As TransitCenter and the Frontier Group reported last week, the federal government pays a huge $7.3 billion subsidy to people who drive to work by making commuter parking expenses tax exempt. There are countless reasons for Congress to scrap this poorly-conceived, congestion-inducing subsidy. While policymakers consider the big picture, they also ought to examine how their own parking benefits are administered.

Here’s the short version: Congress is breaking its own law, and it’s shorting the Treasury hundreds of thousands of dollars per year, by providing free parking far in excess of the allowable limits.

USC 26 Section 132f of the tax code allows employers to provide each worker with up to $250 in free parking per month tax-free, which can add up to $3,000 in tax-free perks per employee each year. That’s a pretty big amount to pay people for exacerbating congestion, but the parking at the U.S. Capitol is worth significantly more than that.

It's hard to know exactly how many free parking spaces we're talking about. The Architect of the Capitol and relevant committees don't like to talk about it, but Lydia DePillis reported in the Washington City Paper a few years ago that a plan for the southern part of the Capitol complex completed in 2005 shows that the House office buildings alone have 5,772 parking spaces assigned to them.

To figure out the market value of those spots, it would help to be able to check the rates at adjacent private lots. The problem is: There are no adjacent private lots.

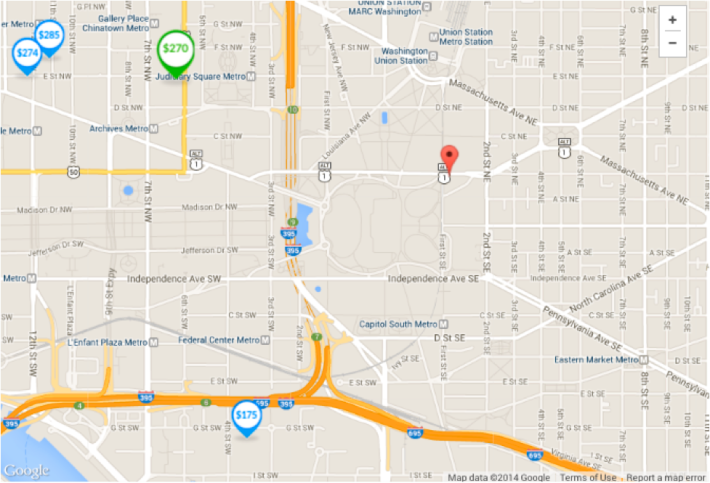

According to SpotHero, there are no available monthly parking spots within a mile of the Capitol. The closest one -- about a 20 minute walk to either the House side or the Senate side -- costs $270.

There are some cheaper options a little farther away, but the cost of parking more than a mile from the destination is almost inconsequential. Given the extreme scarcity of parking near the Capitol, which employs and attracts tens of thousands of people daily, you can bet that on-site parking is worth significantly more than faraway options. Moreover, if so many employees didn’t get free parking on the Capitol grounds, how would that affect demand, and therefore parking rates, at surrounding lots?

According to the law, if an employee is provided with free parking in excess of the allowable limit, the difference should be reported as taxable income, and the employer would have to pay all the normal employment taxes (Social Security, Medicare/Medicaid, etc.) on that portion.

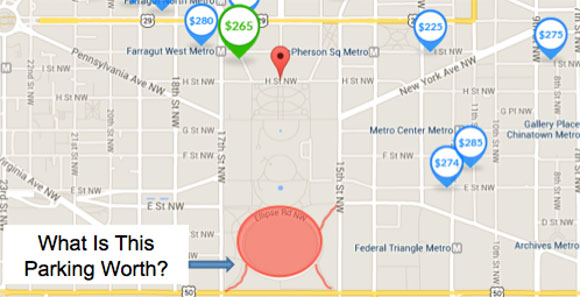

IRS staff affirm that the value of any fringe benefit is based on the market. Congress can't just say the parking is worth $250 and call it a day. They have to acknowledge that the benefit they are providing to staff and members is worth the market price. In the case of a reserved parking space directly on the Capitol grounds, it is likely worth much more than the $270 per month established by the adjacent market for parking.

With this understanding, every staffer and member of Congress receiving free parking is not paying tax on at least $240 in annual compensation -- and that is a minimum estimate. Having seen staffers' pay stubs, I can verify that they are not paying the full value of the parking provided. The failure to report and tax this additional income easily costs the Treasury hundreds of thousands of dollars a year.

The scandalous part is that this is a rule that Congress directly controls. If lawmakers wanted to have an even higher limit for free parking, they could debate it and pass an increase. But rather than address the issue, members of Congress simply break their own law.

And it’s not just Congress, of course. Most likely, many other federal, state, local, and private entities are guilty of non-compliance with the $250 limit on free, untaxed parking. In DC alone, there are huge swaths of land, like the Ellipse south of the White House, which serve only as free parking for federal employees. To my knowledge, no one is keeping track of the value of those spaces, or if employees with this benefit should be reporting additional income when it exceeds the limit.

If Congress would keep its own house in order in terms of reporting its taxable parking benefits, it could spark a larger conversation around whether this is a reasonable benefit to have in the first place. So long as the gravy train keeps rolling, and everyone both expects and receives free parking on Capitol Hill, we’re missing an opportunity for meaningful reform of a tax subsidy that undermines the effectiveness of our national transportation policy.

Will Handsfield is a transportation planner in Washington, DC, and has worked on transportation projects at the local, state, and federal levels. Will bike commutes and lives with his wife and two children in the Lincoln Park neighborhood of Capitol Hill.