Cross-posted from Strong Towns blog.

Today we spend money on infrastructure in the hopes of creating growth. That’s backwards. Infrastructure should not be a catalyst for growth but something that emerges in support of productive patterns of development. There has to be a relationship between the infrastructure we build and the value that is created.

—

Late last month I wrote about the return on investment of our highway projects (Paved with good intentions, April 30). I pointed out what is obvious to anyone who thinks it through: Even if modern transportation improvements really did create a lot of wealth, we capture too little of it to be able to continue this system as we have built it.

The example I used was a diverging diamond in Colorado, a high return investment by today’s standards. The official numbers were that this $7.2 million investment would generate $157 million in wealth and prosperity. Instead of debating that — demonstrating the fiction of such numbers is old hat for us – we simply pointed out that $157 million in GDP growth would only return $260,000 to the federal coffers for highway projects. Since $260,000 is substantially less than $7.2 million, repeating this great wealth generation trick, not to mention maintaining this diverging diamond, is going to be difficult.

I was really disappointed that nobody took me up on my challenge to defend the value of the overall system. I did receive a second hand rebuttal that essentially argued that my analysis was too simplistic, that I’m overlooking all of the (unidentified) second order and third order growth effects. This is what I call the “it’s the system, dude” argument. Sure, we may lose money on each project that you measure, but the overall effect of the system generates more than enough wealth to keep it all going.

This is what I call the Infrastructure Cult. We have no proof for our belief that highway spending creates prosperity, we just believe it to be true. We believe it so strongly that we can easily dismiss evidence to the contrary.

I’m going to repeat my challenge: Someone demonstrate how highway funding, and American post WW II development in general, is not simply a large Ponzi scheme, where spending generates the near term illusion of wealth in exchange for massive, unfunded, long term obligations. Show us how it is making the country financially stronger. I’m dying for someone to make this case as opposed to simply spout the belief.

Today we spend money on infrastructure in the hopes of creating growth. That’s backwards. Infrastructure should not be a catalyst for growth but something that emerges in support of productive patterns of development. There has to be a relationship between the infrastructure built and the value created.

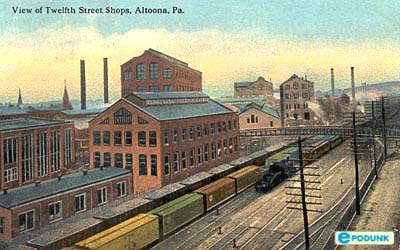

Let’s examine the way the railroads were constructed. Nobody is arguing that there wasn’t government subsidy of the railroads. There was. The land for the tracks and the towns along it were largely given to the railroad companies. Examine that investment, however. Land the government owned was given away. (I realize we can debate whether they owned it — they didn’t — but that is another conversation.) There was no long term taxpayer commitment. There was no ongoing expense the government incurred.

The railroad then built the tracks. Did they build them and then charge a fee (the equivalent of today’s gas tax) to pay for the construction? Absolutely not. That would have been far too speculative. In order to pay for the tracks they did something simple and obvious: they developed the towns along the way. The railroads owned the land, created the railroad stop, subdivided the land around it, sold it to speculators and others looking to develop and then used that money (minus some profit margin, for sure) to build the line. In other words, they used a value capture mechanism to pay for the infrastructure.

The railroads were land developers first, railroad operators second. Once the line was built and the land at the towns sold off, they were free of the need to pay off capital expenses. That meant that the fares that the railroad collected could go directly to covering operations and maintenance (and some profit, for sure). That’s a viable model.

It is also a model with direct feedback. What happened when things didn’t work out, when a town failed to develop properly or when the development of new towns got out ahead of the demand. If the railroads operated like today’s highway departments, if the growth slowed down, we would simply build more railroads and towns. After all, the new infrastructure creates growth, right?

Of course, that is not what happened. Many railroads went out of business, and nearly all lost money, in the Long Depression of 1870, which was at least partially caused by over speculation along the railroad lines. That is what happens in a real market system when there is malinvestment and supply runs too far ahead of demand.

What happens today is that we get an infrastructure cult, where new spending on highways is justified because of a belief that it creates growth and jobs. Add to that a perverse tax like the gas tax — where the system gets more revenue the more inefficient and wasteful people are with their use of resources — and the ability to deficit spend at artificially low rates, and you have a system that is long divorced from financial reality.

One other thing to note about railroads and highways… When a railroad is built, it lasts a long time without needing to be replaced and without a ton of maintenance. In financial terms, you can amortize the maintenance charges over a long, long period of time. In contrast, highways require an enormous amount of maintenance, especially up north where I live. And even with good maintenance, a highway will last about a third as long as a railroad.

So understand what we have done with the Suburban Experiment. We took an affordable, efficient and long-lasting mode of transport that was funded privately by direct value capture and direct user fees and replaced it with an expensive, inefficient and maintenance-intensive system that is funded by politicians with deficit spending and a non-correlated fee.

See why we’re broke?

So how would we shift from a gimmick system to one of value capture? I don’t know in total, but I would start tomorrow with the assessment process. If I ran a DOT and a local government wanted a new improvement, I would assess them and their property owners for the value that is created by that improvement. That won’t cover the second and third life cycles, but it would stop a lot of stupid projects from happening. In fact, it would probably stop every project from happening, and understand why.

When you are assessing someone, you are capturing the value created by the project. Highway enhancement projects wouldn’t happen today because either (a) there is not enough value created to capture, or (b) the property owners won’t be willing speculate that they can recoup the cost of the assessment.

The only reason this system feels normal to us is because it is the system we know. Step back and look at it through the prism of value capture and you will see just how bizarre it is. The Infrastructure Cult is driving us into bankruptcy. It is time we adopted a Strong Towns strategy.