Would stricter fuel economy rules bankrupt transportation funding in America? The Congressional Budget Office seems to think so, but environmentalists are quick to say that the system was hurtling toward bankruptcy anyway.

Under a new rule proposed by the NHTSA and the EPA, CAFE standards are expected to raise the average fuel economy of the new-vehicle fleet from 34.1 miles per gallon — the average anticipated for 2016 and beyond under current standards — to 49.6 mpg. That's fantastic news for the environment, but for those counting on gas consumption to pay for essential infrastructure, a recent CBO study suggests it would be a disaster.

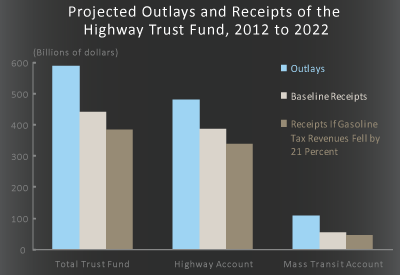

Just how big a disaster is a matter of some dispute. The CBO says that between now and 2022, revenues -- already insufficient to meet transportation needs, already causing endless gridlock in Congress -- would shrink by $57 billion. By the time most cars on the road are in compliance with the new standards, about 2040, the CBO says that would mean a 21 percent drop in funds available for infrastructure spending.

Deron Lovaas of NRDC says the CBO is "sniffing fumes" with its analysis:

To set the record straight, the correct estimate is a loss of $2.5 billion over those 10 years—a reduction of just one percent of the current revenues. The CBO actually noted this themselves in small print in a footnote on page six of the report: “The new CAFE standards would not take effect until 2017, so they would reduce gasoline tax revenues between 2012 and 2022 by less than 1 percent, CBO estimates.”[1]

During 2012-2022, the actual fuel-efficiency-related revenue reduction pales in comparison to the shortfall of $147 billion that CBO estimates in their baseline case without the fuel-efficiency improvements. The $100 billion-plus gap between supply and need from the outdated revenue system is the real issue...

Consequently, it’s fair to say CBO understated the crisis in transportation finance when looking back and vastly overstated the role of fuel economy standards on finance looking forward.

Either way, in the long run it only makes sense to disassociate fuel consumption from the Highway Trust Fund.

Fuel economy is indisputably a good thing and one that should be incentivized with higher gas prices -- and raising the gas tax can help accomplish that. But if people drive, they should also pay for the congestion they cause, the infrastructure they use, and the infrastructure that keeps other people from causing even more congestion.

In an era where people are driving less and opting for more fuel efficient vehicles, the gas tax is an inadequate way to pay for infrastructure. Fuel usage is increasingly unrelated to how much congestion or wear and tear a driver causes. Electric vehicles, hybrids, smart cars and other fuel-sippers are starting to sever that connection.

The conversation over raising the gas tax must be accompanied by a discussion of how to replace the gas tax with something more sustainable.