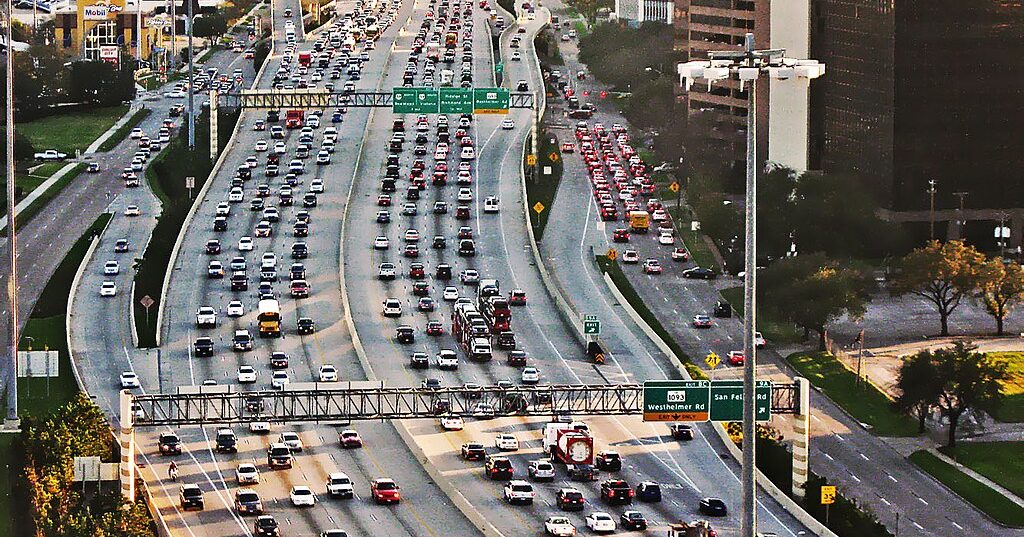

Want to lower taxes? Reduce pollution? Promote savings and investment, rather than borrowing and spending?

Well, perhaps the US could take a page from British Columbia. This Canadian province recently upped the pricetag on its wildly successful carbon tax. And, boy, is it paying off.

This $30 (up from $25) per ton tax on pollution has helped BC lower its corporate income taxes from 12 to 10 percent. And there was enough left over to lower income taxes on those making less than $119,000. To top it off, the program has reduced greenhouse gas pollution 4.5 percent in four years, even as the population has grown.

That's according to economist Yoram Bauman and professor Shi-Ling Hsu in a recent op-ed for the New York Times. According to these scholars, this is a much more enlightened way to issue taxes:

Substituting a carbon tax for some of our current taxes — on payroll, on investment, on businesses and on workers — is a no-brainer. Why tax good things when you can tax bad things, like emissions?

Bauman and Hsu say it's time for the US to get on board with carbon taxes. A BC-style carbon tax in the US would create $145 billion worth of revenue annually, Bauman and Hsu report. That money could be used to used to reduce individual and corporate income taxes by 10 percent. After that there would be enough left over to reduce estate taxes (to please those on the right) and payroll taxes (for those on the left).

Sound far-fetched? Well, if you recall the United States flirted with the idea of cap-and-trade, a different emissions pricing scheme, in the 2009 Climate Bill. Maybe someday, when Congress tires of jabbing each other with sharp objects, they might be well served to consider the British Columbia approach.