One nay-sayer argument against greater federal spending for transportation goes like this: “Too many faceless bureaucrats in Washington have too much control over how states spend their money. Let states raise their own revenues and spend them as they wish.”

Besides, they say, the national government is broke. There’s no more money to spend on roads and trains.

There are a hundred reasons why leaving transportation revenue collection and spending to the states is a bad idea. First, states are in a worse fiscal crisis right now than the feds – in part because they have a balanced-budget requirement, meaning they can’t overspend their revenues in lean times. Second, just because I don’t live in Kansas or West Virginia doesn’t mean I don’t have an interest in those states’ infrastructure, when so much of what I buy rides the roads and rails of those states to reach me. And I start to care a lot about the infrastructure of New Jersey when I travel to New York from Washington.

But here’s another reason: it’s not that much easier to gain public support for raising taxes at the state or local level than at the national level.

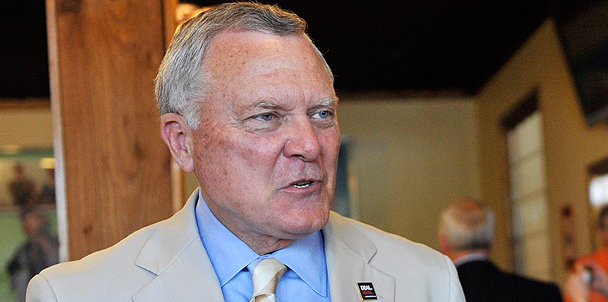

Georgia Governor Nathan Deal is asking state legislators to approve his state gas tax freeze – saving drivers 1.6 cents a gallon, but costing the state $30 million. New York legislators have also drunk the tax-holiday Kool-Aid, despite the fact that it would cost the state $19 million over just three weekends. Massachusetts Governor Deval Patrick is trying to raise the gas tax, and Sen. Scott Brown is giving him a hard time about it. A Connecticut state senator is going around getting petition signatures against raising the state gas tax. Gas station owners in Carson Valley, Nevada are running their own campaign to keep the county from raising the gas tax five cents -- which would just bring it on par with the neighboring county.

There is evidence that when voters know exactly what the revenues will go toward – and it will benefit them – they support higher taxes. But that doesn’t mean raising taxes is ever easy -- even if it's just to replace a federal tax that used to be in place. Once a tax is gone, you can bet people will fight against re-implementation. For proof, just look at the fight brewing over merely extending the federal gas tax that's been in place for decades.