Editor's note: a version of this two-part article originally appeared on Brookings Metro and is republished with permission. Read part one here.

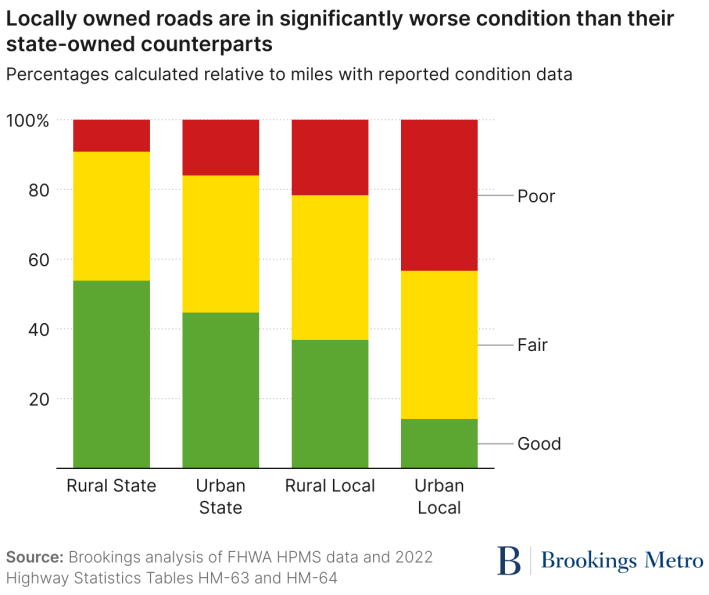

It’s clear that local authorities aren’t receiving their equal share of user fees back from their federal and state counterparts. What makes the fiscal imbalance even more troubling, though, is that local roads are in far worse physical condition than the state-owned portion of the national network.

Since effectively all trips use local roads at some point, a lower-quality network raises the risks of vehicle damage and delay for every road user — even if we only compare the smoothness of roadways, not other design standards such as sidewalk quality.

Overall, state roads are in good shape. Just 11 percent of state-owned roadway miles are considered in poor condition when using either the International Roughness Index (IRI) or Present Serviceability Rating (PSR). The percentages are even lower when looking strictly at rural (2 percent) and urban (5 percent) interstate and freeway miles, which makes sense considering those roads carry high-speed traffic and a disproportionate share of heavy trucks.

The other main category of state-owned roadways is “other principal arterials,” or main throughfares that tend to have higher speed limits. Relatively few of those roadway miles are in poor condition, although far less rural mileage is in poor condition (3 percent) compared to urban mileage (15 percent).

By contrast, over 36 percent of all locally owned roadway miles are in poor condition. The rates are noticeably worse in urban areas, where 43 percent of the road network is in poor condition.

Of course, slower speed limits on many local roads means the conditions can be a bit worse. But even locally owned “other principal arterials” are more often in poor condition in rural (20 percent) and urban (51 percent) areas than their state counterparts. This kind of like-to-like comparison underscores the issues raised by such a sizable fiscal imbalance between state and locally owned roads.

Other studies routinely confirm that America’s roads are in poor condition.

In 2024, USDOT informed Congress that the nation’s interstate highways were in better condition than the National Highway System writ large. And according to the American Society of Civil Engineers, 39 percent of the country’s major roadways were in poor or mediocre condition in 2024.

The patterns are clear: While much of the country’s highest echelon of roadways are in good condition, too many major American roads owned by local governments are not.

Returning gas taxes to local roadway owners would modernize federal highway policy and respond to contemporary challenges

The National Highway System is a powerful example of how well-designed public policy can deliver economy-shaping investments.

From 1956 through the end of the century, Congress and the states perfected a system to capture revenue from the growing pool of drivers to build highways mostly from scratch. The resulting 160,000-mile network is still instrumental in promoting goods trade and shortening trip times across the country, making that network’s maintenance an ongoing national priority.

Yet while that original build-out was essentially complete in the early 1990s, the country is still using much of the original policy architecture.

Just like how federal lawmakers recognized the opportunity that fast-moving highways could create for commerce in the mid-20th century, today’s lawmakers should respond to today’s challenges. Returning some federal gas tax dollars to localities and their shared regions is both a fairer approach and a prudent response to the country’s greatest maintenance needs.

