Editor's note: The following post originally appeared on Medium and is republished here with permission. To read more about the Second Avenue Subway project mentioned here, be sure to check out this post on Streetsblog NYC. The opinions expressed in both op-eds do not necessarily reflect those of the Streetsblog editorial board.

Generally speaking, there are few (if any) public investments that can do more to help connect people to job opportunities, support businesses, and improve affordability than transit expansions.

The problem is, in North American cities, the cost of transit projects (especially rail projects) has grown so high that few major expansions ever get done. The result is that most U.S. transit systems haven’t kept up with population growth, making it harder for residents to access good jobs without the high cost — to both pocketbook and planet — of owning a car.

To help pay for big transit expansions, many cities around the world turn to an innovative financing approach called value capture. The name sounds wonky, but the idea is simple: As commute times and job access improve with a new transit station, the value of nearby real estate rises. A value capture program aims to capture that future windfall to fund construction today.

The idea of public investment benefiting private real estate raises concerns, particularly amid an urban affordability crisis. That may be one reason why value capture hasn’t caught on in the U.S. But if designed well (more on that later), value capture can ensure that private development supports public objectives — creating a vast source of funding for transit expansions that wouldn’t otherwise exist, and that benefit the broader city.

Despite this potential, one common knock on value capture is that it doesn’t work in areas that are already developed. To be sure, undeveloped areas provide the most room for growth. But two new studies suggest there’s plenty of value to capture even in mature real estate markets like New York or the Bay Area—expanding the potential for transit to … expand.

Valuing the Second Avenue subway in Manhattan

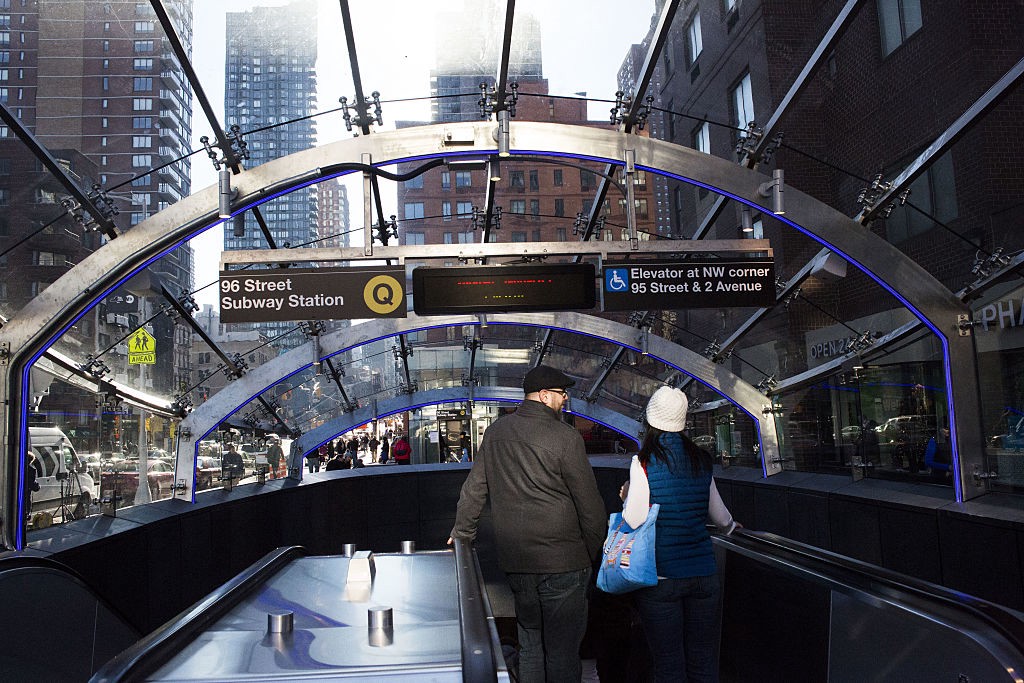

The first study — released as an NBER working paper — comes from a trio of New York-based researchers analyzing the value created by the recent expansion of the Second Avenue subway line. This long-awaited transit project led to three new stations, which opened in January 2017, served by the Q train. The two-mile expansion cost $4.5 billion, making it “the most expensive subway construction project per mile” completed to date.

For the study, the researchers had to determine just how much new real estate value was the direct result of the Second Avenue expansion, and how much merely reflected broader economic factors in the city. That required comparing real estate values across time and place:

- Time. The researchers compared changes in commercial and residential real estate value 10 years before and six years after 2013. They chose 2013 as a pivotal year, rather than 2017, because by 2013 the subway tunnel was done and the line’s eventual launch seemed like a sure thing — meaning the forward-looking market would likely reflect its benefits.

