of options purchasers relying on the credit will have. The cost of many mid-drive cargo e-bikes capable of carrying loads up hills exceeds this cap. A major goal of the e-bike credit is to encourage people to use bikes rather than cars when possible. The lowered cap makes it much harder to achieve that objective.

To the extent that increasing the cap back to $8,000 adds cost, further reducing the duration of the credit is an acceptable compromise. As with the credit percentage, the higher cap greatly advances the goals of the credit. An effective e-bike credit for four or five years is a much better policy than an ineffective credit for 10 years.

Beyond restoring the percentage and the cap, adding an advanced credit mechanism to the e-bike credit could improve the outcome. Similar in nature to the premium tax credit for health insurance, an advanced credit could be applied at the point of sale. The ability to take advantage of the credit to purchase a bike greatly increases its utility to those it targets: lower income Americans. While advanced credits require some complex administrative machinery as previously mentioned, this task is not insurmountable. Some form of advance credit should be considered.

Eric Sakalowsky has been a passionate cyclist and cycling industry professional for more than 25 years who currently lives in Southern California after growing up in New England, New York, and the Philadelphia area. He believes in the power of cycling as a sport but also as a pretty simple, easy-to-deploy, and invigorating change agent that can address challenges spanning transportation/mobility, climate, and equity/access.