Reforming a 44-Year-Old Insurance Law Could Prevent Thousands of Deadly Truck Crashes a Year

Insurance minimums for trucking companies haven't been raised in 44 years. Victims and survivors are paying the price.

12:03 AM EST on January 30, 2024

The feds must close a little known – and decades-old — loophole that may be responsible for thousands of deaths on U.S. roads: rock-bottom insurance minimums that allow unsafe trucking companies to skimp on even the most basic safety measures, said advocates who support a new House resolution.

Rep. Chuy Garcia (D-Ill.) and Hank Johnson (D-Ga.) recently introduced the Fair Compensation for Truck Victims Act, which would increase truck companies' minimum insurance premiums from the $750,000 cap set in 1980 to the $5 million it would be today had it been simply adjusted for inflation.

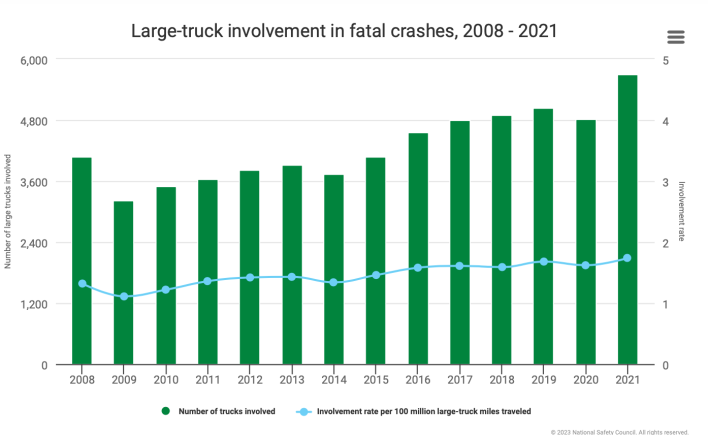

The National Safety Council estimates that in 2021, large trucks were involved in 5,700 fatalities, accounting for 12 percent of all road deaths, despite making up just 5 percent of registered vehicles and logging 10 percent of vehicle miles traveled on U.S. roads — and despite the fact that truckers should, theoretically, be highly trained drivers with fewer crashes than the public at large. Insurance payouts to victims, meanwhile, have remained capped at levels set nearly half a century ago, even as the costs of collisions continue to soar.

Advocates say, though, that the new bill could easily be called the "Preventing Thousands of Deadly Truck Crashes Before They Happen Act" because of the outsized role that low insurance minimums play in keeping unsafe trucking outfits on the road.

"Raising insurance minimums fixes problems on both sides of the crash," explains Jeffrey "J.J." Burns, a nationally recognized truck crash attorney and a board member on the Truck Safety Coalition. "First, it stops crashes from happening, because raising premiums requires a motor carrier to meet certain safety requirements in order for an insurance company to take the risk of insuring them. And on the back end, at the very least, you'll have enough money to pay for at least the medical expenses of people who have ben catastrophically injured, and maybe even the lost wages for people who have lost a breadwinner in the family. ... It’s essentially an economic problem — and for the last 40-plus years, all of the increased costs have been put on the backs of the U.S. motoring public."

Burns traces the problem of ultra-low insurance minimums to the 1980 Motor Carrier Act, which sought to update railroad-era regulations on interstate commerce for the modern trucking age. In the process, though, regulators capped insurance minimums at a then-respectable $750,000, and failed to require their successors to adjust that amount for inflation — an omission that became more dire when the agency lost its ability to change those minimums without involving Congress.

One of the people who bore the brunt of that oversight is Gage Evans, whose husband, Bill Bailey, was one of the victims of a notorious 16-vehicle pile-up in Colorado in 2019. That crash was caused by an inexperienced truck driver who wasn't trained to navigate the steep terrain, which lead to him burning out his brakes, missing a runaway truck ramp, and plowing into a line of traffic at nearly 85 miles per hour, killing four.

The $750,000 insurance policy his employer carried, though, wasn't even enough to cover the medical expenses of the many injured survivors, never mind compensate grieving family members like Evans for their loss. The driver in the crash was initially sentenced to 110 years in prison before his sentence was commuted to 10; the owners of the small trucking outfit that employed him, meanwhile, registered with a new name the day after the collision, and quickly began racking up new violations.

