Why the Mortgage Interest Tax Deduction Has Got to Go

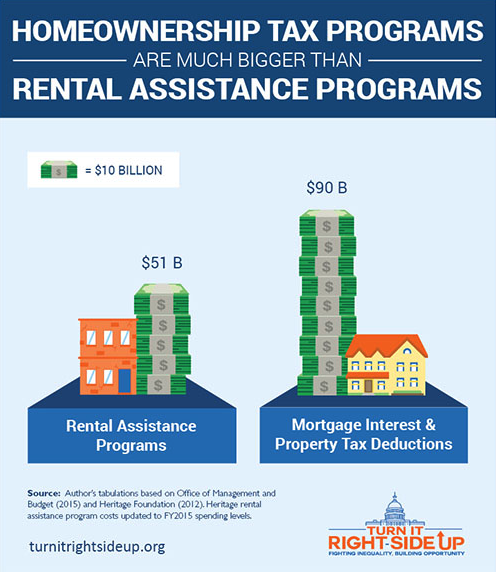

The mortgage interest deduction costs the federal government much more than rental assistance for low-income people.

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Friday’s Headlines Got Served

Another day, another GOP lawsuit trying to overturn a Biden administration climate change rule.

Disabled People Are Dying in America’s Crosswalks — But We’re Not Counting Them

The data on traffic fatalities and injuries doesn’t account for their needs or even count them. Better data would enable better solutions.

LA: Automated Enforcement Coming Soon to a Bus Lane Near You

Metro is already installing on-bus cameras. Soon comes testing, outreach, then warning tickets. Wilshire/5th/6th and La Brea will be the first bus routes in the bus lane enforcement program.

Talking Headways Podcast: Charging Up Transportation

This week, we talk to the great Gabe Klein, executive director of President Biden's Joint Office of Energy and Transportation (and a former Streetsblog board member), about curbside electrification.

Why Does the Vision Zero Movement Stop At the Edge of the Road?

U.S. car crash deaths are nearly 10 percent higher if you count collisions that happen just outside the right of way. So why don't off-road deaths get more air time among advocates?