Drivers have never really paid the true costs of the roads they use — and our communities have always spent public dollars to subsidize our collective car dependence. But even the most informed bike/ped advocates might be surprised by just how little car owners pay into their local road maintenance fund when they pull up to the pump.

Hint: they spend more on their cellphone bills.

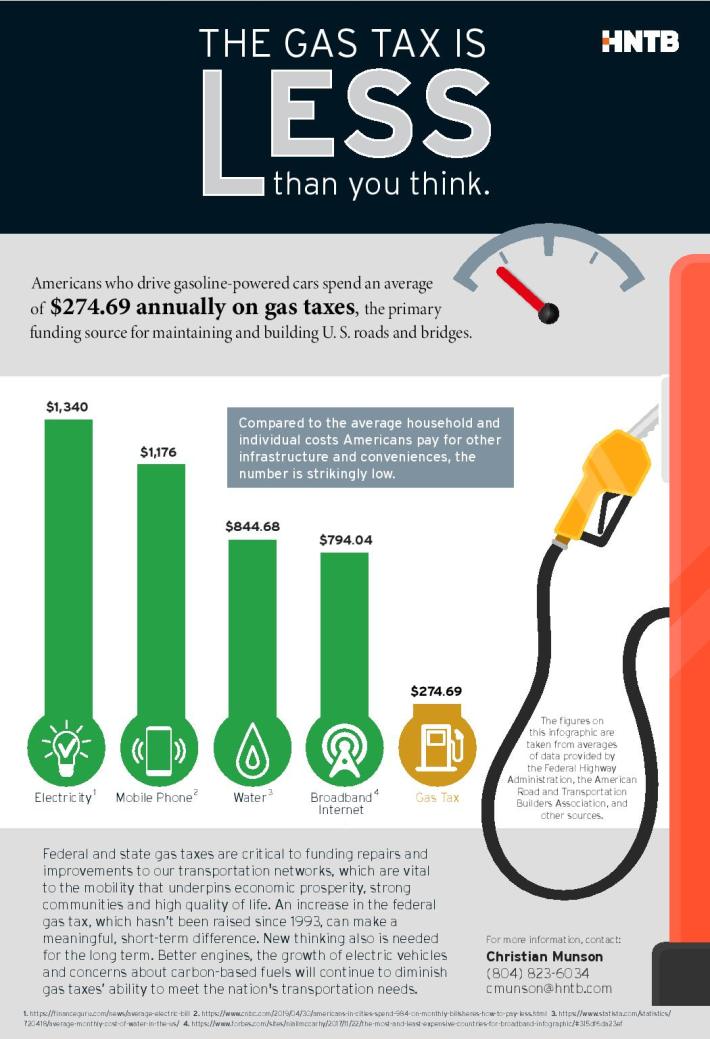

Turns out, drivers pony up an average of just $274.69 in gas tax per year, according to the infrastructure design firm HNTB. That's a fraction of what it actually costs to maintain America's autocentric road network, despite the fact that gas taxes remain a major funding source for road and bridge maintenance.

Or to put an even finer point on it: the average American pays 4.3 times more in cell phone bills every year than for gas taxes.

Of course, HNTB is in the business of building infrastructure, so the company's recommendations in this infographic are pretty predictable: raise the gas tax, and keep an eye on those pesky new trends like vehicle efficiency improvements, electric vehicle adoption and caring about climate change that will cut the average American's gas bill even further.

But take a closer look at how America does road funding, and it becomes clear that ending unsustainable public subsidies to private vehicle owners would take a lot more than just adding a few pennies to what it costs to fill up the tank.

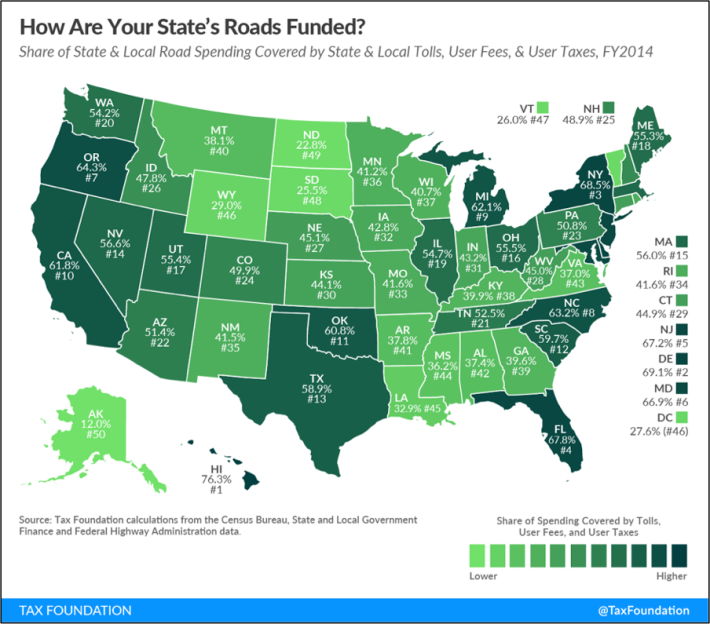

Take this map from the Tax Foundation, which breaks down how much of each state's road funding comes directly from drivers in the form of not just gas taxes, but also tolls and other user fees. Fewer than half even crack the 50-percent threshold. (Shout out to Hawaii, which clocks in at 76.3 percent driver-originated funding; still, even those drivers can't accurately say they pay for every last penny of the roads they use.)

So who is paying for roads, if not drivers themselves? The answer, of course, is all of us.

The average American household spends an average of $1,100 to subsidize car culture, whether its inhabitants buy a drop of gasoline or pass a single dollar to a toll booth collector, according to the Frontier Group. That includes $597 of each household's general tax revenue that ends up getting dedicated to road construction and repair, even if your household is full of cyclists and pedestrians who are hardly causing any road damage at all.

Between $199 and $675 of your sales tax goes also towards tax subsidies for driving, depending on the state and city you're living in. Those subsidies include sales tax exemption for gasoline purchases — yes, most states still don't charge you for those at the pump — and federal income tax exclusion for commuter parking benefits.

And that's before you even get to the most dramatic costs of autocentricity: the loss of human life — both in immediate crashes or due to the long-term effects of climate change.

"It's really important that we find more ways to get people who drive to pay for the impacts of their actions, and not just to fix the damage their vehicles cause to our roads," said Tony Dutzik of the Frontier Group. "They also need to pay for the damage they cause to the environment and the damage they cause to other road users, especially in the case of crashes."

And Dutzik's not being figurative here: he's talking dollars. The Frontier Group estimates that every household pays about $216 per year in "expenditures made necessary by vehicle crashes, not counting additional, uncompensated damages to victims and property." (Think the police cruiser that shows up to collect statements, and the street crew that shows up to clean up the bloody aftermath.) An additional $93 to $360 per household goes to subsidize medical care for pollution-related illnesses.

If HNTB is right, those costs will only go up as our road network continues to grow and grow, and American vehicles get more fuel efficient. Hikes in the gas tax won't cover those costs — but reducing car dependence might just save our communities and the families in them from financial bleed out.