How MAP-21 Allocates Transpo Funds Where They’re Needed Least

1:59 PM EDT on October 3, 2012

Transportation reauthorizations have typically not been a time for major discussions about national policy goals. They’ve been a time for getting while the getting’s good, a time for deal-making and pork and a lot of back-room transactions to make sure every member of Congress could go home and talk about how much federal money they were bringing home.

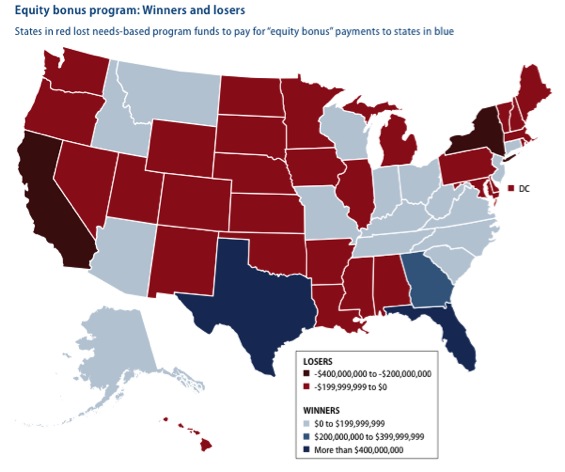

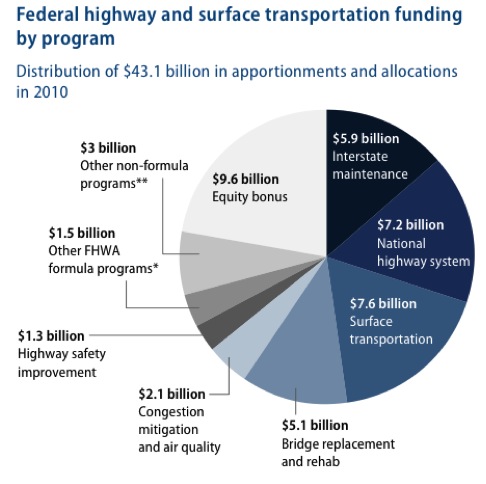

If MAP-21 accomplished anything it was to change that conversation. It eliminated earmarks – no small feat, as the previous transportation bill, 2005's SAFETEA-LU, was one of the most heavily-earmarked pieces of legislation ever. MAP-21 also eliminated funding formulas, which used to hold up every bill for at least a year or two as Congress members tried to manipulate the numbers to benefit their states. And the bill also eliminated the "equity bonus" program, which ate up 22 percent of transportation funding in 2010 and was, at its heart, the exact opposite of everything reformers are seeking in the transportation bill. The explicit purpose of the equity bonus program was to reallocate billions of dollars to where the money was not needed -- and it was the biggest funding program by far in SAFETEA-LU, accounting for nearly $10 billion in 2010.

Unfortunately, although MAP-21 eliminated these inefficient calculations, it froze in place the funding levels that politicians arrived at through this wheeling and dealing. The new law based state-by-state allocations on the share of the total pie each state got in 2009 – and that share was determined by how well the state fared in flawed funding formulas and the equity bonus program.

Donna Cooper and John Griffith at the Center for American Progress just published a report called “Highway Robbery,” lamenting the fact that the equity bonus isn’t truly dead – its legacy still haunts our transportation funding system.

The equity bonus was designed as a way to make sure that no state lost out too badly when it came time to divvy up federal transportation dollars. If the formulas that determined how much funding states received ended up giving a state less than 92 percent of what it sent to the feds in gas taxes, the equity bonus would bump up that state’s take to make sure it wasn’t too much of a “donor” state. In so doing, the program inherently took money from areas of most demonstrated need – based on lane-miles, population, repair costs, and more – and redistributed it to other areas. Pretty screwy, right?

Now, the formulas that determine "need" are far from perfect too. They reward states for having tons of highways, burning tons of fossil fuels, and driving too much. CAP recommends rewriting formulas to take into account repair needs and estimated costs, highway congestion and transit ridership. That seems like a good start. Even better, a discretionary funding system, similar to TIGER grants, would allocate funding to where it will do the most good for mobility, access, and air quality. And real performance requirements would base funding decisions on how well states have managed their money in the past.

