Oregon has led the way in developing an alternative to the gas tax, with a program that levies a fee on vehicle miles traveled. While the Oregon Department of Transportation has spent years developing the mileage-based program and is ready to expand it to all vehicles statewide, it's not part of the massive transportation spending package under discussion at the legislature.

Federal standards to combat climate change have required that automakers produce increasingly fuel-efficient cars and trucks. While the Trump administration is seeking to stop further progress on fuel-efficiency standards, there's little it can do to roll back gains that are locked in through 2021.

As cars guzzle less gas, drivers end up paying less in gas taxes. So some states are thinking about charging for every mile driven, not just for every gallon of gas burned.

Oregon, which enacted the country's first gas tax in 1919, is out in front on the transition to a mileage fee. The state began with a task force in 2001, followed by pilot programs in 2006 and 2012. It launched a permanent program in July 2015, capping participation at 5,000 vehicles. Car owners who volunteer for the program are charged 1.5 cents per mile, measured by a device added to their car. Participants are refunded for state gas taxes they pay at the pump, and out-of-state travel doesn't count toward the total.

The math should work out so a driver with a car that gets 20 miles per gallon would pay the same amount in mileage fees as she does with the gas tax. Drivers with efficient cars would pay more than they do with a gas tax, while gas-guzzlers would pay less.

This change creates winners and losers. Rural drivers tend to have less efficient vehicles, so they would save money under a mileage fee system even though they drive longer distances, according to a study last year from Oregon State University [PDF]. Drivers in urban areas, meanwhile, would pay more than they currently do, because they tend to have more fuel-efficient cars.

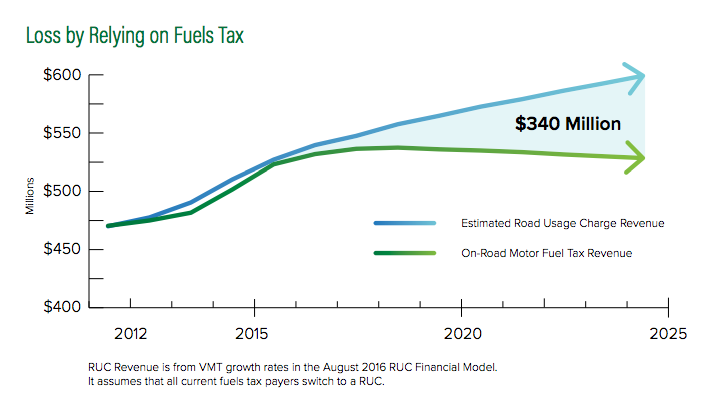

Over time, as cars become more efficient, a mileage-based program would make up for gas tax shortages, according to a progress report on the program released in April [PDF]. "Compared to fuels tax, a [road usage charge] system would generate an additional $340 million dollars in gross revenue within the next 10 years," the report says. "This is because the [road usage charge] model is not susceptible to increased vehicle fuel efficiency."

Although car owners with efficient vehicles pay more with a mileage fee, they make up a large share of the volunteers in the Oregon program. “People with higher-mileage vehicles tend to enroll first. We’re not sure why that is; they might be early technology adopters," said Michelle Godfrey, spokesperson for the Oregon DOT's road usage charge program. “We’ve actually had challenges trying to recruit lower-MPG vehicles into the program.”

Earlier pilot programs assessed higher per-mile fees in congested areas and during rush hours. While it's something the Oregon DOT is open to considering again, the current program is simply a flat per-mile charge. Unlike the earlier versions, the current per-mile charge system, known as OReGO, is slated to continue indefinitely, and ODOT is ready to roll it out on a bigger scale.

“This is ready to go at any time, should the legislature decide that they want us to implement this statewide," Godfrey said.

Instead, the legislature is weighing a transportation funding package that would, among other things, hike the gas tax, institute a bike tax, and add annual surcharges for both electric vehicles and gas guzzlers.

ODOT's April report on the OReGO program holds a dim few of some of these funding fixes, saying that "raising fuels tax is a short-term fix, not a long-run strategy" and that annual surcharges are "even less fair than the increasingly inequitable fuels tax."

But it's unlikely that mileage fees will be added to the legislature's transportation funding plan, which is the subject of intense debate after a similar funding proposal fell apart two years ago.

"The transportation package that's being considered this session is pretty big, and it’s probably too big for [road usage fees] to kind of fit in there," says ODOTs Godfrey. “We’re just following directions from the legislature."