- As a baseline study area, the researchers chose the core Second Avenue subway corridor (First to Third avenues, 59th to 100th streets). Using data on deeds, property taxes, and rentals, the researchers compared the rise in real estate value in this study area to the rise in value across the rest of the Upper East Side (Fifth Avenue to East River, 59th to 100th streets).

When the researchers crunched all these numbers, they found a massive rise in value along the Second Avenue subway corridor post-2013, relative to the rest of the Upper East Side — an increase of 10.2 percent.

The rise held up even when the researchers adjusted the study areas to reflect different geographic comparisons. Those adjustments included a short walking radius around each of the stations; all Upper East Side properties whose distance to a subway station got shorter; and the intersection of the three other geographies. These alternate comparisons still found impressive post-2013 value increases of 7.4, 9, and 8.5 percent, respectively.

The big question, then, was how much actual value the subway created. To get that figure, the researchers estimated the total worth of residential and commercial real estate in the study area prior to 2013, reaching an aggregate valuation of roughly $70 billion. Applying the baseline 10.2 percent post-subway rise to this total value resulted in an estimated $7.1 billion windfall — enough to cover even the historically steep cost of the Second Avenue expansion, with plenty left over.

For the record, the researchers believe the city will likely capture about 31 percent of that new value, or $2.1 billion, in the form of subsequent property taxes. Still, they note, that leaves some $2.4 billion in subway costs that accrued to private landowners rather than paying back the public sector:

[A]dditional taxation, in the form of targeted property tax increases, might be useful to fill the gap. More broadly, value capture could prove a useful instrument in the financing tool box to help fund the large future infrastructure needs.

Valuing the West Springs BART station in the Bay Area

The second study — published in the Journal of Planning Education and Research — comes from planning scholar Shishir Mathur of San Jose State University. Mathur’s focus was a 5.4-mile extension of the Bay Area’s BART rail system to Warm Springs in Fremont, California, just north of San Jose. The new Warm Springs station opened in March 2017, with a total cost of the expansion reaching some $802 million.

Compared with Manhattan’s Upper East Side, Fremont is a much lower-density area, filled with single-family homes as well as some middle-density condos and townhouses. But similar to the Manhattan study, Mathur compared the changing real estate value of these residential markets in response to the BART expansion. To do so, he measured the values of properties near the station (within 2 miles) to those a bit farther away (2–5 miles), both before and after the project’s arrival.

The findings were similarly striking — especially for single-family home values. Mathur found that the value of homes near the station outpaced the value of homes a bit farther away by a range of 9 to 15 percent, depending on the year of comparison.

The low end of the range occurred from 2007–2009, when construction had already begun. During that time, homes near the new station gained more than $98,000 more than homes far from the station, relative to their price in 2001 (before the project was announced). At the high end of the range, from 2015 to early 2017, leading from post-construction to launch, homes near the station gained nearly $206,000 more than comparable ones farther away.

(Mathur did find that BART increased the value of condos and townhomes near the station relative to those farther away, but this finding was only marginally significant. Still, it counters persistent fears that transit spoils property value.)

Again, then, the big question was how much value the transit project created. To get that figure, Mathur multiplied the average value increase post-launch by the total number of homes, for an aggregate value of $1.69 billion — enough value to cover the cost of the project twice over.

For good measure, when Mathur expanded this out over the life of a 30-year mortgage, with a modest annual appreciation of 1.7 percent, he got a total value increase of $4.48 billion — or five times the project cost. He concludes that elected officials should “focus on encouraging communities to share the property value increment to fund transit.”

Valuing the risks

So the new evidence suggests that value capture can play a role funding large transit infrastructure projects — not just as an engine for growth in undeveloped areas, as has long been the case, but potentially in high-demand, highly developed parts of a city as well. Still, value capture has a number of complications that must be considered.

First, as these studies show, calculating value capture is very tricky. That makes the measurements less transparent for the general public, and also opens them up to debate by property owners. In an already developed area, with a wide and dynamic set of stakeholders, that task becomes even harder.

Second, value capture is very politically sensitive, largely because these programs tend to replace general property taxes (which go toward the whole city budget) with project-specific charges or revenue measures (which mainly benefit specific neighborhoods).

Third, there are increasing concerns that expanding transit can lead to harmful neighborhood changes, such as tenant displacement or disproportionate rent rise. The evidence for such change remains mixed, but the concerns are real and should encourage a meaningful discussion of tenant protections — building on successful models like the Twin Cities Central Corridor.

A well-designed program should be able to minimize these (and other) risks. Value capture programs should incorporate input from the local community, find the right balance between a fair charge on the value created by a public investment and a burdensome charge that might discourage local investment, and establish a funding approach (and entity) that retires once the transit project recovers its costs.

All that must be weighed against the biggest risk of all: not expanding transit as an affordable and sustainable backbone for urban growth.