Here’s a startling fact that more Americans need to know: The auto-insurance industry is subsidizing road carnage.

How’s that?

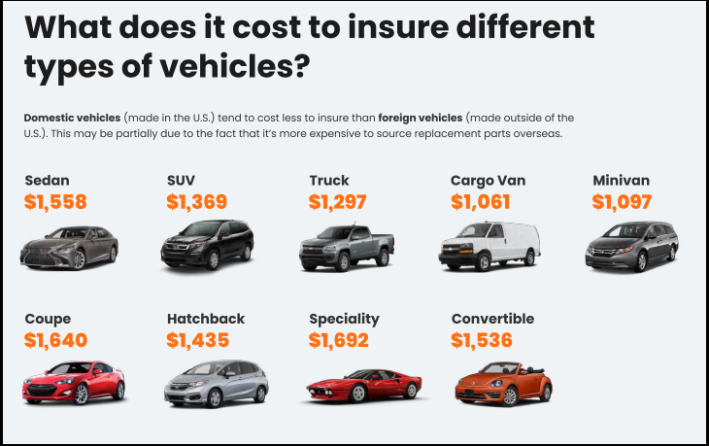

Insurance companies subsidize vehicle violence by charging far less to insure SUVs, pick-up trucks, and minivans — the hulking killing machines that have sent pedestrian and cyclist crash deaths soaring in the last decade — compared to smaller vehicles that aren’t as deadly for vulnerable road users, such as compacts and sedans.

And that’s not the only way: “Aggressive drivers” — those charged with violations such as failure to yield and stop, tailgating, street racing, hit and runs, and reckless driving — pay only 20 percent more on average than their safe counterparts ($1,564 annually, versus $1,208).

That’s it?

Those are two key takeaways from “Insuring the American Driver: Trends in Costs and Coverage,” a new report out from Insurify, which bills itself as “the top-rated virtual insurance agent in America” and ”a valued source of data-driven trends, statistics, insights, and consumer education about” the industry.

Per the report, the average annual cost to insure an American-made SUV is $1,369, a pick-up truck $1,297, and a minivan $1,097. Meanwhile, much-smaller sedans, coupes, or hatchbacks cost $1,558, $1,640, and $1,445, respectively, to insure annually. That makes the three larger kinds of vehicles about 19 percent cheaper to insure, in aggregate, than the three smaller ones.

That’s bad from the point of view of road safety, because larger cars have stoked a rising tide of road death — and anything that makes them cheaper to operate adds to the death toll. SUVs and pick-ups have come to dominate the U.S. market in the past decade or so — so much so that industry experts expect that they will make up 78 percent of sales by 2025, up from 72 percent now.

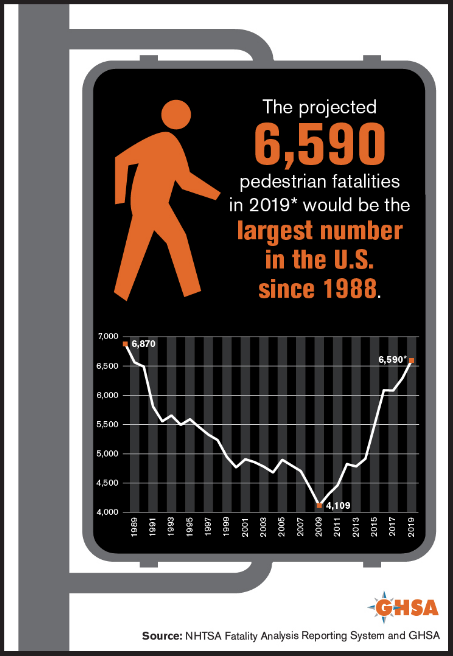

At the same time, pedestrian fatalities in this country have risen sharply, skyrocketing since 2009 after falling for the previous 20 years. Such deaths were estimated at 6,590 in 2019, the highest total since 1988, after falling to 4,109 at the 2009 trough. The Governor’s Highway Safety Association, among other groups, attributes the trend in large part to the growing popularity of SUVs and pickups. Driver distraction (think: cell phones and ever-bigger cockpit screens) is another factor.

