This year, we've seen a range of new transportation revenue-raising proposals from Massachusetts, Virginia, and Pennsylvania, where governors are all pursuing options other than raising the gas tax. Welcome to the new paradigm in transportation funding, says David Goldberg at Transportation for America:

At bottom, the recent move away from gas taxes as the go-to source of transportation funds is a nod to new realities: Their earning power is shrinking every year, and car-dependent voters will not stomach increases commensurate with their desire for a robust transportation network.

The highway lobby has spent years and millions making the case that gas taxes are “user fees” and are rightly devoted to roads. But with experts like DOT Secretary Ray LaHood predicting that nearly every vehicle will be a hybrid or electric a decade from now, most motorists will be paying little or no such “user fee” absent a major change.

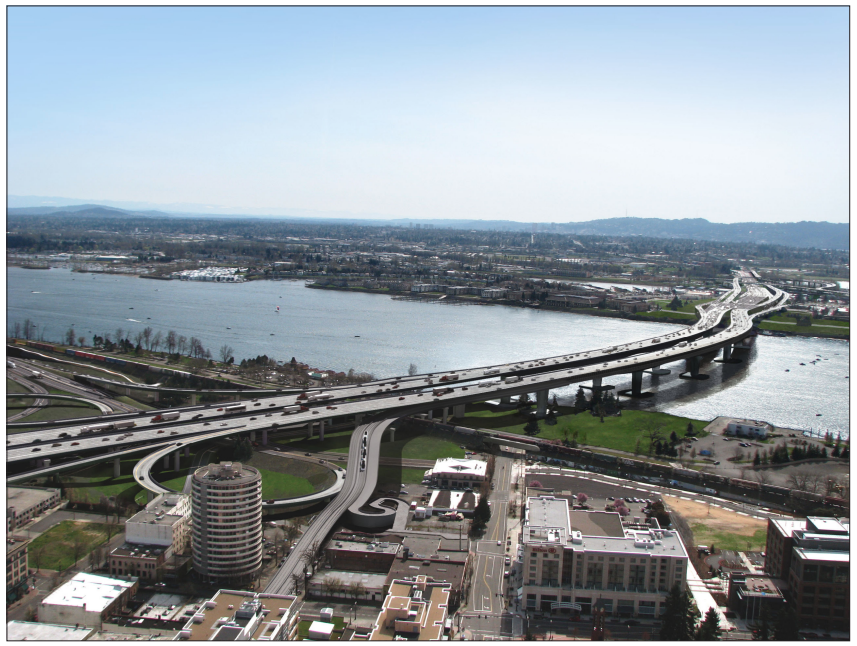

That, of course, says nothing about meeting the needs of the vast majority of Americans who will be living in metro regions too crowded for one-person-per-car travel. State gas taxes certainly can’t meet those needs: 22 states have a constitutional prohibition against spending gas tax revenue on anything but roads, and eight states have similar statutory restrictions.

The gasoline tax has its merits, but given the lack of political will to raise it significantly, and the wide range of needs, it’s time to begin thinking of infrastructure as a basic government function that can, and should be, funded the full range of available revenue sources. Our global competitors, after all, have recognized this for quite some time, and are moving ahead of us in building a 21st century infrastructure.

Some of the non-gas-tax options, though, are clearly better than others. Virginia's proposal to transfer the costs of roadbuilding from drivers to everyone else would be a big step backwards, while institutionalizing the use of value capture to fund transit expansions, as Strong Towns' Chuck Marohn recently recommended, would be major progress.

Elsewhere on the Network today: Better Institutions considers the pros and cons of using income taxes to fund infrastructure. Charm City Streets reflects on the fact that America seems to be unwilling to ban cell phone use by drivers, even as the death toll reaches staggering heights. And Systemic Failure says the Federal Railroad Administration continues to operate as if blissfully unaware that many of its safety regulations have unintended negative consequences.