Why the Mortgage Interest Tax Deduction Has Got to Go

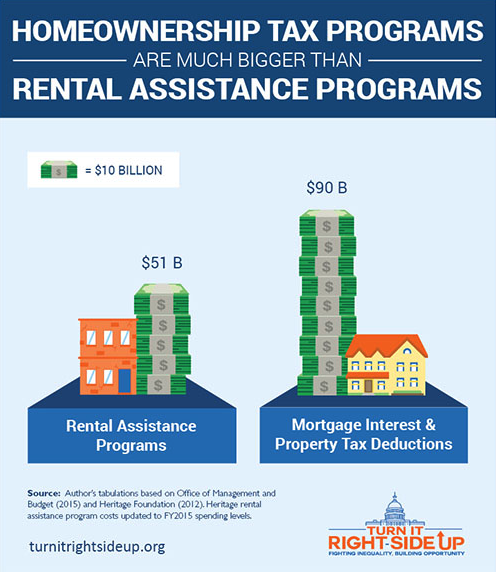

The mortgage interest deduction costs the federal government much more than rental assistance for low-income people.

Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Thursday’s Headlines Don’t Like Riding on the Passenger Side

Can you take me to the store, and then the bank? I've got five dollars you can put in the tank.

Study: When Speed Limits Rise on Interstates, So Do Crash Hot Spots on Nearby Roads

Rising interstate speeds don't just make roads deadlier for people who drive on them — and local decision makers need to be prepared.

Calif. Bill to Require Speed Control in Vehicles Goes Limp

Also passed yesterday were S.B 961, the Complete Streets bill, a bill on Bay Area transit funding, and a prohibition on state funding for Class III bikeways.

Under Threat of Federal Suit (Again!), NYC Promises Action on ‘Unacceptable’ Illegal Police Parking

A deputy mayor made a flat-out promise to eliminate illegal police parking that violates the Americans With Disabilities Act. But when? How? We don't know.

‘We Don’t Need These Highways’: Author Megan Kimble on Texas’ Ongoing Freeway Fights

...and what they have to teach other communities across America.