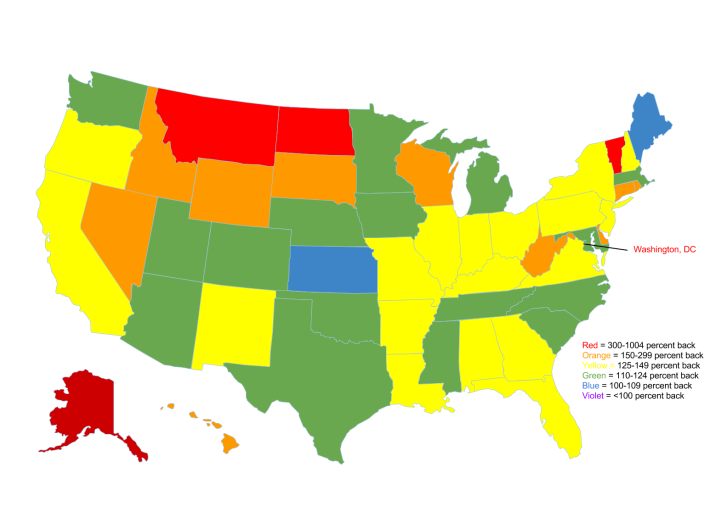

There is a pernicious myth among some states that they give more to Washington in the form of gas taxes than they get back in the form of federal transportation funding. A recent rash of federal bailouts -- $35 billion between September 2008 and March 2010 -- ensured a windfall for every state in the union. And yet many still believe that federal bureaucrats are skimming off the top of their payments to give their hard-earned highway money to the liberal subway-riders in New York or something. It's a dangerous lie with serious repercussions.

FHWA has published a comparison of each state’s highway payments and allocations for fiscal year 2012 [PDF]. Two years after the last federal infusion to the trust fund, states are still profiting. Alaska gets back 7.28 times what it sends to DC. DC itself gets back its gas taxes 10 times over (because of all the federal infrastructure the city maintains). Montana and North Dakota get back three times what they pay. Vermont, almost five times. And not a single state gets back less than 100 percent of what they pay in. Kansas draws the shortest straw of all, which is still a five percent boost from the gas taxes the state contributes.

Even more telling: Looking at the cumulative ratios going all the way back to 1956, only five states -- Indiana, Michigan, North and South Carolina, and Texas -- have recouped less than 100 percent of the gas taxes they've sent to Washington. And those only by the barest margins.

There are two dangers to the falsehood that states get back less than they give.

First, it fuels the “devolutionist” fire of people who think all transportation funding should be paid in and paid out at the state level, leaving the feds out completely. It’s a tempting argument for those who want to drown the federal government in the bathtub. And that would be fine if there were no need for interstate cooperation on transportation networks, or if state transportation departments had a history of innovating on transportation choices. Which they don’t.

Second, the donor/donee claptrap is a powerful deterrent to reform. In the face of demands for a 100 percent return, it's hard to make funding decisions based on merit and not formulas, or demand accountability from states in exchange for federal dollars. Any attempt to dole out at least some transportation funds based on performance -- the only way the much-ballyhooed performance measures in MAP-21 would ever be meaningful -- gets caught in the vortex of state ire about getting back “their fair share.”

The current scenario of federal payouts to states can’t go on forever. Ideally, new revenues will plump up the Highway Trust Fund, and the next transportation bill, due to take effect in less than a year, will reward states that create safer, more efficient, less polluting transportation systems -- instead of getting bogged down in arguments about how to reward states that burn the most fuel.