The conventional wisdom holds that the boom in online retail is causing a big increase in truck traffic. But economist Joe Cortright at City Observatory is skeptical.

Reviewing a recent Brookings Institution analysis of decades of federal freight traffic data, which found skyrocketing growth, Cortright says the picture changes once you take into account how U.S. DOT changed its methodology after 2006:

Over time, US DOT has had to make important changes to the way it defines urban and rural areas (as urban development has occurred) and has had to cope with changing data sources. And, to be sure, DOT has tried to improve the accuracy of its estimates over time. The cumulative result of these changes is that it is very difficult to make statistically valid statements about the change in truck traffic in cities.

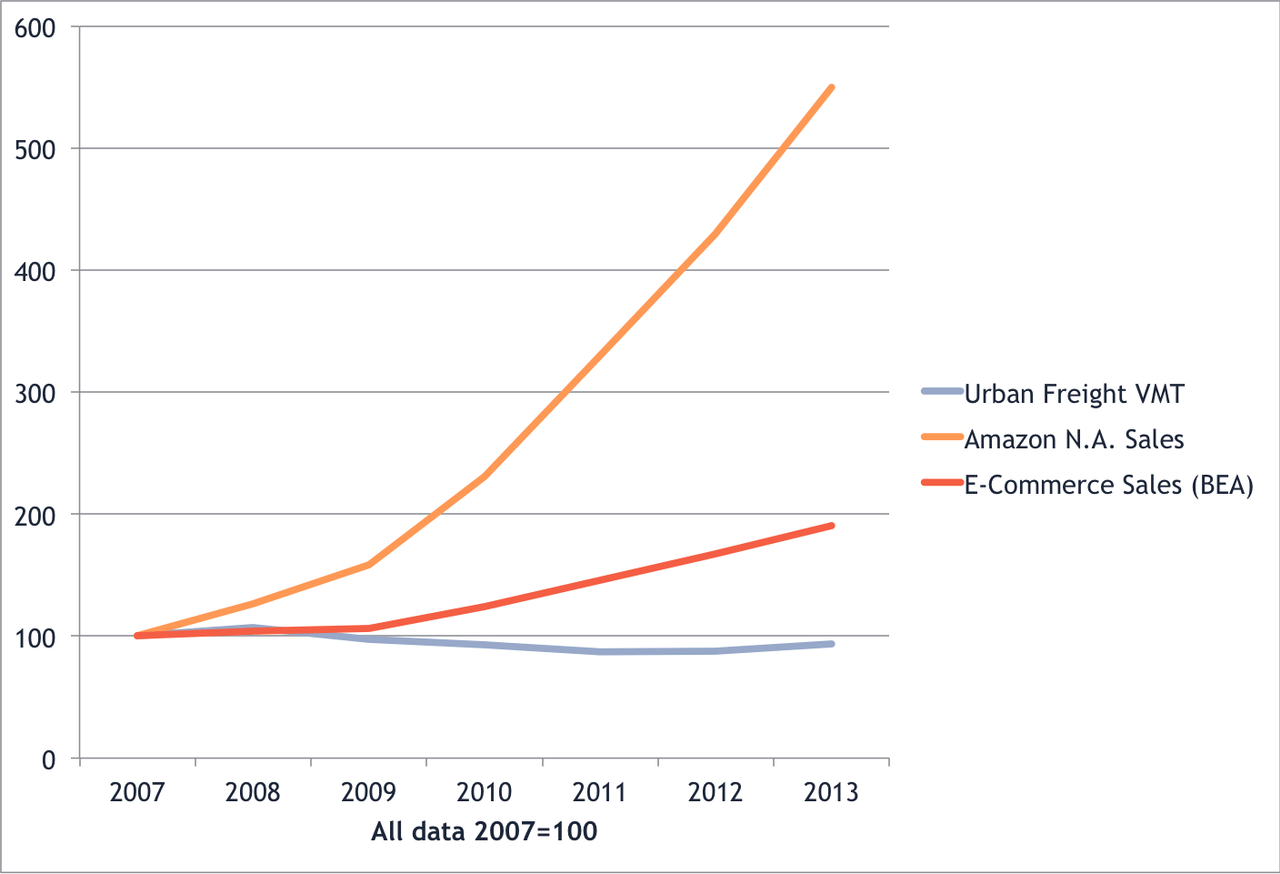

In our view, we ought to heavily discount the published data, and not make comparisons that assume that the pre-2006 data are comparable to the post 2006 data. If we look only at the post-2006 data, a very different picture emerges. For the past six years -- a period for which we have apparently comparable estimates, which appear to be not significantly affected by re-definitions of urban and rural areas -- there is little evidence that urban truck traffic is increasing. If anything, the data suggest that it is flat to decreasing.

The alarmist implication of the “800% growth” statistic is that urban traffic will be significantly worsened by growing e-commerce sales. For example, the Brookings data prompted bloggers at SSTI to write “Urban truck traffic has boomed alongside the rise in e-commerce” and to fret that “If the rapid growth in urban truck VMT is a result of increasing e-commerce deliveries, we are a long way from peak urban truck traffic.”

In our view, such fears are wildly overblown. If anything they have the relationship between urban traffic patterns and e-commerce exactly backwards. The evidence to date suggests that not only has the growth of e-commerce done nothing to fuel more urban truck trips, but on net, e-commerce coupled with package delivery is actually reducing total urban VMT, as it cuts into the number and length of shopping trips that people take in urban areas.

Cortright's evaluation is worth reading in full at City Observatory. Another skeptic of the booming urban freight traffic theory is University of Minnesota professor David Levinson, who recently wrote that we should take projections about big increases in truck mileage with a big grain of salt.

Elsewhere on the Network today: Greater City Providence rounds up local reactions to Rhode Island Governor Gina Raimondo's decision to quash a highway teardown. And Buffalo Rising shares insights into how denser development patterns would benefit the city's economy.