Earlier this week, Denver's B-Cycle bike-share system came under fire for allegedly side-stepping low-income neighborhoods. The accuser was City Council Member Paul Lopez, and his complaint was not something that system operators necessarily deny: There aren't many stations in low-income neighborhoods.

The broader claim -- that bike-share isn't serving the populations that might benefit most from it -- has dogged nearly every system in the country. And at its core there is some truth: American bike-share systems aren't doing a good job reaching low-income and minority populations, according to a recent FHWA report.

Only 1 percent of Boston Hubway users are black. In Washington, DC, only 3 percent of Capital Bikeshare users are African-American, according to CaBi's annual survey [PDF]. Denver's B-Cycle users are 81 percent white and only 21 percent have annual household incomes of less than $50,000, according to the Denver Post.

These are statistics that bike-share cities are painfully aware of. And every locale has adopted different methods to reach disadvantaged groups. Denver and Boulder work with the local housing authorities to make memberships available to residents of public housing. Hubway offers subsidized memberships to anyone with an income less than 400 percent of the poverty rate. Minneapolis's Nice Ride requires no deposit to be held on the user's credit card.

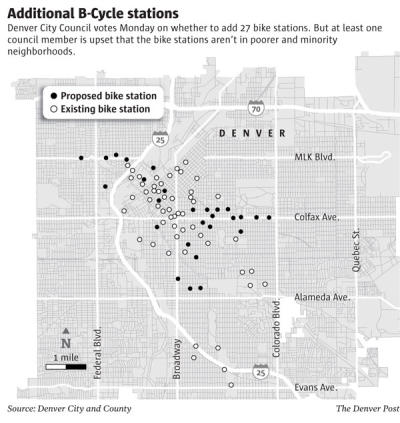

But with many of these programs, success has been limited. One issue is siting -- that was the point raised by Council Member Lopez in Denver. B-Cycle has only one station in west Denver, where much of the city's Hispanic population resides. "That truly says something," he told the Post.

But Parry Burnap, executive director of Denver Bike Sharing, explained that stations do best in densely populated, mixed-use areas with good bike paths. And that in order to stay afloat, the system has to think like a business.

"We run the system through membership and sponsorship," she told the Post. "If we hang a station out there that is not strategically connected, we have to hire people to maintain it."

Minneapolis faced similar criticism following its first year of operation, says Paul DeMaio, of MetroBike LLC, a consultant to Capital Bikeshare and creator of the Bike Sharing Blog. The city has since adjusted its stations to accommodate low-income neighborhoods.

But there are often additional social obstacles to bike-share for lower-income people.

"There’s a cultural issue, in many communities," DeMaio said. "It’s not cool. No one else is riding a bike."

For example, when a local organization donated 100 B-Cycle memberships to Denver Housing Authority residents, only 32 people took advantage, and only 23 used the bikes more than once, according to the Post.

Denver Councilman Albus Brook complained to the Post of a "cultural chasm" between neighborhoods. He reported his constituents' response to B-Cycle was: "'Why in the world would I pay for a bike when I can borrow my cousin's?'"

But surely one of the biggest obstacles preventing lower-income people from benefitting from bike-share is the issue of collateral. All the modern U.S. bike-share systems require a credit or debit card to rent a bike. "Otherwise people have no incentive to return the bike," said DeMaio.

That effectively excludes low-income people who don't have bank accounts. About 17 million people across the U.S., or about 1 in 12 households, are "unbanked," according to a recent report from the FDIC. And the "unbanked" are disproportionately black and Hispanic. More than 21 percent of African American households and 20 percent of Hispanic households are "unbanked," compared to 4 percent of white households and just over 2 percent of Asian households, Bloomberg reports.

Washington, D.C. has gone farther than other cities in attempting to reach unbanked residents with a program called Bank on DC, which allows low-income people to set up no-fee, no-minimum bank accounts. Those who take part in the program are eligible for a $25 discount on an annual CaBi membership.

But Greg Billing at the Washington Area Bicyclist Association said the program has not necessarily been a game-changer.

"It has been working at the issue but isn’t the magic bullet yet," he said. "It’s a little bit of a process to go through Bank on DC and become a Capital Bikeshare member."

Russell Meddin is the founding member of Bike Share Philadelphia, an organization working to bring bike-share to the City of Brotherly Love. Meddin thinks it is absolutely crucial, if Philadelphia launches a bike-share system, that it serve low-income people, because of the city's demographics. But he doesn’t think the idea of helping the unbanked get bank accounts is the right approach.

"You’re making them do something that’s out of the ordinary for them," he said. "You need to set up something that’s ordinary for them."

Meddin likes the idea of tying bike-share payments to cell phones, which many low-income people do have -- allowing them to purchase memberships when they pay their phone bill.

Meanwhile, it remains an odd fact that, in America, private companies are able to offer low-income people without credit auto loans, cash loans, and layaway, but we can't seem to figure out how to provide them with the financial tools to ride public bikes.

Correction: Bank on DC members are not required to make deposits and local organizations help defray the costs if a bike is stolen.