While governors debate raising (or eliminating) their states' gas taxes, buzz is building about mileage-based fees, or a vehicle-miles-traveled charge. A House provision to ban U.S. DOT from studying such a fee has gone away (along with its sponsor), while Rep. Earl Blumenauer is trying to get the Treasury Department to look into how it could work. And a new report from the Government Accountability Office says that would be a good idea.

The House Transportation Appropriations Subcommittee requested the report. Subcommittee Chair Tom Latham is dead-set against a VMT fee, as many rural representatives are, fearing that long distances between destinations in the heartland will end up costing them a lot if charged by the mile. Latham should take a look at the GAO’s conclusion: "Mileage-based user fee initiatives in the United States and abroad show that such fees can lead to more equitable and efficient use of roadways by charging drivers based on their actual road use and by providing pricing incentives to reduce road use."

That’s the first line of the GAO’s 81-page report, and it’s a ringing endorsement of the idea of a mileage-based fee, implying that it is not just a way to collect revenue but also an effective mechanism to make better use of existing roads.

The impetus behind the desire to study VMT fees, of course, is the fact that current receipts don't match spending levels (which, in turn, don't match the need) due to the fact that the gas tax hasn’t been raised in 20 years, and fuel-efficient vehicles are consuming less gas. While the gas tax was equal to 17 percent of the cost of a gallon of gas when it was set at its current level in 1993, it is now only 5 percent. The GAO noted that funding for surface transportation is on the agency’s “High Risk List.”

But it's not all about revenues. The GAO thinks that a VMT fee would also reduce congestion and lead to more efficient roadway use, which in turn could lead to fewer calls for very expensive road-building projects:

For example, mileage fees and other forms of road pricing such as tolling send clear price signals to road users, and provide incentives to drivers to consider alternatives such as public transit or carpooling which can reduce congestion, vehicle emissions, and overall spending on fossil fuels. The Congressional Budget Office (CBO) reported that most drivers currently pay much less than the full cost of their highway use, and that mileage fees could provide a better incentive for efficient highway use than fuel taxes do because the majority of highway costs are related to miles driven. In addition, we have reported that if those who benefit from a program do not bear the full social cost of the service, they may seek to have the government provide more of the service than is economically efficient.

Several states have tested VMT fees, and the GAO drew on their findings, as well as those of other countries that have implemented similar fees. The agency identified three distinct systems, and each comes with its own drawbacks (political or otherwise): those involving GPS tracking attract howls of protest from people fearing invasion of privacy; a pay-at-the-pump system, which still leaves out electric vehicles that never need to visit a pump; and a prepaid manual system based on odometer readings with a high potential for fraud and evasion.

While this last option is the least sophisticated, it’s also the only one the GAO studied with a real-world national example that includes passenger vehicles. In New Zealand, the program has been operational for 35 years.

The GAO found that, if privacy concerns could be overcome, a GPS-based system was the most versatile, since it could be configured to charge variable rates based on place and time of day.

A major drawback to a VMT fee, no matter what method it uses to track mileage, is that implementation will cost a lot more than fuel tax collection and could eat up the additional revenues collected. Installing on-board units in 230 million U.S. passenger vehicles could cost in the range of roughly 8 percent to 33 percent of the revenues generated over a 20-year period, the GAO estimates. In Germany, the GPS units cost about $240 each, not including installation.

“Similarly, retrofitting thousands of gas stations to support a pay-at-the-pump system would be costly and challenging,” the GAO states. “For example, the Oregon and Nevada pay-at-the-pump pilot programs cited difficulties finding and recruiting gas stations to participate in their pilot programs.” In the 12-state study, nearly a quarter of participants had trouble with their on-board units – a rate that would be “disastrous” in a real nationwide rollout.

Mileage fees for commercial trucks are easier and less costly to implement and less controversial than for passenger vehicles, and they would go a long way toward getting trucks to pay for the damage they cause to roads. FHWA estimates that heavy trucks only pay for about half the costs they create in terms of wear and tear, though the report notes the need for updated estimates on the amount of damage caused by these vehicles.

Germany charges heavy trucks to drive on the autobahn. About half are equipped with on-board units; the rest pay manually. Not only did it raise revenues, it “achieved its second goal of creating incentives for operators to invest in lower emission vehicles, which has resulted in reduced emissions across the German and European trucking fleet.” Since fee rates were variable based on the truck’s emission class, number of axles, and distance traveled, trucking companies started investing in the lower-emission trucks that are charged less money. “In 2005, the lowest emission commercial truck classes… comprised less than 1 percent of the commercial trucking fleet. By the end of 2011, those classes comprised about 70 percent of the commercial truck fleet,” reported the GAO.

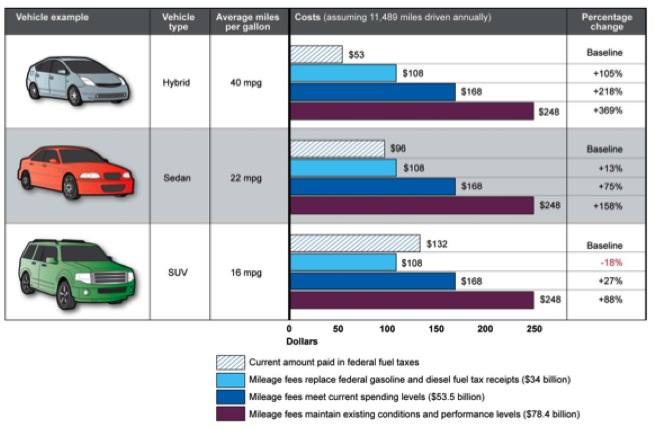

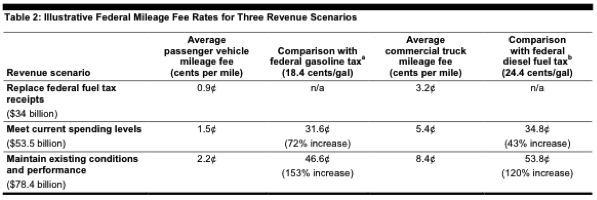

The GAO looked at where the VMT fee would have to be set to attain three different revenue targets. The first would match current gas tax receipts (though the goal of any new program would, logically, be to supercede those), which came out to an average charge of 0.9 cents-per-mile for passenger vehicles and 3.2 cents-per-mile for commercial trucks. The second option would match current spending (though current spending is based roughly on receipts), which would require an average passenger car fee of 1.5 cents-per-mile, 5.4 for trucks. And the third scenario would raise what the GAO estimates is needed to "maintain existing conditions and performance," through an average fee of 2.2 cents-per-mile for cars, 8.4 for trucks.

VMT models do run the risk of eliminating one incentive for driving a more fuel-efficient car. James Whitty, who manages the Oregon DOT office in charge of that state’s VMT fee pilot, said he thinks they’ll never replace the gas tax with a mileage fee for all vehicles. “Vehicles below the midpoint, about 20 miles per gallon, are already paying a load of gas tax,” he told Streetsblog earlier this year. “It just doesn’t make economic sense to include them in this.” Plus, he said, drivers of fuel-efficient cars would revolt if a VMT system ended up providing a financial break for drivers of inefficient vehicles. Indeed, even in the third scenario, with the highest VMT fees, SUV drivers would only pay 88 percent more than they pay now. Hybrid drivers would pay 369 percent more.

Still, under any envisioned system, the fee would remain a small percentage of the total cost of gas – far lower than in many other countries.