Car insurance claims and crash casualties plummeted in Wales after speed limits were slashed to 20 miles per hour — and it's sparking a conversation about whether similar shifts could help cut sky-high insurance rates in the U.S., too.

Motor underwriting outfit Esure recently reported that vehicle damage claims had fallen 20 percent since the U.K. nation reduced the default limits on residential streets and other "built-up" areas where people are likely to walk in September 2023, in reflection of the fact that 90 percent of people outside a car will survive a crash when struck at that speed. Despite local exceptions to the rule, around 35 percent of Welsh roads are now signed for human-friendly speeds, up from just 2.5 percent before the shift — and 58 percent of motorists are obeying the new laws, even without substantial infrastructure changes to reinforce them.

The impact on traffic violence totals, meanwhile, may have been even bigger. On roads signed for less than 30 miles per hour, Wales reported a nearly 33-percent year-on-year decrease in crash injuries in the three months after the change was made, though how much of that was directly attributable to the lower limit is still being studied.

Still, U.K. advocates seemed ready to take a victory lap.

"[This] confirms on a national scale the benefits from lower speeds not only reducing casualties and danger but also providing a benefit to drivers in reduced insurance claims," Rod King, founder of 20 is Plenty For Us, told The Guardian. "Statistically, some of those crashes which never happened would have resulted in death or injury for the road users involved. The national 20-mile-per-hour limits has already saved lives and injury."

Vehicle damage claims in Wales have fallen by 20% at one leading car insurer since the nationwide 20mph speed limit was introduced last September. Wales was one of the first countries in the world to introduce a default 20mph speed limit in built-up areas. https://t.co/geZX8v25Kl

— Brent Toderian (@BrentToderian) June 10, 2024

Of course, insurance payouts are a big topic in the U.S. too — though few are talking about lowering speed limits as a solution to the problem. Stateside, the average price of a policy spiked 24 percent last year, and is predicted to rise another seven percent by the end of 2024. That could bring the average monthly premium close to $200, more than the average U.S. household spends on clothing, education, or their pets, and a particularly significant burden to struggling low-income families.

Experts have traced the increase to several factors, including inflation, the rising costs of car repairs as vehicles get larger and more laden with expensive tech, as well as a regulatory backlog at the state level that some argue has forced insurers out of certain markets and left motorists with fewer affordable choices.

Still, we shouldn't overlook the single most obvious reason insurance rates are continuing to rise: because U.S. roads are just too dangerous.

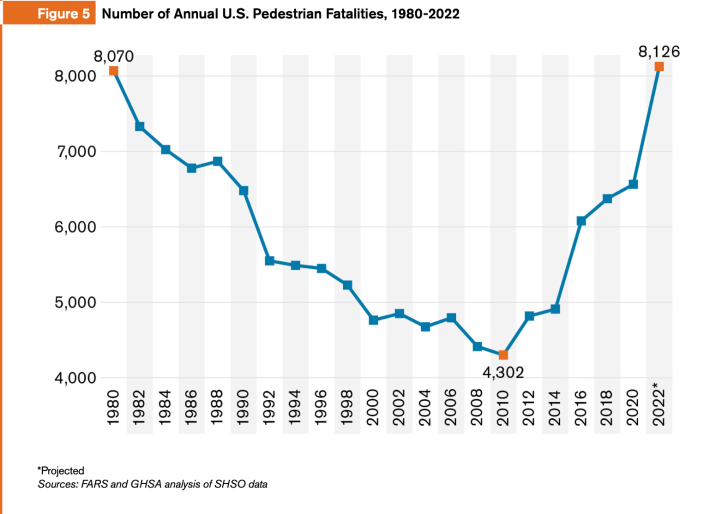

In 2022, 42,514 people lost their lives to traffic violence in America — a 16-percent leap from the 2019, pre-pandemic number. And buried within those numbers, of course, is a hidden epidemic of pedestrian deaths, which hit their highest level since 1981 that same year, as well as a twin epidemic of cyclists deaths, which hit their highest level in the history of the federal reporting system.

And buried within those numbers is a growing mountain of insurance losses, too, even in years when enough car occupants survive crashes to make overall fatalities plateau and give the illusion of increasing safety for all. A recent CNN analysis of LexisNexis data found that in 2022, insurers reported losses on 27 percent of collision claims, a three-point rise over the prior year — an increase that the outlet chalked up to speeding and other "riskier" driving behaviors.

Of course, America's roadway safety problem isn't just about speeding — it's about legal speed limits that are set so high in places where people walk that pedestrians are all but guaranteed to die if they're struck. And until those limits come down — and until infrastructure and vehicles are redesigned to match them — our insurance rates may rise, too, which could mean more motorists will drive illegally without it.

Unfortunately, there's a depressing post-script to Wales' success, as conservative politicians push to limit its use even if they can't outright repeal it. Still, if the Welsh can stick to their guns, they'll probably save their drivers a lot of money — and save everyone else a lot of bloodshed.