"The premiums on that minimum insurance are so low that if you say, 'I have one truck and I want to start a trucking company,' you’re off and running," Evans adds. "It leads to irresponsible behavior right from the get go. [The trucking company involved in my husband's crash] did not check references on the driver. They didn't check if he'd driven a mountainous route before. All this stuff along the way multiplied the danger — and I think it all started with allowing someone who doesn’t think ahead to start a business, just because they could pay for that minimum insurance."

'Like counting cards in blackjack'

Some advocates say that the irresponsible company that killed Evan's husband isn't an outlier.

In part because reasonable insurance minimums are no longer a barrier to securing shipping contracts, small, owner-operated trucking carriers have exploded across the United States since 1980, with 95.8 percent of companies on U.S. roads today running 10 or fewer trucks each, and most running just a single vehicle. Many of those micro-carriers are undoubtedly safe and responsible, but some are inexperienced shoestring operations racing to compete on price in a crowded field. Burns says many can barely afford minimum insurance, never mind things like hiring full HR departments to vet drivers or installing automatic emergency braking on vehicles.

Meanwhile, insurers like the Owner-Operators Independent Drivers Association — which doubles as major lobbying group, and whose members own an average of fewer than two trucks a piece — have little reason to conduct meaningful underwriting, much less deny companies that skimp on safeguards. Many company can secure a policy in moments over email.

"Anyone can get into this line of work; no one is really on first base [in terms of] knowing who these companies are," added Zach Cahalan, executive director of the Truck Safety Coalition. "And if you’re the insurance provider, it’s like counting cards in blackjack; $750k is less than one-fifth of the risk that [a crash] really poses, so you really can’t lose. Insurance carriers are incentivized to open up as many of those policies as they can, even if it means having higher crash rates in their portfolio ... Everyone wins, except for road safety."

Recommended

Theoretically, when the insurance money runs out, truck crash victims could mount civil suits against the employers of the drivers who struck them. When they're suing micro-companies, though, there's often little money to collect — and because truck crashes are more likely to involve many victims with expensive, life-altering injuries in addition to the dead, that often means financial devastation for multiple people at once.

