Stay in touch

Sign up for our free newsletter

More from Streetsblog USA

Tuesday’s Headlines Are Driving Inflation

Driving — specifically, the cost of car ownership — is one of the main factors behind inflation, according to the Eno Center for Transportation.

SEE IT: How Much (Or How Little) Driving is Going on in America’s Top Metros

Check it out: The lowest-mileage region isn't the one you'd think.

Monday’s Headlines Bring Another Setback

The Biden administration's new rule requiring states to report their greenhouse gas emissions from transportation was dealt another blow when the Senate voted to repeal it.

‘The Bike Is the Cure’: Meet New Congressional Bike Caucus Chair Mike Thompson

Meet the incoming co-chair of the congressional bike caucus — and learn more about how he's getting other legislators riding.

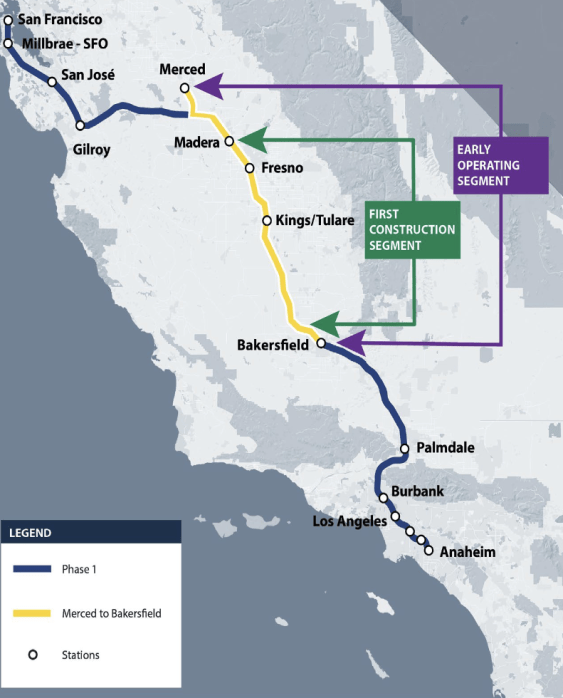

Calif. High-Speed Rail Takes a Step Towards Acquiring Trains

The contract calls for two prototype trainsets for testing to be delivered by 2028, and four trainsets to be used on the "early operating segment" between Merced and Bakersfield, ready between 2030 and 2033.