American road-safety advocates have been trying to call attention to the vehicles’ outsized dangers — only to be rebuffed by indifferent regulators and manufacturers who are making money hand over fist. Studies have found that SUVs are 50 percent more likely to kill vulnerable road users in the event of a crash — in part because of their high front ends. American SUVs are so dangerous to people outside of them that the European Transport Safety Council this year called for banning the oversized vehicles from towns and cities.

But from the insurers’ point of view, car insurance is not about promoting road safety; it’s about indemnifying the value of the automobile as property.

“It’s a common misconception that smaller, more affordable cars are also less expensive to insure,” said Kacie Saxer-Taulbee, a data scientist for Insurify. “In fact, that cheaper price tag may actually be a component of their downfall. Sedans and other small cars are more likely to be owned by younger, city-dwelling (and therefore riskier) drivers than more costly SUVs, trucks, and minivans which are more likely to be owned by older drivers in suburban and rural areas. Not only are small, affordable cars more likely to get in accidents in the first place, they’re also made of cheaper parts that are more likely to rack up expensive damage in the event of a crash.”

In other words, in the typical car-only crash, your Honda Civic is likely to require more body work than your Ford Explorer.

The low rates for aggressive drivers also stem from the industry’s property- and profit-focused view, added Saxer-Taulbee.

When estimating a driver’s risk of filing a claim, she explained, insurers rely on a specialized algorithm, based on how often other drivers with a similar record have filed a claim in the past.

“It isn’t meant to be punitive, per se; rather, it’s an insurer’s best guess as to how much a driver may cost them,” she said. “Different insurance companies factor a DUI conviction differently into these pricing algorithms. Progressive, for example, reports to only raise premiums an average of 6 percent for a driver who has been charged with drunk driving.”

Six percent?

“The fact of the matter is that, surprisingly, insurance companies do not consider drivers with a first-time DUI to be as risky as you’d expect," she said. "However, across all providers, you can expect your rates to continue to climb with multiple DUIs on record.”

Um, how does a driver with multiple DUIs on his record even get insurance — or keep his license?

That’s a headscratcher for many people who deal with the insurance industry on the part of people injured by drivers.

"The report attempts to make the insurance-underwriting process appear rational, and linked to the conduct and riskiness of the driver being underwritten and insured, but that is not the whole story,” said Steve Vaccaro, a personal-injury attorney who represents many cyclists injured in crashes. "Even a report from an industry source reveals that the premium increase due to proven lawbreaking or reckless driving is the same or less than factors like state or city of residence.”

The damage done by louche insurance practices vis-a vis vehicle size and driver recklessness is compounded by the fact that insurance for all automobiles, which is regulated by the states, does way too little to compensate for the harms inflicted during crashes, according to Gregory Shill, a University of Iowa Law School expert on how American law subsizes and encourages driving.

“State insurance minimums ignore the inherent vulnerability of people [outside the vehicle] to impact with [vehicles] traveling at high speed,” Shill wrote in a seminal law-review article. “The median and most common minimum amount of bodily injury coverage required is $25,000 while the most stringent is $50,000, and, in Florida and New Hampshire, the minimum is zero. In three of the nation’s five most populous states — California, Florida, and Pennsylvania, with nearly 75 million residents among them — the mandatory level of insurance for bodily injury is unusually low, between zero and $15,000.”

Even the states with the most stringent insurance requirement aren’t doing justice by pedestrians, Shill argues, because “a payout of $50,000 is unlikely to compensate for hospital bills, lost wages, pain and suffering, and other damages inflicted on an unprotected pedestrian by a vehicle. The surge in pedestrian deaths in an SUV- and distraction-heavy environment has exacerbated this disparity.”

The industry’s role in promoting car carnage flies under the radar because insurance regulation is the province of states, Shill and other experts say — making it more difficult to fix than if it were a federal matter. It also doesn't help that the not-for-profits that work on the issue — such as the Insurance Institute for Highway Safety and the Highway Loss Data Institute — are themselves industry front groups wholly supported by a long list of insurance companies and associations. A typical press release? “New BMW model performs well in crash tests.”

You get the picture.

Insurify says that its report analyzed data from 25.5 million car-insurance premiums from all 50 states.