There are five stages of mourning, and Congress is moving through them as they begin to face the inevitability of increased revenues for transportation. Lawmakers been through denial, anger, and bargaining, and now they’re pretty solidly in the depression phase. That leaves just one more: acceptance.

But today’s hearing in the House Transportation Committee was still pretty depressing. Members are still thrashing around trying to find a solution that they like better than the only realistic option, which is raising the gas tax by 10 cents a gallon.

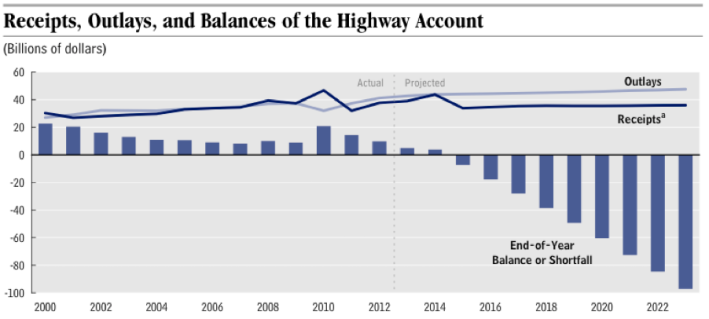

Kim Cawley of the Congressional Budget Office was called in to deliver the sobering news: “To avoid the projected shortfall we see in 2015, the Congress could eliminate all highway and mass transit spending in 2015, or raise the tax on motor fuels by about 10 cents per gallon, or transfer about $15 billion from the general fund to the Highway Trust Fund.” New CBO figures estimate that the Highway Trust Fund will be completely out of money by the start of 2015 [PDF].

(And by the way, 2015 isn’t quite as far away as you think: the federal government’s fiscal year starts October 1 of the prior year.)

The road to acceptance is a bumpy one, of course. A few holdouts are still in the denial phase. Rep. Reid Ribble (R-WI) accused gas tax advocates of treating it as a “sin tax” and worried it would hurt the trucking industry. (Actually, the American Trucking Associations support a 12-cent hike.)

And then South Carolina Republican Tom Rice was somewhere between the phases of anger and bargaining. He said Americans living paycheck to paycheck can’t handle another tax increase. And it’s true: An increase in the user fee will hurt some people more than others, and efforts should be made to mitigate the pain for people with low incomes. But Rice’s proposed solution showed just how far he is from accepting reality. “If there was a way that perhaps we could bring the fuel costs down,” he said, “it might not be as much of a hardship to raise the gas tax a few pennies.”

It's been a while since I’d heard a Republican accuse President Obama of raising the price of gas, and I’d almost forgotten the complete lack of understanding among some in Congress about how global oil prices are set -- or the fact that U.S. gas prices are actually pathetically low, and it shows in our inefficient, auto-centric transportation system.

Clearly, Rice’s heartfelt compassion for the down-and-out is blurring his vision a little. After slamming the president for shutting down some coal-fired power plants, saying that would drive utility costs up, he let loose this doozy: “If we would use the tools we have and the resources God’s given us, it wouldn’t be so hard.” Maybe someone should remind Rep. Rice that we have a finite quantity of those resources and are up against the extremely serious consequences of overusing them.

Texas Republican Roger Williams was another bargainer. He opened with a bit of optimism and a lot of swagger: “I’m going to give you an idea that’ll work,” he said, with a straight face. His credentials for solving a crisis no one else can figure out: “I’m a small business owner. And I’m from Texas. And I also have been in the automobile business for 42 years.” Bless his heart.

Williams' big idea? You’ve probably already guessed it. Eliminate CAFE standards; let the market determine how fuel-efficient the vehicles are. (He neglected to mention that the market loves fuel efficient cars and fuel economy standards are exceedingly popular in this country.) No matter: Williams introduced a bill to eliminate CAFE standards last month.

The automotive industry was the biggest contributor to Williams' election to Congress in 2012, with the oil and gas sector in third place, according to the Center for Responsive Politics.

Of course, some of the deal-making involved saner ideas. Los Angeles Democrat Janice Hahn said she’s one of just two members of Congress (though there are a couple of senators too) who drives an electric vehicle, and so she doesn’t pay any user fee at all for the roads. She’d like to see a vehicle-miles-traveled fee, and there was a substantial debate on the merits of such a fee. The discussion, impressively, didn't fall into the usual trap of hysterical concerns about privacy. As Hahn said, drivers don't raise a stink about trackers that allow them to pay to use high-occupancy toll lanes on the highway. What's the difference?

Meanwhile, I was beginning to get my back up as I heard Rep. Dina Titus, a Democrat from Las Vegas, start to shift the conversation away from revenues “to the other side of the equation.” I thought she was about to go where no other member was willing to go, which is to recommend a dramatic reduction in transportation spending. And it would have to be dramatic -- far more so than the House proposal in 2011 to cut spending by a third. Given the projected state of the Highway Trust Fund in 2015, spending would have to be reduced to zero. (Previous projections assumed cuts of "only" 92 percent would be necessary.)

But that wasn't what Rep. Titus was suggesting at all. She surprised and impressed me when it became clear that she wasn’t talking about Draconian cuts at all -- she was talking about sensible transportation policies. Referring to Las Vegas’ dependence on tourism, she touted the complete streets policy the city has adopted -- “kind of a holistic approach that reduces the need for a lot of costly paving,” as she said.

Titus said Washington state estimates that its complete streets planning program will save the state about 30 percent per project. “Could we talk a little bit more about what Congress can do to encourage states to develop complete streets programs, to bring down the cost?” she asked.

But, as much as transportation reformers give a big “Amen!” to Titus’ point, complete streets alone won’t be the solution to the transportation funding crisis. It will almost certainly involve increased revenues.

Tom Petri, who chairs the Highways and Transit subcommittee where today's hearing took place, made it clear he understands the gravity of the 2015 deadline. Though he didn’t support any one solution, he gently implied that perhaps some freshman Republicans -- like Williams -- who are dead-set against tax increases don’t really have the background to make an educated call. “Many of our members were not in Congress when previous funding shortfalls were addressed,” he said, “and it is important that members understand the fiscal reality we face and the measures the U.S. DOT would need to take.” Educating those members appears to be a major reason that the hearing was held in the first place.

Ranking Democrat Nick Rahall of West Virginia was somewhat clearer that a tax hike was the inevitable solution, praising states for making the “difficult choices” that Washington has been avoiding. What have those choices been? “Over the legislative years 2010 through 2013, seven states enacted significant transportation revenue-raising measures,” Rahall said, pointing to Wyoming, which last February raised its fuel tax “by a whopping 10 cents per gallon, from 14 cents to 24 cents,” and Maryland’s transportation package, which may end up raising the state’s gasoline tax from 23.5 to 43.7 cents per gallon.

Today’s hearing laid out the problem and allowed members to start batting around ideas for a solution. As the clock ticks toward 2015, they’ll have to accept the need to get serious and start making those difficult choices.