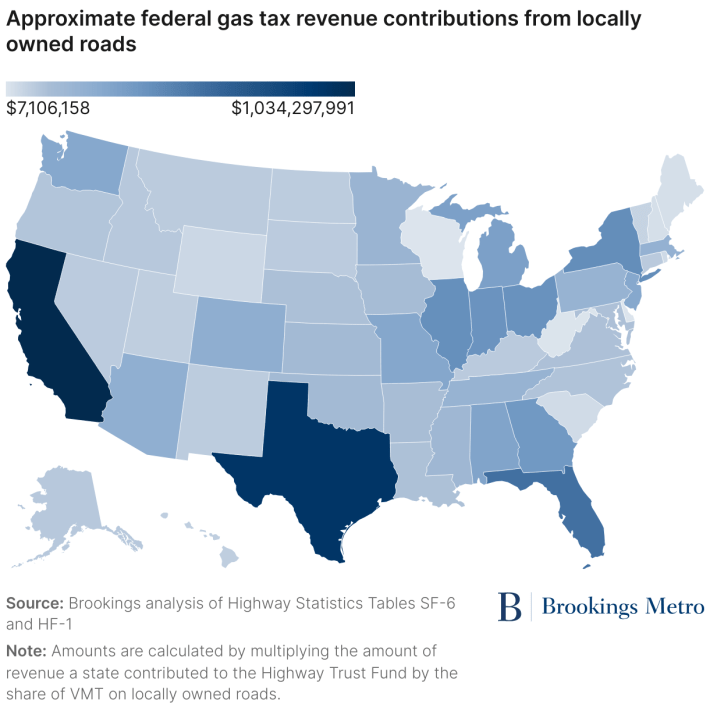

Considering their total share of driving, regions and localities have reasonable claim to a sizable share of federal funds. Using 2022 data, their VMT share of 34 percent would equate to $10.3 billion in federally apportioned funding that year alone.

Those numbers are especially large in higher-population states with relatively high local VMT shares, such as California ($1 billion), Texas ($941 million), and Florida ($584 million).

It’s important to put these kinds of numbers in context. Returning $319 million in annual federal funding to Alabama’s cities and counties, for example, would transform their public works departments, accelerate construction on priority corridors, and free up more funding for public safety, education, and other locally managed assets. These local governments have been subsidizing their state for decades through federal transportation taxes; returning fiscal resources to them would help rebalance the condition of the full network.

With the IIJA set to expire in November 2026, now is the ideal time to consider adjusting the federal apportionment formulas.

One option is to launch a new regional investment program, assigning revenue based on a more advanced analysis of VMT and tax receipts. Another is to modify a current formula program, such as the Surface Transportation Block Grant, to deliver money directly to regions and their municipalities. Policymakers will also need to consider who would qualify as direct funding recipients, suballocation methods within regions, project qualifications, and other conditions.

This analysis also underscores the need to expand transportation asset management policies (known as “TAMP” within federal policy context). Current federal policies only require states to measure conditions on the National Highway System. This report confirms such a scope overlooks the major locally owned roads in the worst condition. Reformed TAMP policies should require states to monitor all federal-aid highway system miles and offer fiscal support to do so. A broader universe of data will offer a clearer picture of which assets are most in need of investment.

States don’t need to wait for federal action

This analysis makes clear that gas tax revenues and incomplete road condition data are distorting the fiscal picture for state officials. Capturing additional revenue from roads that states don’t own makes it appear that their network produces more own-source revenue than it really does.

Not only has this led to worse road conditions for the state’s drivers using locally owned roads, but it also may be incentivizing state officials to overprioritize or overbuild their own network in the process — creating a longer-term maintenance burden for every household and business.

This data should underscore the opportunities a fiscal rebalancing offers. Returning more funding to localities would directly address some of the worst road conditions, while at the same time encouraging state agency officials to better judge the merits of projects on their own network. Legislators, governors, and other state leaders should see fiscal rebalancing as another way to bring greater accountability to their state transportation programs and improve the driving experience in their state.

Fortunately, many states already demonstrate a more pro-local approach. California, Colorado, and Iowa all expended over 30 percent of their total transportation disbursements in 2023 on grants-in-aid to localities, while Arizona and Minnesota weren’t far behind. That same year, Michigan spent over a third of its disbursements on direct capital investment in local roads.

States could also continue to experiment with fund swapping to extend the combined reach of federal and state dollars into regions and localities. Other states can reference those policies to model their own legislative and agency approaches.

Under a true 'user pays' system, local communities would benefit

Elected officials have long supported the concept of a user-pay principle when determining how to invest precious tax revenues in the country’s transportation network. While many still favor the user-pay system, both federal and state policies have not provided locally owned roads with a fair share of their users’ tax contributions. This rerouting of funding has led to a drop in the physical quality of a large portion of the nation’s roads simply because they are locally owned, leading to constrained municipal budgets and a distorted fiscal picture for federal and state officials.

Federal policymakers should address this fiscal imbalance head-on. Revising federal formula programs to return more money directly to local revenue generators can improve roadway conditions for all system users, spreading benefits to all the people and businesses who rely on the complete network throughout their daily life.