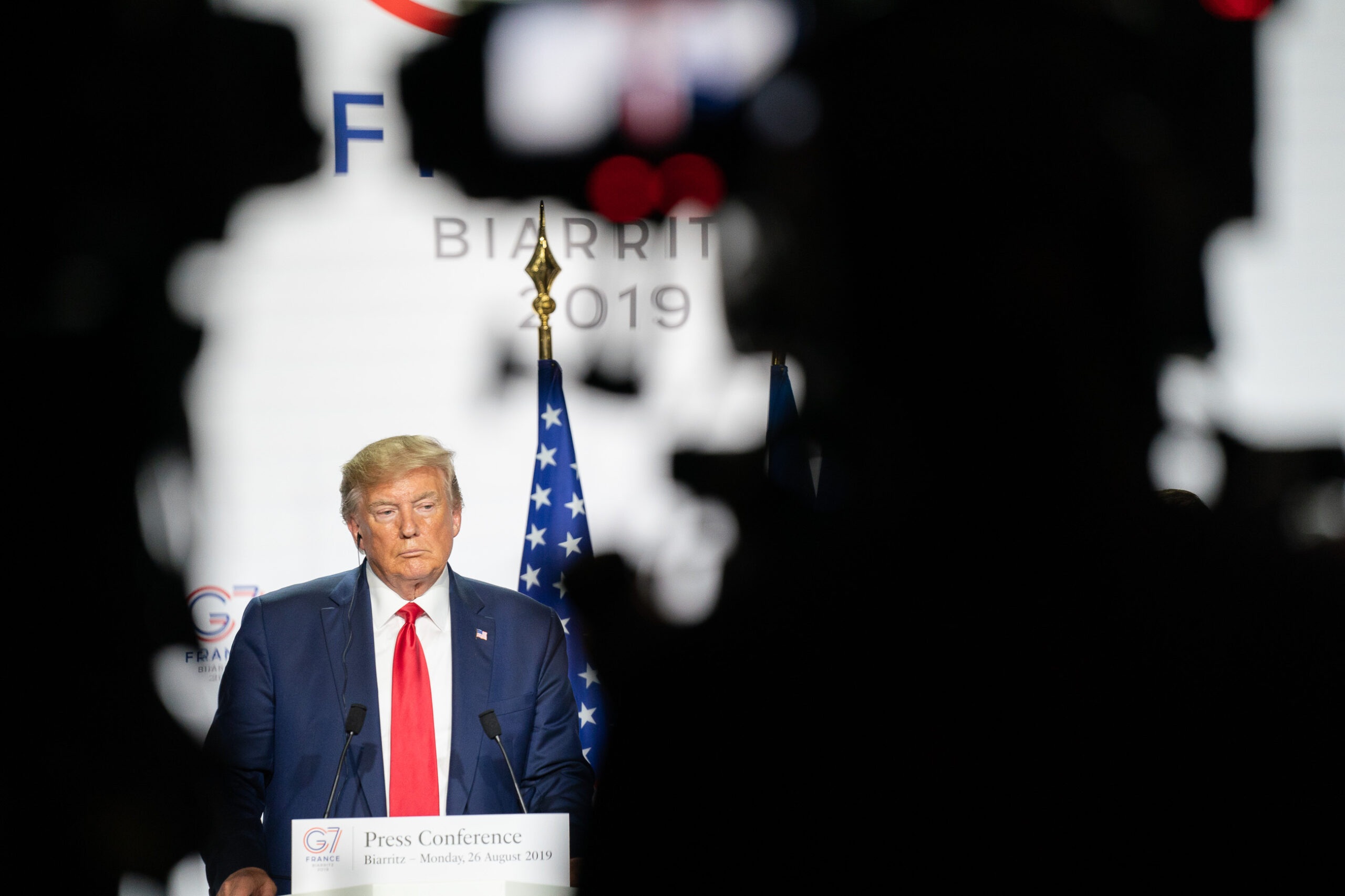

The Trump administration's insistence on paying for infrastructure with private finance risks draining public coffers to pad profits for banks. In fact, a story from Rhode Island suggests that's already happening.