So, no one’s arguing that outdated formulas make for a robust and thriving transportation program. But the equity bonus makes a bad situation far worse, mainly serving as a slush fund to cobble together more votes on transportation bills.

This was especially apparent in the talks leading up to the passage of SAFETEA-LU in 2005. “They were trying to negotiate this equity bonus thing, and they had to make up data points that would get them to where they needed to get,” said Eno Transportation Center President Joshua Schank, who was then-Senator Hillary Clinton’s transportation advisor at the time. “It was a really complicated way of saying, 'We need this state in, and we need this state in.'”

Congress added in criteria for population density – low density states got an equity bonus bump, as long as those states also contained a certain amount of federal land. States with populations under a million got some equity bonus money. So did states with high traffic fatalities and low household incomes.

My favorite is the inclusion of a criterion for states with gas tax rates equal to at least 150 percent of the federal gas tax. That netted exactly one state: Wisconsin. Is it a coincidence that in 2005, Wisconsin had a senator on the Appropriations Committee and a House member who was the vice-chair of the Transportation Committee?

The equity bonus deals weren't reserved for just the hard-to-get votes. The two states that got the most out of the program were Montana and Alaska. Senators Max Baucus (D-MT) and Don Young (R-AK) were among the chief negotiators of SAFETEA-LU. “It was always seen as a cover to how they were going to get the right amount of money to leadership states,” Cooper told Streetsblog. “It was never only going to be donor/donee.”

In the end, a program designed to make sure the formula losers don’t lose too bad ended up giving money to nearly every state in the union – only Rhode Island and Maine were left out of its largesse.

Let’s look closer at Montana. That state got about 30 percent of its federal transportation funding through the equity bonus program in 2010 -- $133 million.

CAP calculated what each state would have gotten if the $9.6 billion equity bonus program were eliminated and that money were distributed to the states simply based on existing formulas. Montana would have gotten $86.6 million in that case, a far cry from the $133 million the state received through its equity bonus.

Meanwhile, look at New York, which through the equity bonus program received only half the amount it would have gotten from needs-based funding. From his vantage point in Clinton’s office, Schank said he was especially sensitive to how New York had “a target on its back” in equity bonus negotiations.

California lost big too, down $338 million from what it would have received if there was no equity bonus program. But Alaska? Alaska gets back five dollars for every one it pays into the system.

It adds insult to injury when you think about how Republicans go after the 1.5 percent of federal transportation funds that support active transportation projects. CAP addresses that in the report, saying that the 22 percent of federal transportation funding devoted to equity bonuses sends a lot more money after a lot less good than keeping a little pocket change for “sidewalks that enable kids to walk to school safely or bike routes that are used for commuting or recreation.”

Also carried over from SAFETEA-LU into MAP-21: the mini-equity bonuses worked in to eight of the 11 core highway programs, which guarantee each state a certain percentage of the total dollars available, regardless of their needs. “Making sure everyone gets a piece of the pie is often a winning political strategy, but it’s rarely the most efficient way to allocate scarce government resources,” the CAP authors write. “To further understand the impact of these rules, consider Delaware, the only state to receive the minimum apportionment for all eight highway programs in 2010. On a purely needs-based allocation, Delaware should have received about $36 million through the program. But because of minimum apportionments and other adjustments, it received about $66 million.”

So who loses when states like Alaska and Delaware clean up? California, New York, Pennsylvania – the same states that lose out when funds are distributed through the equity bonus program. Big states with high populations and extensive transit systems -- in short, the states with the greatest needs.

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Friday’s Headlines Are Down on Highways

Two outlets recently featured articles on the harmful effects of ongoing freeway projects.

Commentary: There is Zero Ambiguity to the West Portal Tragedy

What happened in West Portal was entirely predictable and preventable. The city must now close Ulloa to through traffic and make sure it can never happen again.

Talking Headways Podcast: Details of Development Reform in Minnesota, Part I

Jim Kumon of Electric Housing discusses his work as a developer and urban policy educator in the Twin Cities.

Thursday’s Headlines Don’t Like Riding on the Passenger Side

Can you take me to the store, and then the bank? I've got five dollars you can put in the tank.

Study: When Speed Limits Rise on Interstates, So Do Crash Hot Spots on Nearby Roads

Rising interstate speeds don't just make roads deadlier for people who drive on them — and local decision makers need to be prepared.