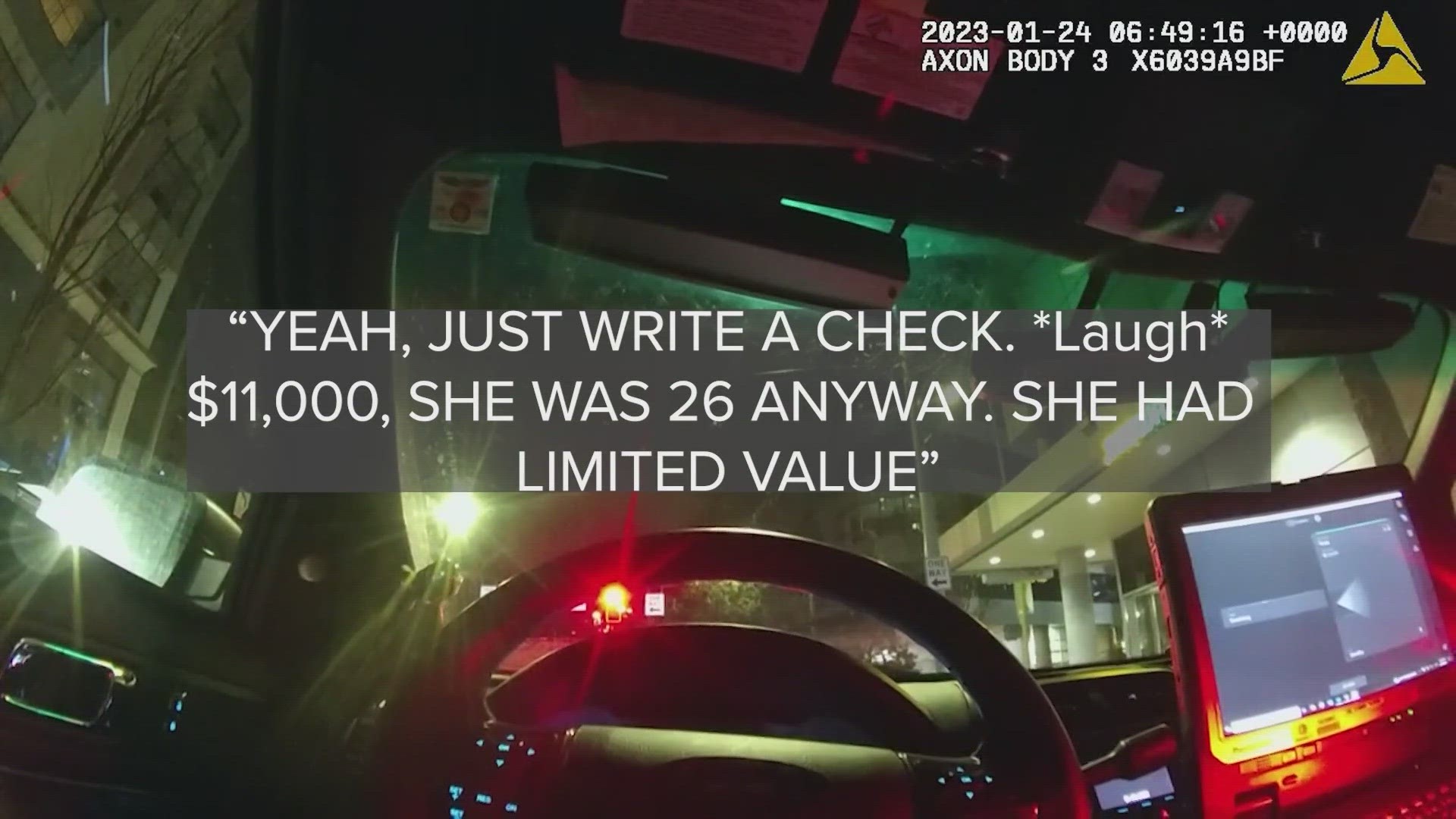

"If you lose both your legs in a truck crash, obviously the value of your legs far exceeds $750,000," added Burns. "But the insurance company will probably come to you and say, 'You can either take that now and that’ll be all you get, or you can file a lawsuit and take this guy to trial. Yes, you might get a $10 million judgment. But guess what? John Q. Truck Driver doesn’t have any money; that judgment is just a piece of paper. And now you have to pay your litigation expenses, too.'"

Overdue for change

Like other structural contributors to traffic violence that go ignored, Cahalan says he understands why truck insurance reform hasn't been a priority in Washington over the past 44 years — and why it hasn't been a focus of Vision Zero advocates, who might not make the connection between shoddy underwriting and deadly crashes with big rigs. And he also acknowledges that forcing insurers to cover the real costs of these collisions would shake the foundations of an industry that has foisted them onto victims — and likely force many owner-operators to become employees.

He says that trade-off, though, is more than worth it for the life of even one Bill Bailey, whose wife Gage Evans still remembers him as an "engineer with the heart of a poet," and who is still grieving the many years they hoped to share.

"We’re unnecessarily putting the public at risk so a small subset of people can continue to make their livelihood in this way," Cahalan adds. "Running your own trucking company is an expensive proposition; I'm not saying it's not. But if you can't afford [a reasonable premium], you’re going to have to work for someone who can."

Kea Wilson has more than a dozen years experience as a writer telling emotional, urgent and actionable stories that motivate average Americans to get involved in making their cities better places. She is also a novelist, cyclist, and affordable housing advocate. She previously worked at Strong Towns, and currently lives in St. Louis, MO. Kea can be reached at kea@streetsblog.org or on Twitter @streetsblogkea. Please reach out to her with tips and submissions.

Read More:

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Kiss Wednesday’s Headlines on the Bus

Bus-only lanes result in faster service that saves transit agencies money and helps riders get to work faster.

Freeway Drivers Keep Slamming into Bridge Railing in L.A.’s Griffith Park

Drivers keep smashing the Riverside Drive Bridge railing - plus a few other Griffith Park bike/walk updates.

Four Things to Know About the Historic Automatic Emergency Braking Rule

The new automatic emergency braking rule is an important step forward for road safety — but don't expect it to save many lives on its own.

Who’s to Blame for Tuesday’s Headlines?

Are the people in this photo inherently "vulnerable", or is this car just dangerous?