The projected cost of a local highway project -- the Route 95 viaduct -- has ballooned more than 50 percent in a year, the Providence Journal reports. Much of the increase is due to special perks for private lenders that the state hopes will win favor from the Trump DOT.

The Journal's Patrick Anderson reports:

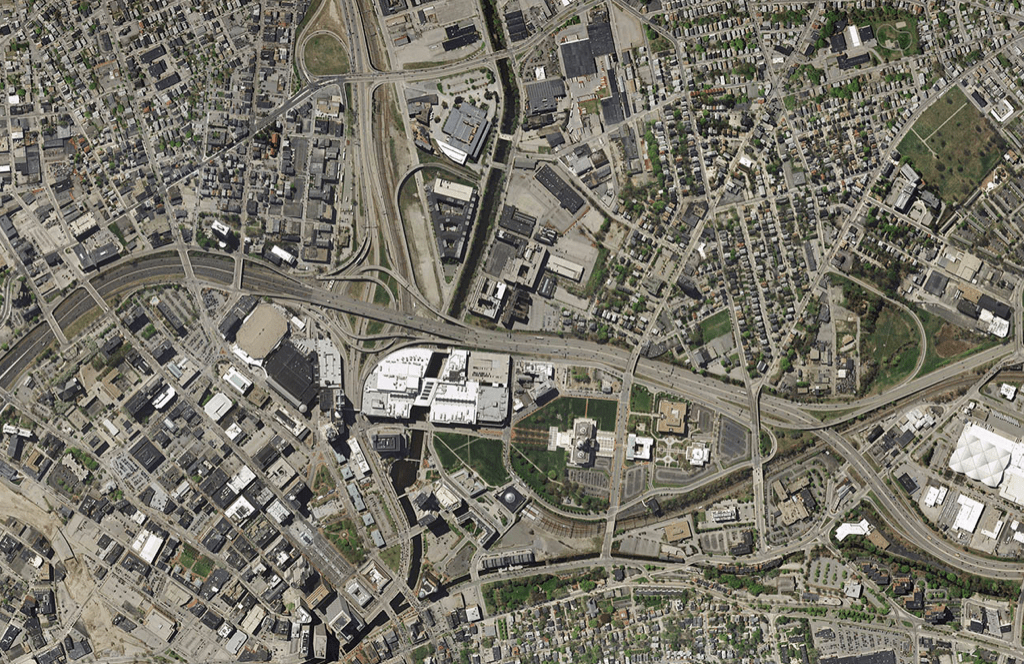

The state last month applied for a $60-million grant from the U.S. Department of Transportation’s [Trump Administration-enacted] “INFRA” program for the reconstruction of the Route 95 Northbound Providence Viaduct, roughly the same project it sought a $59-million grant for a year ago under the Obama administration’s predecessor “FASTLANE” program.

But the estimated cost of the underlying project — replacing the decrepit Route 95 North bridges and interchange in the center of the city while adding new travel lanes — has grown from $226.1 million to $342.9 million, according to the respective grant applications from the Rhode Island Department of Transportation.

A big chunk of that cost increase is connected to financing and the private part of the project. This year’s grant application says the “estimated design-build cost” is $264 million. The new plan then adds interest on a $45-million private loan and a “15-percent return to the private partner.”

Why would Rhode Island spend all that money on private financing when it can borrow directly at a lower rate? There aren't even tolls on this stretch of highway, so there is no projected-related revenue stream to pay back the loan.

Rhode Island DOT spokeswoman Lisbeth Pettengill admitted to the Journal that including the loan will help the agency win a federal grant. She told Anderson:

The new [Trump-era] guidelines encourage states to find private partners and to take more of a role in funding projects. With these guidelines in mind, we redefined the project to fit those new grant requirements.

Private finance deals are often sold as a way to get more infrastructure for the public's money. But as this case demonstrates, they often just funnel more money into bankers' pockets at the public's expense.

Hat tip to former Streetsblog reporter Stephen Miller for catching this story.