Sprawl and the Cost of Living

12:55 PM EDT on July 6, 2016

Cross-posted from City Observatory.

Over the past three weeks, we’ve introduced the “sprawl tax”—showing how much more Americans pay in time and money because of sprawling urban development patterns. We’ve also shown how much higher the sprawl tax is in the US than in other economically prosperous countries, and how sprawl and long commutes impose a psychological, as well as an economic burden. Today, we’ll take a close look at how ignoring the sprawl tax distorts our view of the cost of living in different regions and neighborhoods.

As one old saying goes, an economist is someone who knows the price of everything and the value of nothing. It’s often claimed that some places, often sprawling Sunbelt cities, have a lower cost of living, based usually on observations about lower housing prices. And judged solely from the sticker price of new homes, the argument has some merit.

But as our aphorism about economists implies, there is a lot more to this question than just one set of prices. If you’ve followed our series on the sprawl tax, you know that living in some cities—those with cheap average housing costs, like Houston or Dallas or Birmingham—also carries with it a heavy, and largely ignored cost in the form of the “sprawl tax”: much higher transportation costs. In short, we tend to fixate on the price of something we can easily measure (housing) and simply leave out the value of something that is much less obvious (sprawl and longer commutes).

How big is the sprawl tax, relative to the supposed cost of living differences among metropolitan areas? Quite large as it turns out: enough to erase much of the supposed cost advantages that low density settlement is supposed to offer.

We know that within metropolitan areas, there’s a strong tradeoff between rents and home prices and typical commute distances. Low density housing, at a long remove from the city center and most metro area jobs, commands lower prices, reflecting in large part the added transportation costs implied by more far-flung and less accessible locations. Others, notably the Center for Neighborhood Technology through its H+T calculator, have addressed the tradeoff between housing costs and transportation costs within metropolitan areas. Our analysis here uses the sprawl tax in concert with Bureau of Economic Analysis estimates of housing costs differences at the metropolitan level to examine this tradeoff.

The Sprawl Tax and Cost of Living Differences

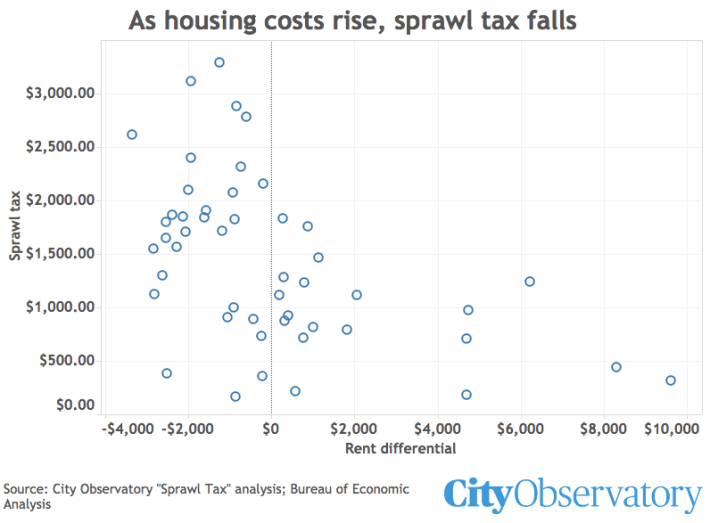

In the following chart, the vertical axis shows the sprawl tax: higher values mean that a region’s residents pay more for transportation costs and travel time as a result of sprawl. The horizontal axis shows the rent differential: how much more (or less) the typical resident pays in annual rent/housing costs compared to the typical large metropolitan area. Areas to the right have higher rents; areas to the left have lower rents. And, as discussed in the post-script, at least some portion of the difference in rents reflects real quality of life differences between cities; but for now we use this as an index for housing cost comparisons.

The chart illustrates a range of different combinations. Four metro areas with the highest sprawl taxes (Atlanta, Nashville, Dallas, Houston) all have lower than average housing costs. For example, according to the BEA estimates, the annual cost of housing in Houston is $850 per person less than the national average. But the typical Houston household would face a sprawl tax based on longer commute distances of about $2,900 per worker which would essentially wipe out the superficial price advantage from housing.

The nation’s most expensive housing markets—including San Francisco, San Jose, New York, and Washington—have housing costs that are considerably higher than the national average, with per person annual rental costs exceeding the national average by $5,000, up to almost $10,000 in San Jose and San Francisco. But these cities have much lower than average sprawl taxes. Workers in San Francisco, San Jose and New York pay less than $500 per year in sprawl taxes. This amount doesn’t fully offset the added rental costs, but combined with the quality of life differences between high prices and low prices cities, makes the differences much smaller.

And for many cities, adding the sprawl tax essentially erases the supposed cost of living advantage from cheaper housing. For example, Houston’s housing cost is about $1,100 per person less than Portland’s ($845 below the large metro average compared to $318 above). But Portland’s sprawl tax ($871) is $2,000 less, per worker, than Houston’s ($2,877), which for many households will more than eliminate the housing price advantage.

