Between the punditry and horse race tracking that pass for modern reporting, we haven't seen much thoughtful analysis of what effects President Obama's $50 billion infrastructure plan might have on the anemic economy.

While specifics of the proposal are still forthcoming, land use expert Christopher Leinberger of the Brookings Institution says a national infrastructure bank could be exactly the sort of fix we've been seeking. Writing at The Avenue, Leinberger argues that a combining public and private financing can help the country modernize its infrastructure and channel investment to support walkable development:

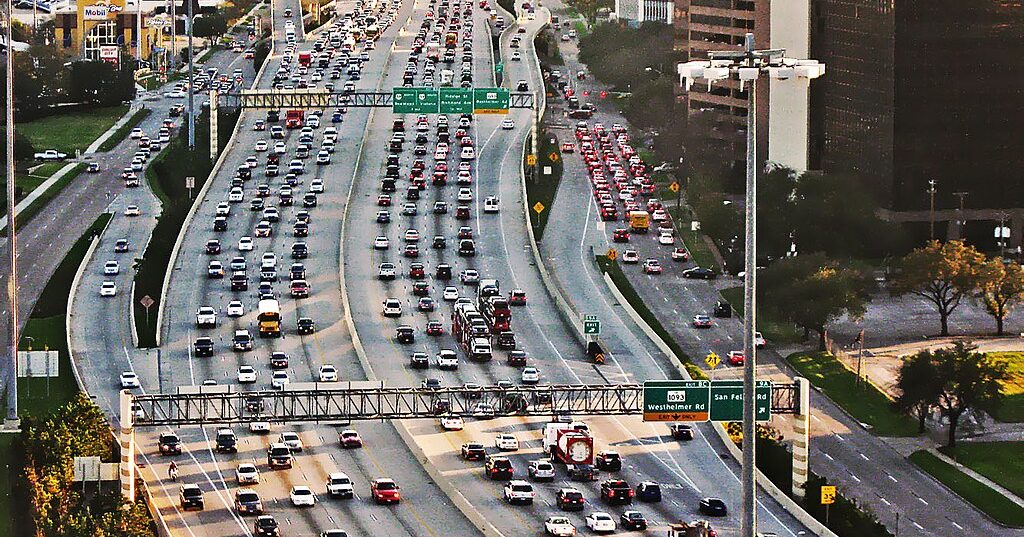

Today, there is huge pent-up demand for higher density development in human-scaled urban places. These places have price premiums that are 40 percent to 200 percent higher than the auto-oriented suburban development--the kind of development that has driven the economy into its Great Recession ditch. Transportation investment in repairing existing road networks, building new and repairing existing rail and bus transit, bike trails, and walking infrastructure will encourage the walkable urban development the market is demanding.

These investments will be leveraged with private dollars which should multiply the impact of the proposed $50 billion of public investment by a factor of three to five times. The private money will help insure the investment is smart--private investors are looking for a financial payback, not a political payback. The risk will be spread and private investors will insure it is prudent.

The built environment (real estate and infrastructure) is over 35 percent of the assets our economy deploys, the largest asset class by far. That asset class is on the sidelines because we have overbuilt the drivable suburban fringe of our metropolitan areas.

Because of its market orientation and potentially high rate of return, Leinberger calls the infrastructure bank "fiscally conservative." That's a message you aren't likely to hear from the cable networks over the coming months.

More highlights from the Network: Bike Portland considers Santa Rosa, California's new "Cyclisk," a 60-foot tall sculpture made out of recycled bikes. The Transport Politic parses the decision facing Vancouver -- expand Skytrain into a growing suburban region or continue its commitment to the urban core? And Circle & Squares Studio imagines the impact light rail might have on the city of Indianapolis.