It may be "seven years too late," as tactical urbanist Mike Lydon put it, but President Obama has released a transportation proposal that calls for big shifts in the country's spending priorities.

Obama's proposal would generate $30 billion annually from a $10-per-barrel surcharge assessed on oil companies. More importantly, the revenue is linked to a substantial shift in what transportation projects get funded. It's the kind of thorough proposal, on both the revenue and spending sides of the equation, that Obama shied away from for most of his presidency. (It would only have stood a chance during his first two years in office.) While this Congress would never pass it, the proposal does lay down a marker for what smart federal transportation policy could be.

In a rough sketch laid out by the White House yesterday of the upcoming proposal, Obama calls for major increases in transit funding and investing in a network of efficient high-speed rail. Perhaps even more innovative is a $10 billion program to reduce carbon emissions from the transportation sector. This program, among other things, would fund states to better coordinate housing and job development with transportation. Obama's proposal also calls for $2 billion to support research and development and the implementation of autonomous vehicles.

Not surprisingly, what has gotten the most press is the oil tax, which even Obama admits would likely be passed on to consumers through higher gas prices. Already, Republican Congressional leaders have called the proposal "DOA."

Obama's people have acknowledged the bill faces long odds in Congress, describing it as a conversation starter. An unnamed administration official told Politico the plan would help shift the nation's transportation policy out of the Eisenhower era.

“This is a new vision," one "senior official" said. "We’re realistic about the near-term prospects in Congress, but we think this can change the debate.”

Likely to be glossed over by most coverage is the fact that Obama's proposal would help people save over the long run by chipping away at car maintenance costs caused by poor road conditions and reducing the time Americans spend driving. It's also important to note that the federal transportation program is currently funded thanks to budget gimmicks that can't be sustained much longer.

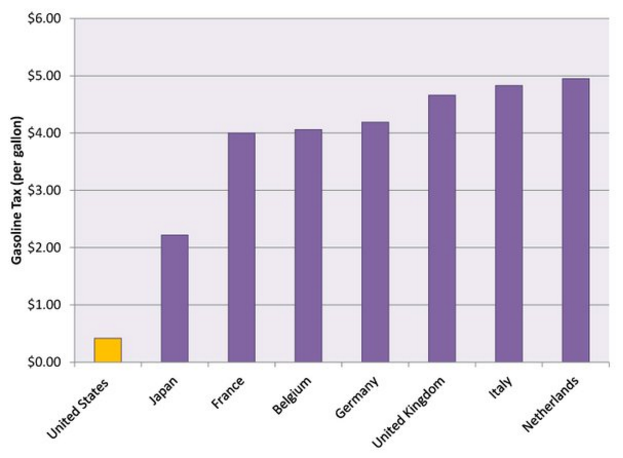

Meanwhile, Tony Dutzik at the Frontier Group notes that even if this passes, the U.S. would still have by far the lowest fuel tax rate in the industrialized world (top chart).

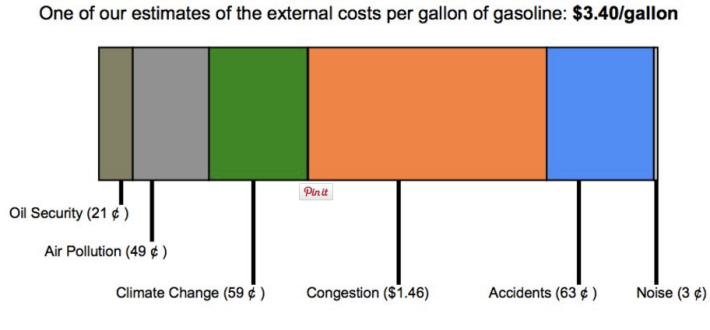

Costra Samaras, a climate researcher at Carnegie Mellon, says that Obama's $10-a-barrel proposal works out to a tax of about $23 per metric ton of greenhouse gas emissions, or "toward the low-ish end of the social cost of carbon."

According to Samaras, the social costs of driving add up to about $3.40 a gallon. The current federal gas tax is 18.4 cents per gallon. Obama's proposal would likely add about 10 cents per gallon, Samaras says.

More details about Obama's proposal should be available next week.