In the midst of major funding crises and unprecedented demand, transit agencies across the country are paying hundreds of millions of dollars to big banks because of bad deals made in the pre-recession, pre-bailout days. That's according to a new report from Refund Transit, a coalition of transit unions and community organizations calling for banks to voluntarily renegotiate these deals.

The financial products that got transit agencies in trouble are called interest rate swaps -- deals that were supposed to protect transit agencies against increases in borrowing costs. Instead, after the economy fell off a cliff in 2008, interest rates are now at historic lows, and transit agencies are stuck paying many times the current competitive rates.

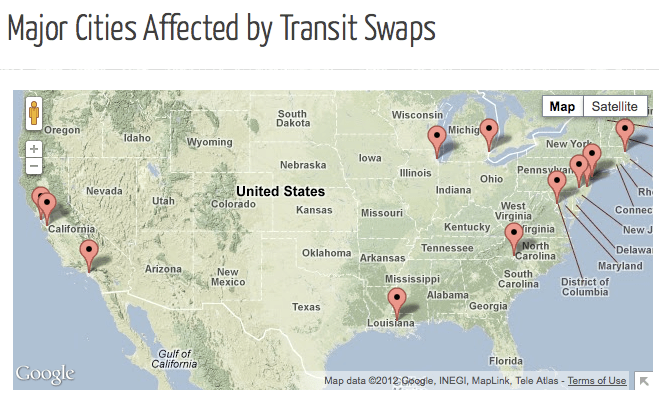

Refund Transit's survey of 12 major transit providers found that public transportation agencies were overpaying by $529 million thanks to these deals, which were sold as a way to minimize risk and save money. Los Angeles's transit system is losing $19.6 million annually compared to the interest rates they would otherwise be paying. Detroit -- where low-income workers face up to three-hour transit waits and are occasionally stranded -- loses $54 million annually. The state of New Jersey's transit system loses $83 million, according to the report.

The Refund Transit coalition includes the Amalgamated Transit Union, the Transportation Equity Network, and a handful of grassroots community groups, and they are calling on banks to renegotiate.

"Banks sold these deals as insurance policies that would let taxpayers lock in lower interest rates without having to worry about rates shooting up in the future," the organization says in the report. "However, these deals were actually more of a gamble than an insurance policy."

Larry Hanley, president of the Amalgamated Transit Union, said banks should not be profiting from conditions they helped to create, especially since banks themselves were insulated from the economic crash by taxpayer funds.

"We got them out of their mess," he said. "Today we are lending the banks money at 0.5 percent a year – the taxpayer is lending them the money – but then in turn, they are gouging the taxpayer through these agencies and through the city governments."

Meanwhile, earlier this week, the city of Baltimore and the Tennessee Department of Transportation, acting as part of a class action lawsuit, settled a lawsuit against JP Morgan that charged the lender colluded with other major banks to manipulate interest rates downward -- exacerbating losses for public entities who purchased this type of financial product.