While the Trump administration pursues massive cuts to HUD that threaten urban neighborhoods, especially poorer ones, there's one form of housing assistance that the White House is much less enthusiastic about reducing: the mortgage interest tax deduction.

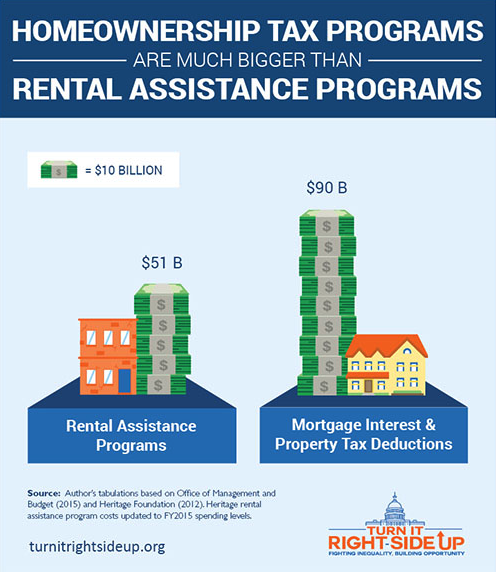

The mortgage interest deduction costs the federal government more than all rental subsidies combined, writes David Meni at Greater Greater Washington. And all that money promotes sprawl by encouraging people to buy more house, while transferring wealth to the upper tiers of the income ladder.

While there is bi-partisan support among think tanks for reforming this tax break, the politics of overhauling such a massive giveaway to the affluent are exceptionally difficult. Meni breaks down why the mortgage interest deduction is so regressive:

The MID is currently projected to be a $96 billion program by 2019. And as we recapped in that earlier post, nearly all of that spending goes to high-earners with large mortgages.

This staggering inequity is because of how the benefit is designed. You can only claim the deduction if you itemize your expenses, something that only those with higher incomes tend to do. As a result, the value of the benefit actually goes up as your income rises. This means that the MID actually incentives mortgage debt, rather than homeownership -- you get a larger benefit if you have a more expensive mortgage.

As a result of all these policy design choices, someone making millions of dollars a year -- even if they have multiple homes -- gets an average of $1,236 per month from the MID. That could cover most or all of a month’s rent for low-income households, whose average share is just eight cents, if they can get the benefit at all.

For someone with a $1 million mortgage, the MID means that the federal government gives you back about $22,000 a year -- enough to push a family of three above the poverty line.

More recommended reading today: Streets.mn says the focus on "distracted walking" is a distraction from the real threats that make walking so dangerous. And Bike Portland reports on some good news from Oregon state legislature which should clear the way for a 20 mph default residential speed limit in the city.