A sensible discussion of the real differences in the cost of living between places has to look just past the prices of a few commodities and big ticket items, to consider the intrinsic value consumers attach to great urban environments, the variety and convenience of consumption opportunities in compact urban centers and the sprawl tax the consumers must pay.

Methodology: How we calculated living cost differentials

The best measure we have of inter-metropolitan differences in consumer prices is the Bureau of Economic Analysis Regional Price Parities (RPP) estimates. These estimates, prepared from the data used to construct the nationwide consumer price index, confirm some of our fundamental intuitions about differences in costs of living between communities. The cost of goods varies little among places. The difference between relatively expensive and relatively inexpensive cities (that is, the 75th percentile and 25th percentile) in the cost of goods is just 2.5 percent. For services, prices vary somewhat more, about 8 percent. So what’s really making up the difference in cost of living? No surprise: housing, which varies by more than 30 percent.

Regional Price Parities for Metropolitan Areas of Over 1 Million, 2013

Component Weight Mean Interquartile Range (25%-75%)

Goods 41.5% 99.2 97.3 – 99.7

Services (excluding rent) 37.9% 99.3 94.3 – 102.1

Rent 20.7% 107.2 85.5 – 116.0

Source: Bureau of Economic Analysis, City Observatory calculations. Weight is the share of these items in the RPP calculation. Index values are for the entire nation, i.e. U.S.=100. Mean and interquartile range are weighted by metro area.

Here are BEA’s estimates of the rent price index for the 51 largest U.S. metropolitan areas (those with a population of one million or more). The data are indexed to the national average rent (U.S. = 100). On average, rents are about seven percent higher in large metropolitan areas (i.e. the index for the median metropolitan areas of the 51 largest is 107). Rental prices in San Jose and San Francisco are 80 to 90 percent higher than nationally; rents in Louisville and Birmingham are 25 to 30 percent lower than the national average.

Because housing costs are the biggest source of variation in the measured cost of living among large metropolitan areas, we use the BEA data to estimate how much more, or less, a typical household pays for housing, based on the difference in rents among metropolitan areas. BEA estimates the rents as a combination of the actual rent paid by renters, and the “imputed rent” which is the value of housing services received by households that own their own homes). We compute the difference in the income paid for housing among metropolitan areas by observing the difference between the average rental price parity for the 51 largest metropolitan areas (107) and the actual value for each metropolitan area. We multiply that difference by the per capita personal income of the area and the share of per capita income devoted to rent (estimated by BEA at 20.7%).

A Postscript: Two Big Challenges with Comparing Living Costs

We present the estimates of housing cost differentials here, and compare them to the magnitude of the sprawl tax to illustrate how important urban form is to our economic and personal well-being. But its also worth noting that conventional cost comparison measures understate two important economic advantages of cities.

First, as with other commodities, differences in prices often signal the value that consumers attach to different objects. Housing may be more expensive in San Francisco or Hawaii than in Omaha or Idaho, but much of this difference reflects the value that we attach to being in a vibrant city or a sunny, tropical climate. A two bedroom apartment near the beach in Maui or on Nob Hill in San Francisco represents an entirely different set of amenities than a similarly sized apartment in Fresno or Fargo. Indeed, a whole class of economic analysis—hedonic regression—uses these price differences to estimate the value of natural and manmade amenities.

Second, there’s an inherent limitation in trying to compare different places that have widely different sets of attributes and consumption opportunities. Typical estimates of cost-of-living differences will look only at a single commodity (like housing) or a very limited market basket of simple goods and services, and use these to compute differences in living costs between places. The assumption is that consumers or households buy the exact same mix and quantity of goods and services wherever they live. Economists have cast serious doubt on the validity of these simple-minded price comparisons. It turns out, consumers attach value to having convening access to a big range of goods and services, something you find mostly in cities. Columbia’s Jessie Handbury has shown that the greater mix, variety and convenience of shopping opportunities in larger cities means that consumers actually enjoy lower prices for the particular market basket of goods they prefer in larger cities than in smaller ones, contrary to the notion that small town prices are lower. BEA’s Regional Price Parities which imply that New York’s prices for goods are 8.8 percent higher than the national average aren’t adjusted for quality and variety. According to Handbury’s estimates, when you make that adjustment, prices in larger cities are actually lower than in smaller ones.

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Kiss Wednesday’s Headlines on the Bus

Bus-only lanes result in faster service that saves transit agencies money and helps riders get to work faster.

Freeway Drivers Keep Slamming into Bridge Railing in L.A.’s Griffith Park

Drivers keep smashing the Riverside Drive Bridge railing - plus a few other Griffith Park bike/walk updates.

Four Things to Know About the Historic Automatic Emergency Braking Rule

The new automatic emergency braking rule is an important step forward for road safety — but don't expect it to save many lives on its own.

Who’s to Blame for Tuesday’s Headlines?

Are the people in this photo inherently "vulnerable", or is this car just dangerous?